- The petrochemical industry prominence lays on providing essential raw materials to many manufacturing and conversion industries across many economic sectors.

- Many industries such as automotive, food packaging, construction and consumer products depends heavily on petrochemi-cal feedstock.

- The industry is exposed to cyclical supply-demand conditions and prices, as the desire to exploit economies of scale encourage large and intensive in-vestment to meet anticipated future de-mand.

- Hence, prices are normally based on a combination of production costs and sup-ply demand dynamics on global exchang-es.

- In 2019, significant capacity additions and slowing demand caused the industry val-ue pool to decline. Sector was further im-pacted in 2020 due to COVID-19 pan-demic

Wounded but not sunk :

How Covid-19 is disrupting the global petrochemicals and downstream industries

Executive summary

Allianz Trade does not issue direct policies in the Middle East. It operates in partnership with and provides reinsurance support to a number of selected locally licensed insurance companies, which issue Trade Credit Insurance Policies designed and approved by Allianz Trade in its capacity as a Reinsurer

How Covid-19 is affecting the global petrochemical and downstream industries?

The industry globally is classified into four key regions including North America, Eu-rope, China, and Rest of the World.

China has reduced the production output in H120 of petrochemicals as well as its downstream products due to limited inventory and a shortage of workforce.The demand drop for oil and petrochemicals from China has resulted in a price de-cline of these products.

The US and European chemical prices remain under pressure from the falls in up-stream costs and weaker demand, offset partly by firm demand into certain seg-ments and a reduction in derivative imports.

However, visibility over short-term demand remains weak while social distancing measures remain in place and business and consumer confidence is low. China should continue to lead the way in the recovery while the US should reach its pre-crisis GDP levels end-2021. Europe will remain the laggard until 2022 after suffering a second wave.

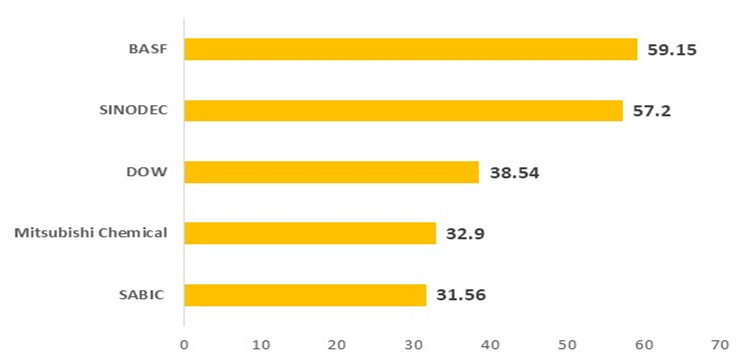

Figure 1: Top five chemical companies: World’s largest by revenue in $Bn (2020):

How Covid-19 is affecting the global petrochemical and downstream industries?

Throughout recent years, the petrochemical industry was impacted significant-ly by a supply reduction of the global petrochemical manufacturing hubs while inventory is tied up.

In addition to feedstock price disruption triggered by oil price drop, during 2020 COVID-19 pandemic, many countries implemented social and travel re-strictions, which caused a further demand drop and declined in consumption of petrochemical products globally.

Further decline in prices, earning and companies valuation led by falling oil prices. As per McKinsey Global Institute: 35% of the chemical industry’s annual EBITDA could be at risk because of supply-chain disruptions, which affect the petrochemical production output.

The pandemic also forced the industry for a faster response to key conse-quences of this disruption: Oversupply and imbalances from supply chain dis-ruptions and demand shocks, new competitive global dynamics as oil price collapse shift regional feedstock cost advantages, restructuring need and ur-gency to put purpose at the heart of the recovery plan and invest in green technology.

What measures taken by leading Petrochemicals undertake to mitigate and limit damages?

Level of impact and recovery trajectories by major petrochemical end users segments

Some of the lost demand was offset and supported by a surge in demand from food packaging, and hygiene sectors.

However, it returned to pre-pandemic levels as consumer panic buying dimin-ished.

While demand for construction with disparities within regions expected to re-cover by end of H121. Automotive industry and household equipment only by H2 21. An important segment Airlines expected to recover only by end of 2023 to pre-crisis level.

Crude oil prices outlook

Petrochemicals sector risk rating

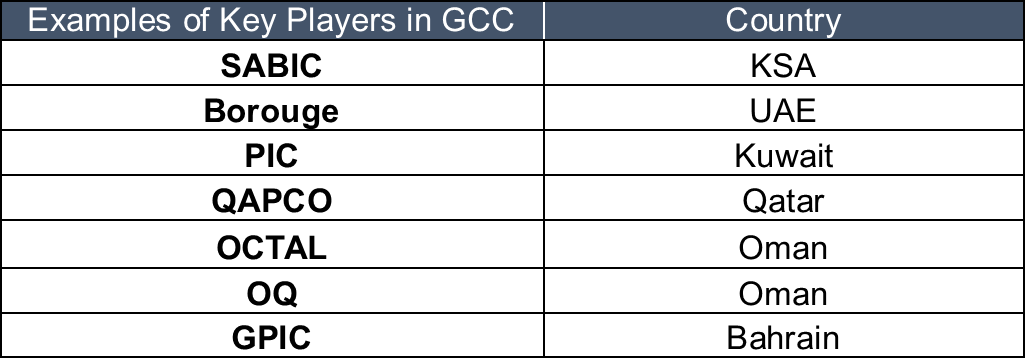

Sector dynamics and trends focus in KSA

The Saudi petrochemical sector has grown to be one of the main pillars of the Saudi economy and played an important role in economy development with about 10.3% in country GDP in Q3 2020. In light of COVID-19 outbreak, sector reported a noticeable decline of 6.6% overall the year 2020.

Majority of dominating players are owned and supported by the Saudi Gov-ernment with good cash position and adequate financing structure. The feed-stock prices for Saudi key players is heavily correlated to ARAMCO raw materi-als supply. In tandem with its core product "petroleum derivative", the local in-dustry indicates slight improvement in average selling prices and demand, as the business activity evidenced improvement by falling COVID-19 case num-bers in the fourth quarter of 2020, despite other major economies suffering a second wave.

Saudi producers enjoys a competitive edge compared with global producers suffering the rise in operating costs, the decline in the raw material margin and lower operating profits. Operational efficiency and economies of scale should ensure that Saudi Arabia retains an advantage over rivals during near future, given the challenging operating environment in the context of the pandemic.

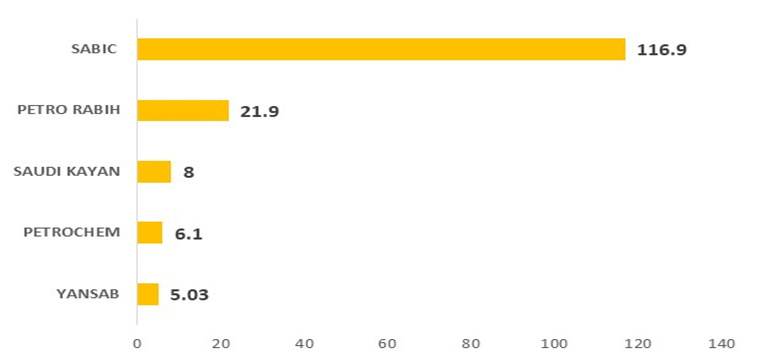

Profitability: net profit range for the past five years is 9% on average. During 2020, profitability dropped significantly among players turning into losses of 8.7% on average. Sector Overall Revenues dropped by 26% on average for the past year 2020. Saudi Sector experts indicated this was triggered by lower oil prices, weak average selling price and the demand drop notably in Q2. For-tunately, both average selling prices and demand rebound since local authori-ties eased the restriction measures .

In addition to the non-oil sector support from the government to increase the share of non-oil exports to non-oil GDP (32.7% in Oct. 2020) to reach 50% by 2030 as per the Saudi Vision.

Financing: The sector tends to be in healthy financial structure with an aver-age of 2x liquidity in 2020. The industry enjoys high access to external borrow-ing from local financial institutions (Banks, SIDF, etc.) as majority of the key players are capital intensive with increasing leverage trend.

Consolidation: mergers between the major players and raise in capital are witnessed in the industry as per the latest acquisition events (SAFCO, SABIC and ARAMCO, SIIG & Petrochem). The objective is to achieve further improve-ments to efficiency and productivity to compensate for the loss of margins. The Saudi industry is expected to achieve around $ 840 Mn profit in Q4 2020 fol-lowing the supply-chain resilience and recovery post the pandemic.

Saudization: 12% localization in small enterprises or 45% in sizable entities is obligatory by Saudi regulations. The industry operates with an average of 70% localization and less than 13% non-technical labor. According to researches, every single job contributes to SAR 1.2 Mn country GPD, and creates other four job opportunities in the value chain. More essentially, launching Ministry of In-dustry & Mineral Resources to be separated from Ministry of Energy will en-hance the petrochemical industry contribution in country GDP and increase employment of citizens by focusing on more expansion in the downstream chain; this would contribute to non-oil sector revenues and enhance an inte-grated structure of petrochemicals supply chains.

Industry and ratio analysis were based on publicly available data of company’s listed in Tadawul ex-change for the period of 2020

Packaging industry an important end market for this sector in KSA

Risk stance and outlook

FORWARD-LOOKING STATEMENTS

The statements contained herein may include prospects, statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and un-known risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such forward-looking statements.

Such deviations may arise due to, without limitation, (i) changes of the general economic conditions and competitive situation, particularly in the Allianz Group's core business and core markets, (ii) performance of financial markets (particularly market volatility, liquidity and credit events), (iii) frequency and severity of insured loss events, including from natural catastrophes, and the development of loss expenses, (iv) mortality and morbidity levels and trends, (v) persistency levels, (vi) particularly in the banking business, the extent of credit defaults, (vii) interest rate levels, (viii) currency exchange rates including the EUR/USD exchange rate, (ix) changes in laws and regulations, including tax reg-ulations, (x) the impact of acquisitions, including related integration issues, and reorganization measures, and (xi) general competitive factors, in each case on a local, regional, national and/or global basis. Many of these factors may be more likely to occur, or more pronounced, as a result of terrorist activities and their consequences.

No duty to update

The company assumes no obligation to update any information or forward-looking statement contained herein, save for any information required to be disclosed by law.

Allianz Trade does not issue direct policies in the Middle East. It operates in partnership with and provides reinsur-ance support to a number of selected locally licensed insurance companies, which issue Trade Credit Insurance Poli-cies designed and approved by Allianz Trade in its capacity as a Reinsurer