Q: In a recent article, Bloomberg reported that the world’s supply of chips is in danger unless Taiwan gets vaccines. With Taiwan being the leading provider of semiconductors chips, how will the Covid-19 situation and lack of vaccines affect related exports and supply chain?

A: The global semiconductor supply chain has become increasingly vulnerable to Covid-19 vaccination programs and geopolitical disruption, due to key suppliers being based in distinct regions of the world.

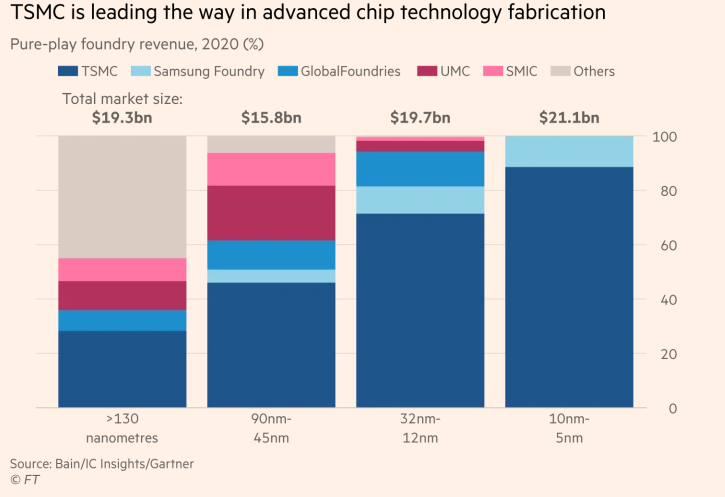

Taiwan is the biggest manufacturing base for some of the world’s most advanced chips, the integral component from smartphones to supercomputers. Recent studies show that Taiwan Semiconductor Manufacturing Co’s share of the market’s most advanced nodes currently in production is up to 90%. In view of less than 5% of the Taiwan population vaccinated against Covid-19 and the backlog of vaccine orders, any further disruptions would add on to the already much prolonged lead time for semiconductor products (currently at 16 weeks, up from 11 weeks as at end of 2020).