Why is it important?

At the beginning of your Policy, we charge a premium based on your expectations for business in the coming year. But your actual sales could be more or less, depending on how the business has performed in that time.

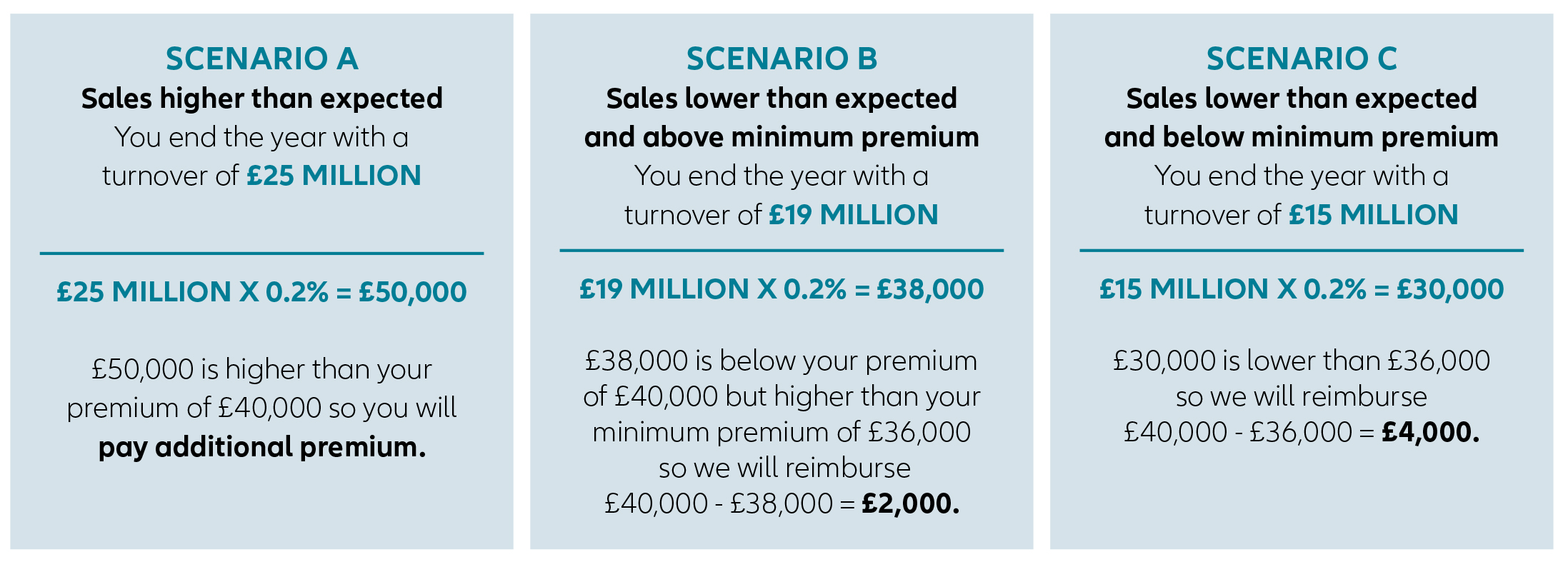

If your sales are higher than expected, we will have covered a greater value than forecasted and we will send you an invoice for additional premium. If your sales are lower, then we will have covered less than expected and will reimburse part of your premium, capped at the minimum premium specified in your Policy Schedule (usually 90% of expected premium).

For example, let’s say your expectations for business next year are £20 million and your premium rate is 0.2%, so your premium is £40,000 premium. Your minimum premium would be: £40,000 x 90% = £36,000.