Global insolvencies are set to surge by +21% in 2023 and +4% in 2024, while insolvencies in the UK are expected to increase by +16% and +9% in the same period as businesses are tested by weak demand, prolonged pressure on profitability, weaker cash buffers and tighter-for-longer financial conditions, according to the world’s leading trade credit insurer.

Half of the countries researched likely to exceed pre-pandemic levels of insolvencies in 2023

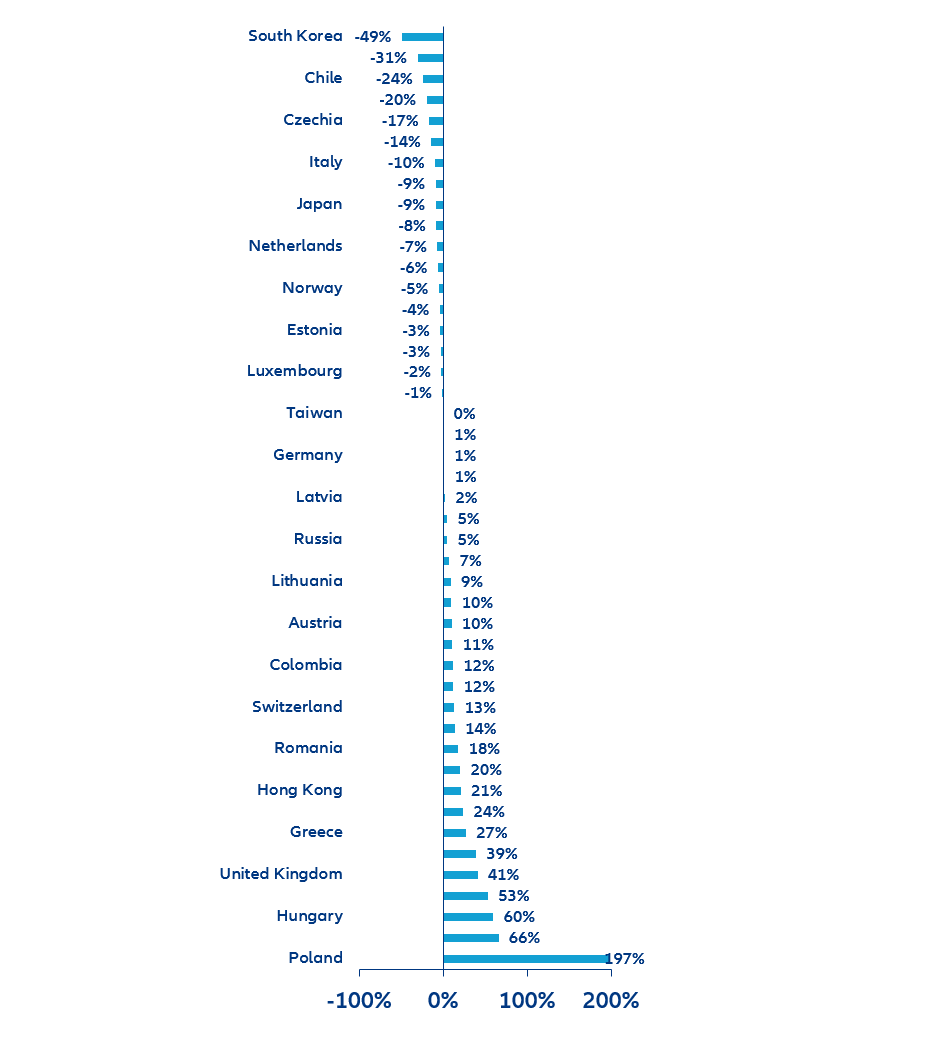

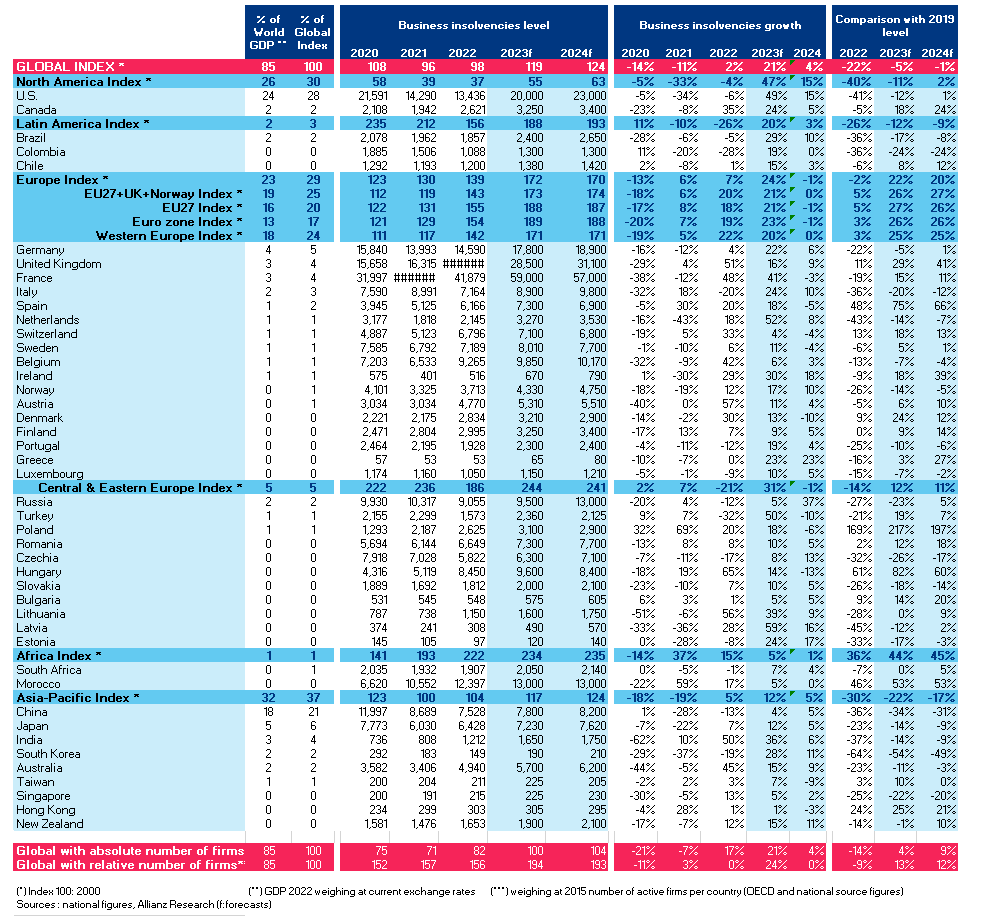

The global rebound in business insolvencies is picking up speed: the Allianz Trade Global Insolvency Index is set to jump by +21% in 2023 and +4% in 2024. Half of the countries analysed are likely to exceed their pre-pandemic levels of insolvencies in 2023, and three out of five in 2024. Compared to 2019, business insolvencies will be up +41% (31,100) in 2024 and most countries are likely to exceed their 2019 levels by the end of 2024.

The UK faces a high risk of a prolonged upwards insolvency trends in 2023 (+16% i.e. +3,930 insolvencies) and 2024 (+9% i.e. +2,600), according to Allianz Trade. “Domestic firms have had to deal with a fragile situation amid a sharp growth deceleration, earlier monetary tightening and rapid inflation in addition to specific Brexit-related issues,” said Maxime Lemerle, Lead Analyst for Insolvency Research at Allianz Trade.

As a result, insolvencies quickly bounced back in the UK after the phasing-out of state support measures. They increased by +4% in 2021 and +51% (24,565 bankruptcies) in 2022 across all sectors. Allianz Trade expects business insolvencies to continue to exceed the pre-pandemic level, gradually closing the gap with 2011 highs by 2024 (to 31,100 cases), albeit still below the 2009 records.

“Across Europe, we expect the number of insolvencies to reach 59,000 in France in 2023 (+41% y/), 17,800 in Germany (+22%) and 8,900 in Italy (+24%). In the US, we expect an increase of +49% in 2023 as a result of tighter credit conditions and an expected sharp economic slowdown, which would mean a return to 20,000+ insolvencies per year. In Asia, China should see a moderate increase (+4%) as the re-opening has not eliminated all risks, notably in the real estate sector,” said Maxime Lemerle.

Beyond lower growth, extended pressure on profitability, weaker cash buffers and tighter-for-longer financial conditions are driving the rebound in insolvencies.

The current muddle through environment is the main reason behind Allianz Trade’s forecasts for increased insolvencies. The underwriter expects elevated input costs to persist, along with a prolonged recovery in wages and the long-lasting effects of rising interest rates . This combination of factors will increase corporate risks at a time when weakening global demand reduces firms’ ability to pass on price increases to customers, unlike in 2022. To add to this, the increase in working capital requirements recorded in 2022, notably in machinery and transport equipment, is here to stay.

“We calculate that the Eurozone and the US would need respectively 1.3pp and 1.5pp of additional GDP growth in 2023-2024 for insolvencies to stabilize. Additionally, companies will have to watch out for domino effects: the number of insolvencies for companies with more than EUR50mn in revenue is now slightly above pre-pandemic levels. Construction, retail, and services are the most affected sectors,” adds Maxime Lemerle.

Weaker cash buffers and tighter-for-longer financial conditions are testing the resilience of the most fragile companies. This includes those with the least pricing power (e.g. specialized retail such as textiles, household appliances, and some services including restaurants); those that are the most exposed to a higher wage bill such as retail, transportation and construction; and those the most exposed to rising interest repayment costs (construction, durable goods).

What if another major financial crisis happens?

The recent disruptions experienced by the banking sector in Europe and in the U.S. is a stark reminder of 2008-9 when the financial crisis acted as a massive catalyst for insolvencies. Clues from the Global Financial Crisis (GFC) indicate that smaller-sized firms with high leverage and low diversification are the most vulnerable. The GFC had a particularly severe impact on SMEs, which are particularly vulnerable to large economic downturns for a number of reasons, including a decrease in turnover, difficulty accessing credit, currency volatility and supply chain disruptions.

“According to our estimates, a financial crisis as that seen during the 2008 financial crisis would mean 21,600 additional insolvencies in the US over 2023 and 2024, and 99,900 in Western Europe. Even without a major financial crisis, a credit crunch of the magnitude seen in the early 2000s during the tech bubble burst would lead to 12,900 and 95,300 additional insolvencies over 2023 and 2024, respectively. And in case of a credit freeze that would stop new loans, insolvencies would increase by an additional 10,700 cases in the US and 46,300 cases in Europe”, says Maxime Lemerle.

ENDS.