It’s pretty hard to poke a hole in January’s employment report. It’s nuclear-powered.

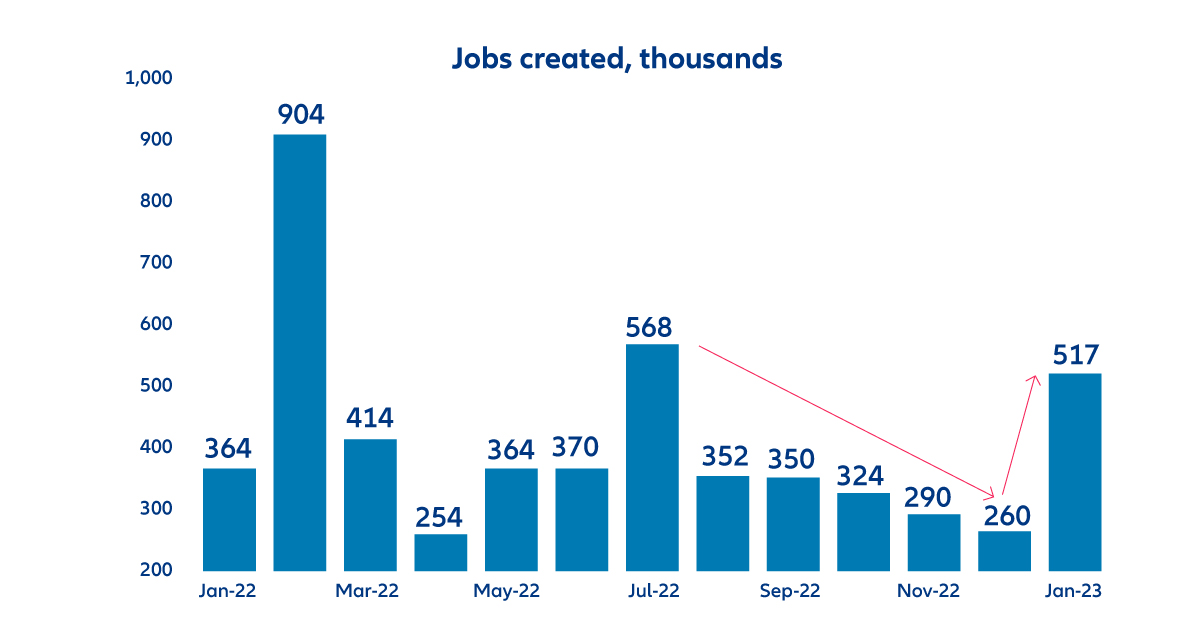

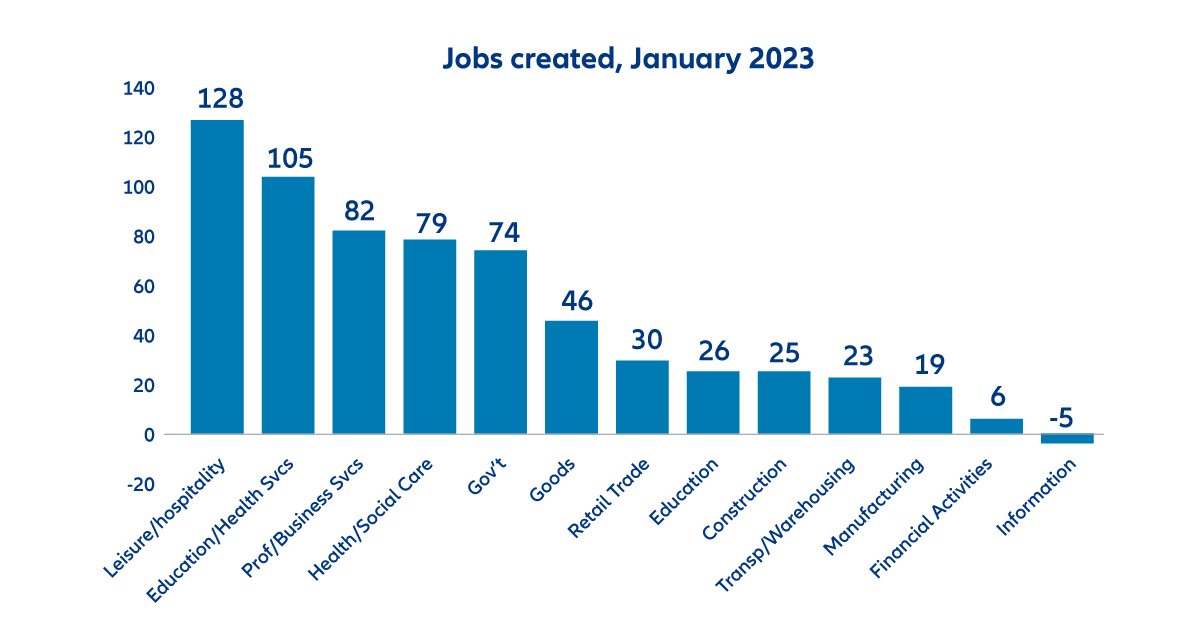

Non-farm payrolls (NFP) gained 517k jobs in January, almost three times as much as expectations of 187k. Some of the gains can be explained away. The uncertainty on the NFP estimate is +/- 100k every month, 35k university strikers returned to work, seasonal adjustments were changed, and benchmarks were revised. I know I should be more analytical, but given all the other decay in the economy… it just doesn’t look right.

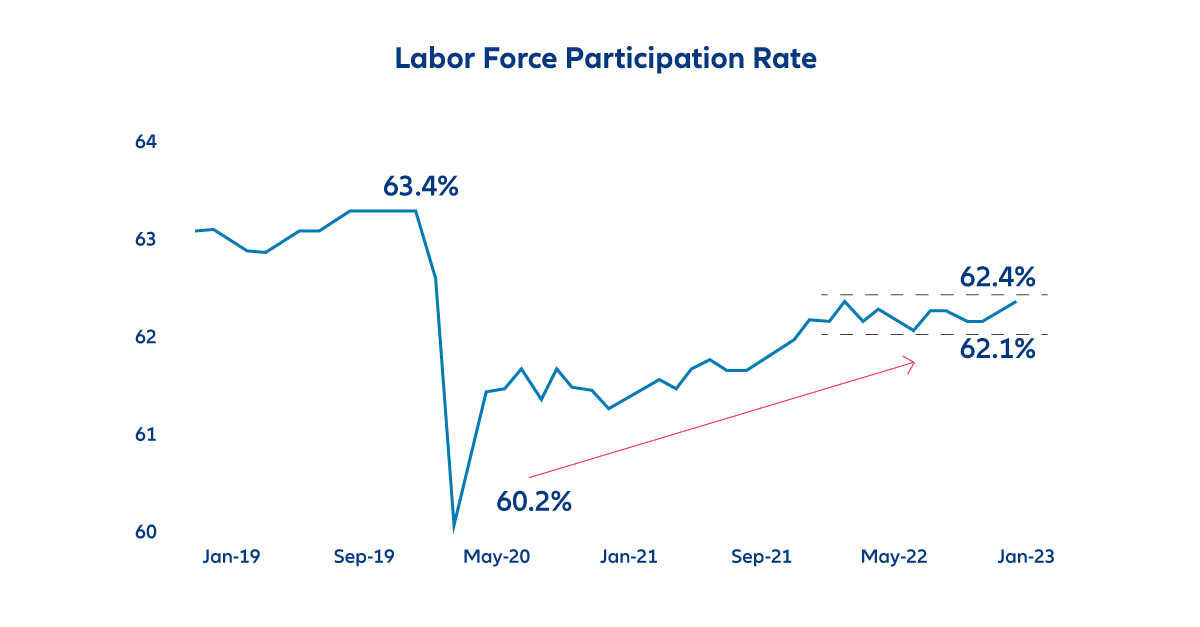

The unemployment rate fell from 3.5% to 3.4% (correcting an error from this morning), the lowest in over 53 years, in part due to an increase in the labor force.

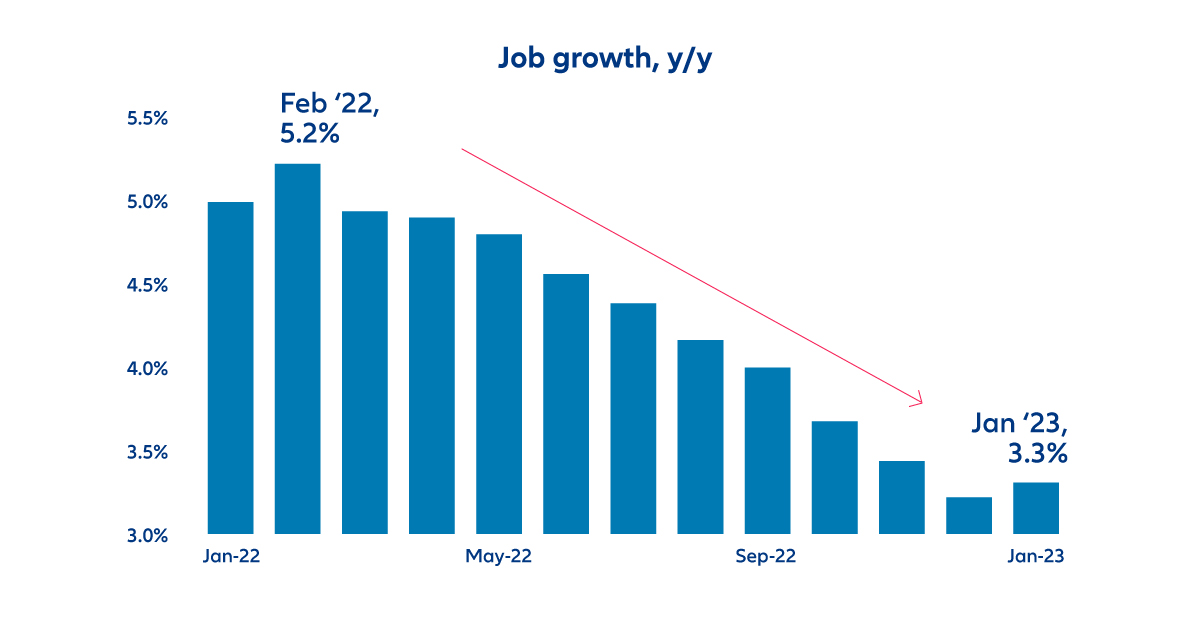

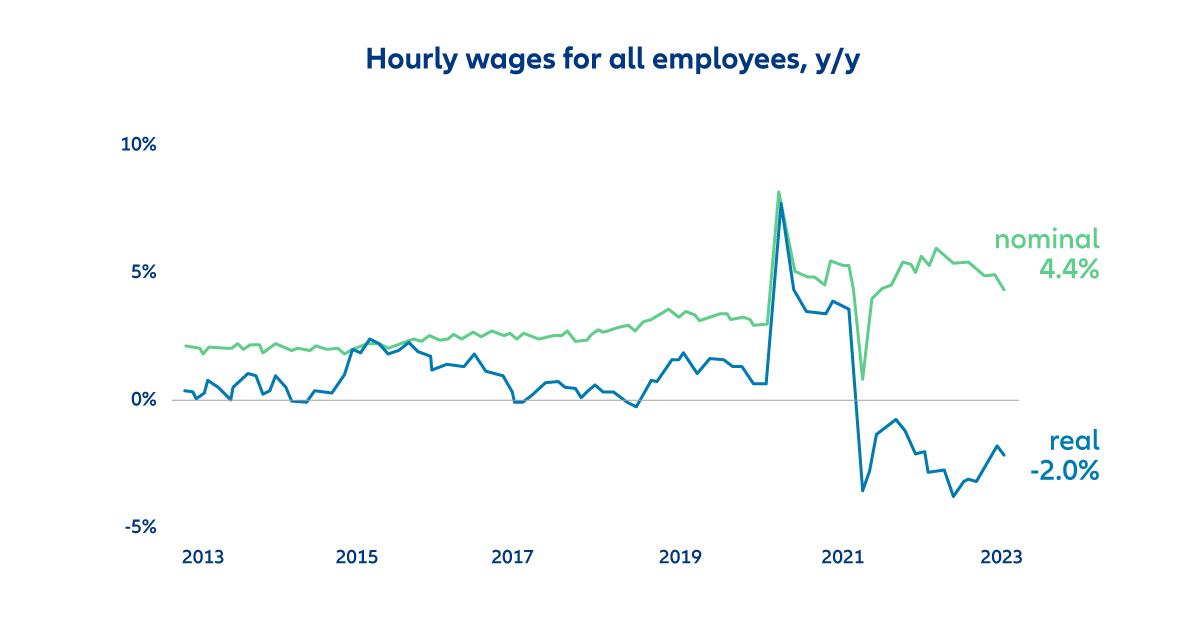

Wage growth moderated from 4.8% y/y to 4.4%, the lowest in 18 months.

This is the conundrum in the report - wage growth is cooling despite a red-hot labor market. That’s not supposed to happen. When demand for an item goes up and supply goes down, the price should rise (think eggs). In the labor market, the statistics show demand has far outstripped supply, and yet growth in the price of labor, and wages, is slowing.

So how could that happen? There could be a behavioral dynamic under the surface which isn’t caught by theories in the short term. First, there appears to be less job security in the economy as layoffs are spreading and quits are falling. Perhaps that’s drawing people back into the labor force. And now, employers are getting the upper hand on job applicants who had previously been so demanding. Employers are hiring more people, but can now make job offers at pay increases less than previously expected. I can’t prove it, but there is anecdotal evidence to support the idea.

And of course, slowing wage growth makes things even worse for consumers after inflation.

So non-farm payrolls are going through the roof and unemployment is going through the cellar.

But it’s irrational to think that data from one report from one month is so important that it outweighs everything else that is pointing to a recession. This is the list I have been giving recently: falling retail sales, shrinking real disposable personal income, slowing real consumption expenditures, consumers worrying more about the future than the present, the consumer confidence measure of jobs plentiful-hard to get having peaked, a collapsing housing market, manufacturing in recession, and of course the inverted yield curve.

However because this shocking news happened so recently, the immediacy of the report makes it seem more impactful than it probably is. The recent job report may well be an anomaly, and in any case, we expect future employment reports to be more “normal” going forward. We maintain our forecast for a relatively short and shallow recession.

Get economic & trade content in your inbox

Sign up for our newsletters to make sure you don't miss anything.