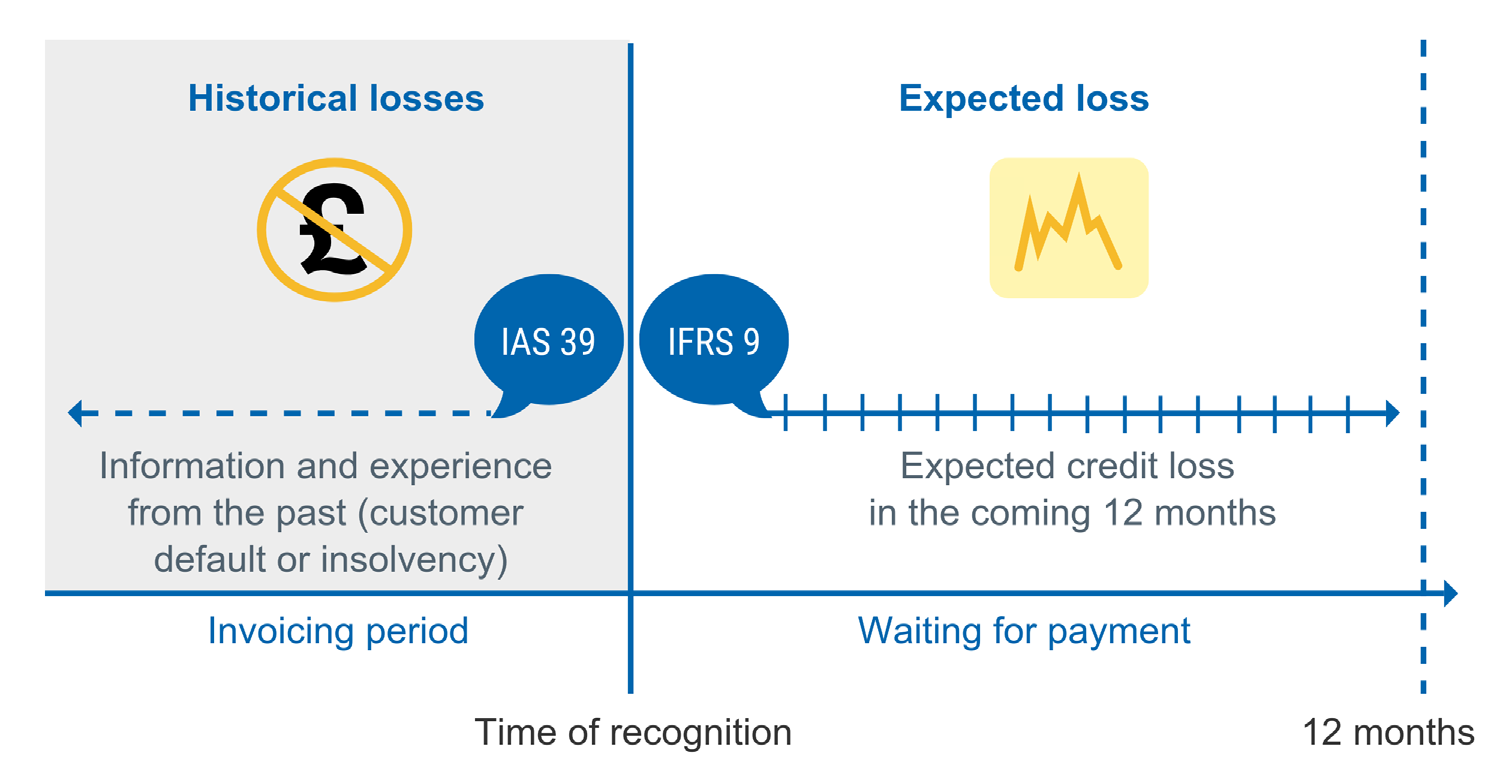

The new IFRS9, effective from January 2018, establishes a new model to calculate provisions for credit losses: the so-called “expected credit losses“ (ECL) model. It focuses on the risk that a receivable will default rather than whether a loss has been incurred and therefore includes requirements to use forward looking information.

It replaces IAS 39 which was criticised for being too complex and deferring the recognition of credit losses until too late.