Executive Summary

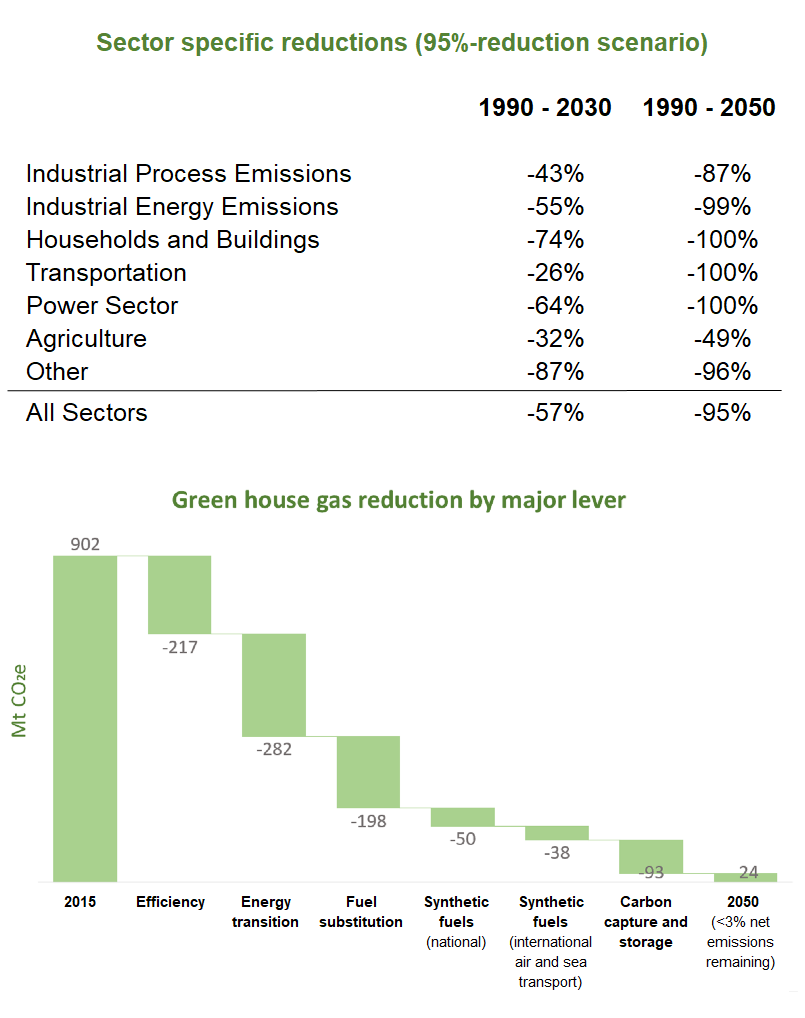

The economy needs to be jump started while maintaining a flat infection curve and concurrently bending the global temperature increase to stay within the 1.5 degrees warming limit. A global alliance of cross-party political decision-makers, business and financial leaders, NGOs, scientists and think tankers alike, have been emphasizing the necessity to use the opportunities of the economic recovery from COVID-19 as an accelerator for the transition to a net-zero emissions’ society.

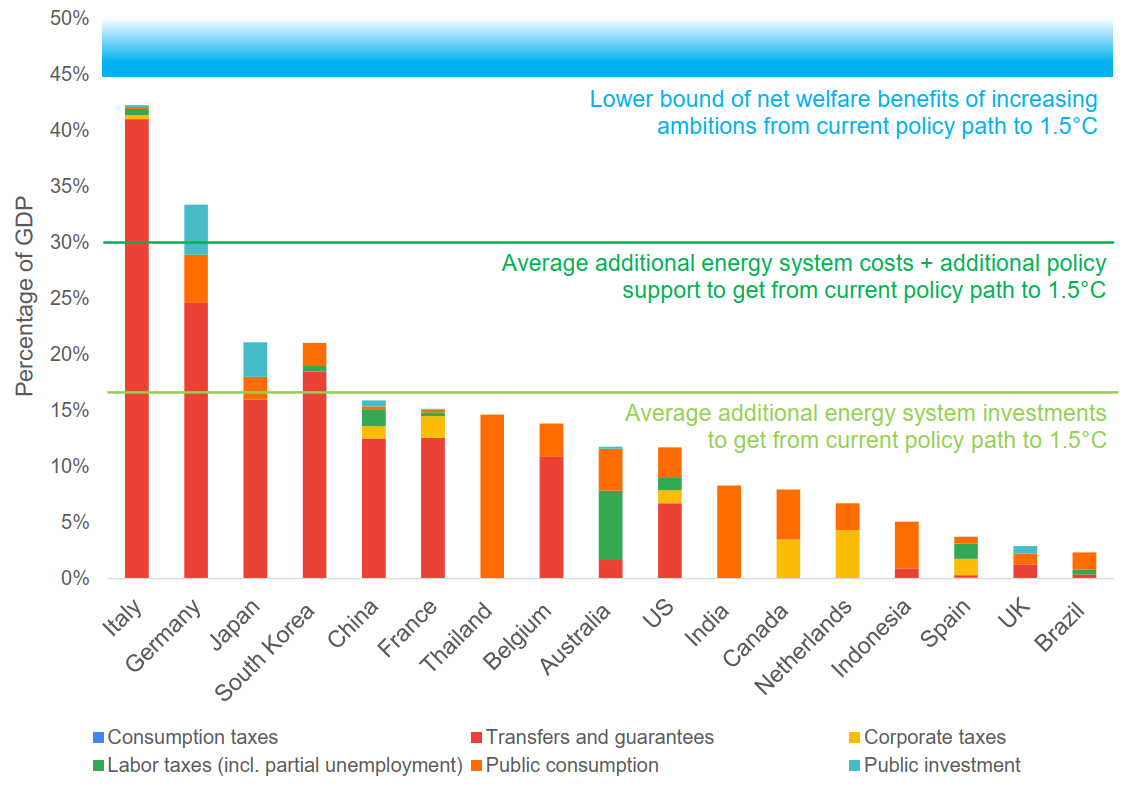

The COVID-19 pandemic represents a historic window of opportunity to accelerate the global transition to a net zero emission society. Fiscal measures providing immediate pandemic relief have surpassed USD 7 trillion in total. But only a fraction of the current programs addresses energy transition infrastructure or other ‘greening’ activities. Instead of encouraging companies to return to their pre-crisis paths, economic recovery programs should rather incentivize companies to account for externalities by measuring and managing associated effects.

Public funds are not without limit. Overstressing public budgets will suppress long-run growth. Providing appropriate conditions for the potential crowd in of private sector green finance will significantly accelerate the recovery. It will thus unburden public entities by inducing a substantial leverage on the available financial resources. In addition, it will provide essential signals to the financial system and thus direct capital towards ‘green’ and ‘greening’ activities. It will align the allocation of investments with policy targets and will allow for the system-wide application of metrics to measure progress against environmental targets.

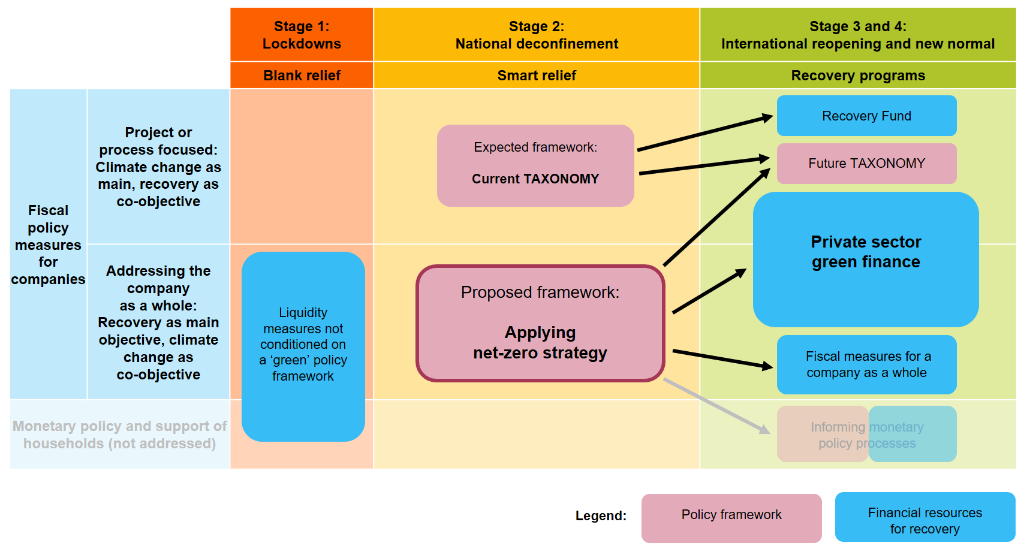

Beneficiaries of fiscal pandemic relief and recovery measures should be in line with these principles if they have 1) a commitment to a net zero by 2050 emission pathway, 2) a mitigation strategy including intermediary targets and details on how to achieve this plan, and 3) metrics that allow to verify progress and contribution of new investments to achieving the emissions’ reduction trajectory. The immediate COVID-19 recovery measures are different in their nature from policy measures originally intended to mitigate climate change. Additional approaches are needed to close the gaps in available policy frameworks and utilize the COVID-19 measures to develop their fullest potential, i.e. ensuring economic recovery while simultaneously building the foundations for achieving climate targets. Incentivizing the implementation and the disclosure of net-zero transition strategies could close this gap. In addition, it is important to prioritize a preferential set of fiscal recovery policy types which offer high economic multipliers and substantially positive climate impact.

A long run strategy for sustainability and resilience attracts investors and customers. Sustainability and resilience are continuously gaining attention. Integrating sustainability and managing greenhouse gas (GHG) emissions in line with net-zero pathways is key to the resilience of business models as well as a corner stone for building trust towards investors and customers. Furthermore, companies pursuing net-zero pathways can generate positive spillovers by incentivizing public entities to substantiate their long-term strategies (LTS) and Nationally Determined Contributions (NDCs).

Avoiding sustainability pitfalls will be key. It is imperative to avoid continually increasing disparities resulting from lock-ins in brown technologies and therefore potentially stranded regions. Only sustainable and inclusive growth promotes convergence by empowering society to participate in the benefits of green growth and ensuring that no one is left behind.

Scope

Only 4% of the current and immediate COVID-19 relief measures can actually be considered ‘green’ according to a recent study (Hepburn et al. ,2020). In strong contrast to this, policy makers broadly expressed the intention to integrate climate and sustainability targets when designing post-pandemic economic recovery programs. How is a ‘greening’ of these programs possible? And how can further measures support existing policies in limiting climate change and meeting the UN Sustainable Development Goals? Developing and disclosing net-zero transition strategies would be a solution that should be considered when designing criteria for companies receiving financial incentives. This would subsequently result in crowding in additional private sector green finance, thereby leveraging fiscal support considerably. The view presented here is applicable to currently discussed recovery programs. It opens an additional perspective for programs focused on investing in green infrastructure. It addresses areas that are particularly well-suited in supporting the recovery as well as the transition to a net-zero society. Beyond the scope of this contribution is the comprehensive discussion of ‘green’ recovery funds and complementary carbon pricing policies. Nevertheless, both are issues which must not be neglected.

The issue at hand

The current debate provides profound suggestions for the pandemic relief measures to concurrently satisfy a ‘green’ objective, but this perspective is often missing when concrete policies are being formulated. The ‘green’ in the context of these debates predominantly refers to climate change. For progressing further and greening the recovery path, it is thus urgent to translate the climate objective into actual and applicable conditions or criteria that can be linked to commitments for receiving financial support. In principal, those conditions and commitments need to reflect our societies’ imperative of pursuing a resilient, sustainable and inclusive growth path. Acknowledging the available regulatory frameworks to date, at least the climate objective should be addressed appropriately. Current policy frameworks, like the EU Taxonomy, to date are intended to assess and promote activities that are specifically focused on climate change mitigation and adaptation. However, the Taxonomy is not suitable for designing fiscal measures focusing on a broader recovery perspective in its current stage of development. Given that the taxonomy focuses on economic activities and not entire companies, it proves to be challenging to apply this framework for assessing COVID-19 support measures that will be targeted at company level. Yet, the taxonomy does neither address activities that are not particularly harmful to the climate (e.g. student loan) nor activities that are particularly harmful to the climate (as they would fall under ‘do no significant harm’ rule), thereby excluding companies as a whole from benefits which are pursuing such activities. In order to address these challenges, a constructive approach would be to specify requirements on a company level. Acknowledging the commitment to a net-zero transition strategy as an eligibility criterium for these measures or certain benefits could be a viable way forward:

Fiscal measures should be designed in a way that – as a result - they support and accelerate amongst beneficiaries the disclosure of:

1) a commitment to a net zero by 2050 emission pathway,

2) a mitigation strategy including intermediary targets and details on how to achieve this plan, and

3) metrics that allow to verify the progress and the contribution of new investments for achieving the emissions reduction trajectory.

As sustainability and resilience are continuously gaining attention by investors and customers, the advantages for companies in pursuing such a strategy will be far-reaching. Only companies that are credibly able to prove their sustainability and resilience will be able to keep investors and customers from turning away. Furthermore, companies pursuing net-zero pathways can generate positive spillovers by incentivizing public entities to substantiate their long-term strategies (LTS) and Nationally Determined Contributions (NDCs). Greenhouse gas emissions are currently the center of attention, but further issues like biodiversity and circular economy are already lining up.

Figure 1: Generating opportunities through net-zero recovery strategies