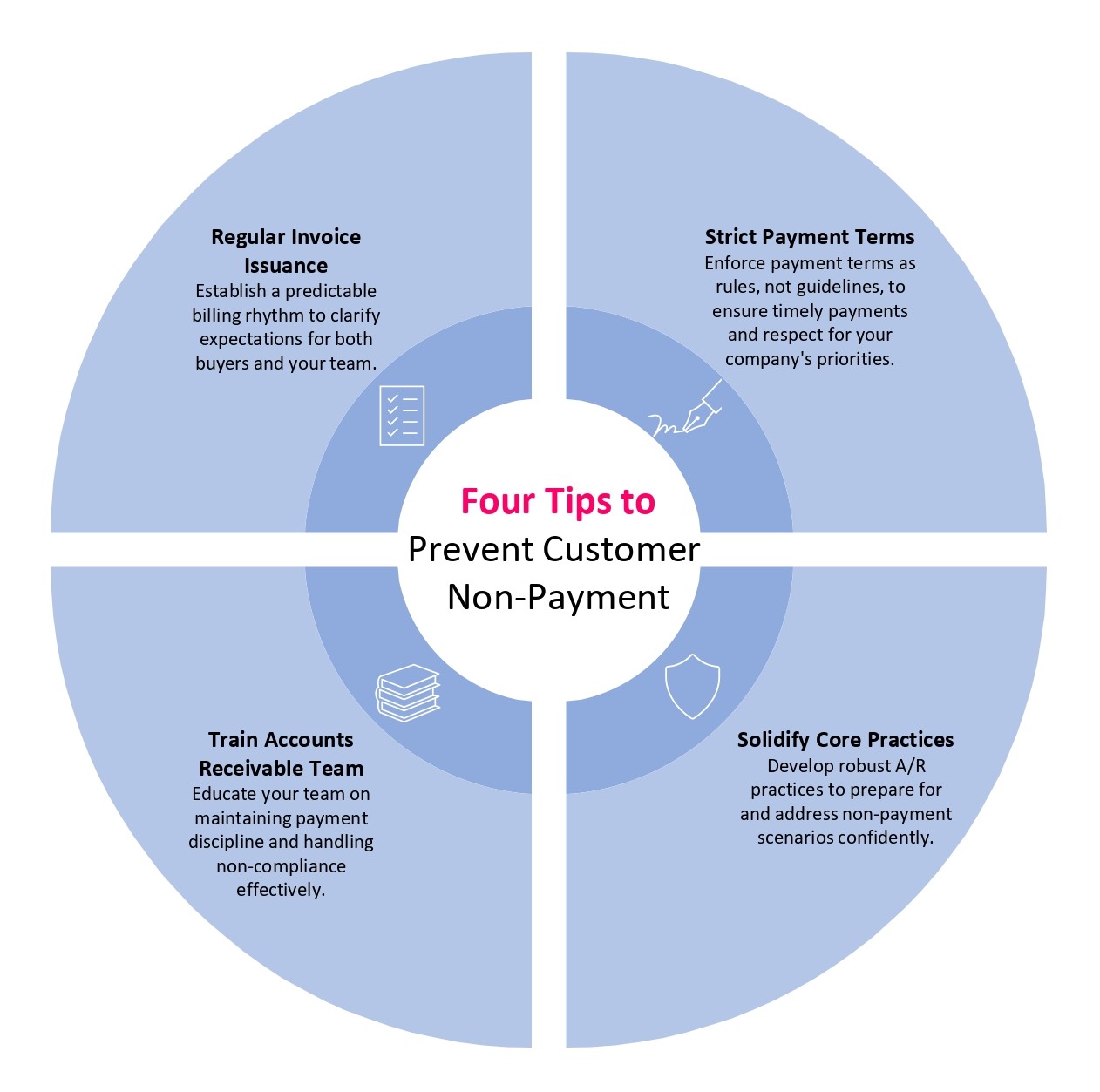

4 Proven Tips to Prevent Non Payment of Invoice by Customers

Tip 1: Regular Invoicing to Mitigate Non Payment of Invoice Risks

This may seem obvious and basic, but it really needs to be done. You need to become very predictable. Buyers can’t pay what they haven’t been billed; you need to develop your rhythm so they know what to expect. This helps both your buyers and your internal staff.

While regular invoicing is crucial, it's equally important to address the elephant in the room: unpaid invoices. These are more than just numbers on a spreadsheet; they represent a tangible setback for your business. Imagine a pile of overdue invoices sitting on your desk, each one a missed opportunity for cash flow. It's a scenario that brings frustration to any business owner. Visualize stacks of these invoices, marked with bold red 'overdue' stamps, and it's clear why tackling this issue head-on is vital. By maintaining a strict invoicing rhythm, you're not only promoting regular payments but also preparing to handle these challenging situations more effectively.

Tip 2: Use accounts receivable payment terms as a rule, not a guideline.

You may have toyed once or twice with the idea that rules are meant to be broken. They are not. To ensure you get your payment on time, you need to establish a rule early on that payment terms must be followed. Payment in 30 days means 30 days. You want to be friendly but firm. Your company is a priority for you and you want your buyers to feel the exact same way. Establish your expectations early and then maintain them throughout the entire relationship.

In the world of trade credit insurance, non-payment can escalate into a more serious issue: commercial debt. It's a consequence that no business wants to face. However, with a firm stance on payment terms, you're not just ensuring timely payments; you're also laying the groundwork for effective commercial debt recovery. Should the need arise, professional debt collection agencies and legal support become invaluable. These resources, often a part of trade credit insurance solutions, offer a structured approach to recovering your dues while maintaining professional relationships. Remember, it's not just about getting paid; it's about sustaining your business's financial health and reputation.

Tip 3: Training Your Team to Handle Non Payment of Invoice Scenarios

We have often heard, “An educated customer is your best customer.” But ask yourself: What about my staff? Are you really taking the time to educate them?

Train your team why the rhythm is important, and then how to handle themselves and your invoices should someone decide not to follow the rules. Habits are like reflexes, they happen automatically. Training your team how to handle these interactions with your buyers helps them hold the line when it comes to how they work with buyers on a day-to-day basis.

Think of it this way: If your competitor has established a strong pattern and rhythm for accounts receivable and business debt collection and you have not, which company will get paid first?

Establish guidelines for their actions; help them understand what needs to be done to protect your company’s most valuable assets: Your accounts receivables.

In our quest to prevent non-payment, let's broaden our perspective to include credit risk mitigation. This proactive approach is about more than just reacting to overdue payments—it's about foreseeing and managing potential risks before they become problematic. Tools like thorough risk assessments and creditworthiness checks are essential. Implement early warning systems to alert you to potential risks, and educate your accounts receivable team on these tools. By doing so, you're not just guarding against non-payment; you're actively working towards a more secure and predictable financial environment for your business. This strategy not only supports your current operations but also positions your business as a savvy player in the trade credit insurance niche, appealing to businesses keen on managing their risks effectively.

Tip 4: Establish standards for your core accounts receivable business practices.

Everyone knows that eventually, a problem will arise, so when non-payment inevitably happens it shouldn’t be a surprise to anyone – not you or anyone on your team. Your training should also include:

Having these practices in place should ensure you are insured for non-payment—both in preparation and in actuality.

Allianz Trade's credit insurance in Singapore (also called accounts receivable insurance) helps protect your A/R assets in the case of non-payment.