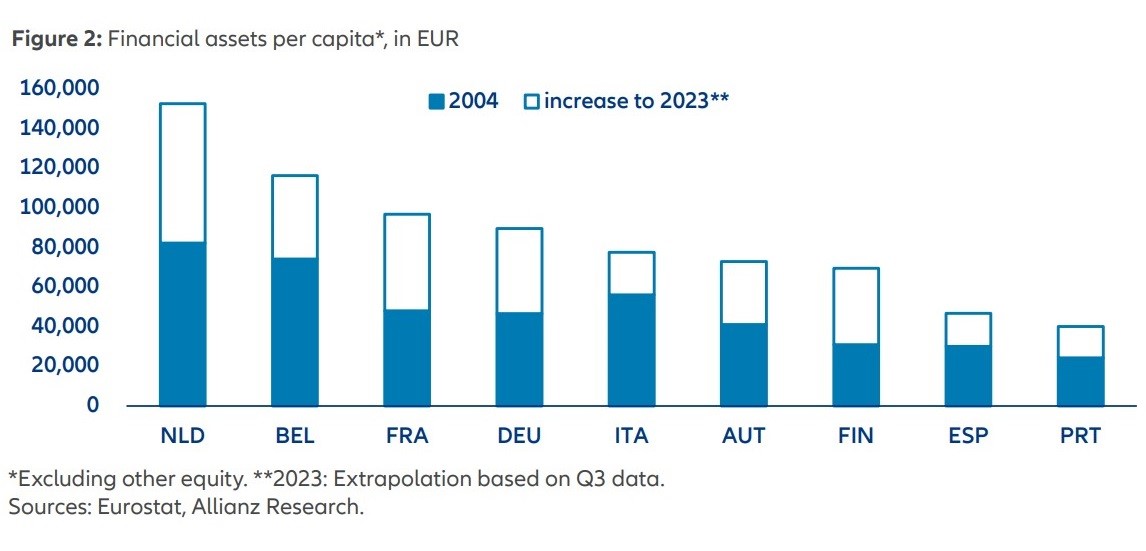

The average amount Belgians added per year over the past 20 years in financial assets (savings, investments and pensions) was €2,380. Added up, Belgians have the second most financial assets at their disposal after the Dutch. This is according to our report on private financial assets in the nine main EU countries.

The differences are stark. On average, Dutch people gained €3,590 over the past 20 years. Portugal is last with an average of €880. The overall conclusion is that private households have managed to almost double their financial assets (savings, investments and pensions) over the past 20 years. Despite the crises that occurred such as the financial crisis, de Covid-19 crisis and now the war in Ukraine, among others. To be clear, the value of home ownership or other property was not included in the study.