5 ways to grow your international trade business with confidence

1. Find new customers

Save time and money, stabilise cash flow, make forecasts predictable and enable real long-term, sustainable growth.

Picking the right markets and choosing customers who will pay you on time is difficult and takes a lot of time and effort.

Growth but not at any cost

When a company grows too fast it can encounter problems, and if is not well managed it may bring the company down.

With Trade Credit Insurance cover you benefit from:

- Powerful predictive analytics and intelligence on over 83 million companies worldwide via our proprietary database

- Real-time past-due and claims reporting from our nearly 60,000 customers worldwide

- A unique credit grading/scoring system to help you accurately vet potential customers and an early warning system when customers might be at risk of late or non-payment.

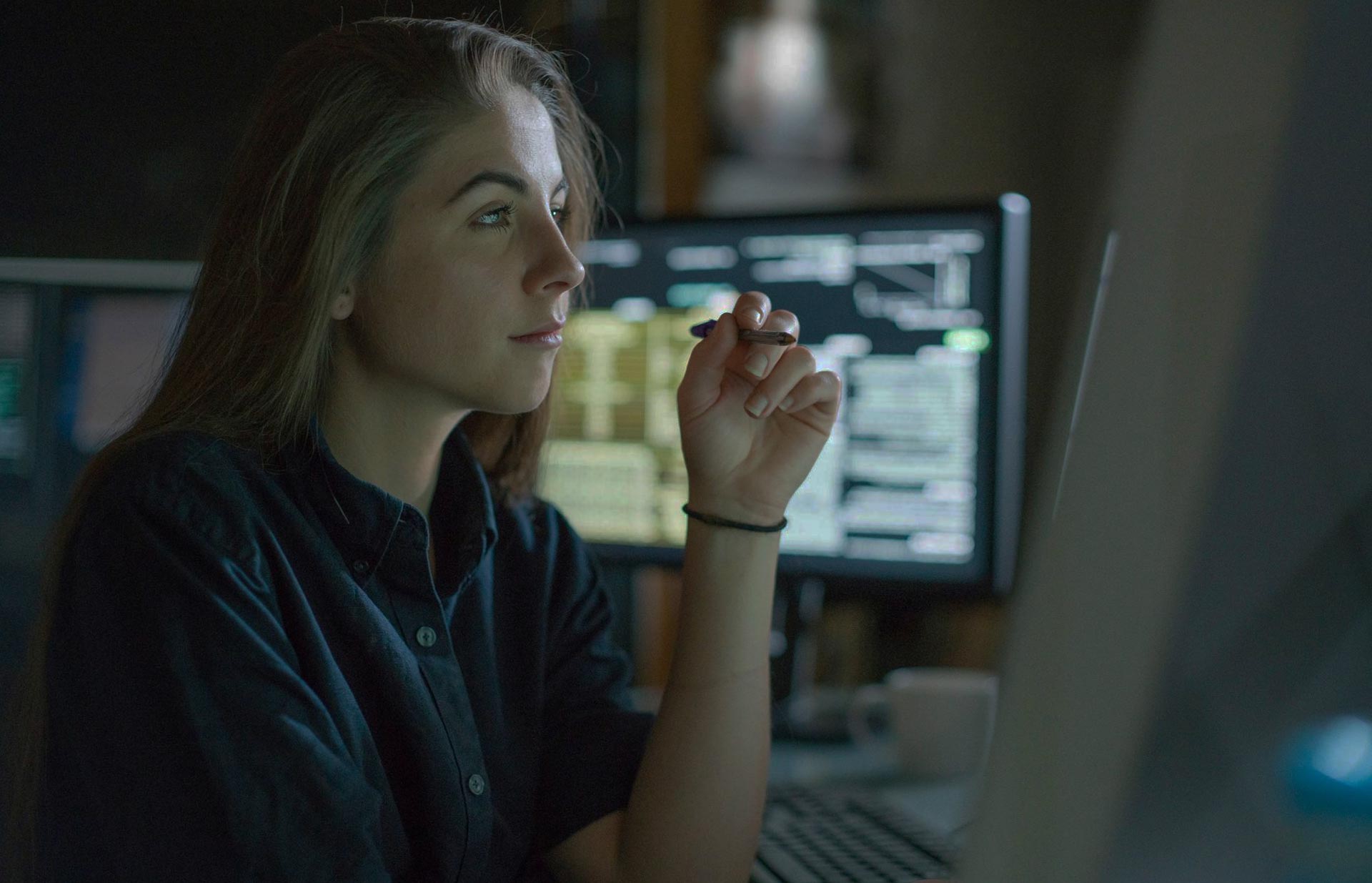

2. Expand to foreign markets, increase foreign trade

Allianz Trade consistently monitors +83 million companies worldwide with 1,700 credit analysts based in 62 countries.

Which markets should I export to?

Who are my potential customers within these markets?

Who can help me develop my business within these markets?

We will help you identify and choose the best opportunities and export markets to operate in, in order to:

- Stay on top of trends through our market analysis and economic research content: global insolvency outlook, sector risks analyses, country collection profiles, export credit risk etc.

- Access country-specific risk information via our regular bulletins on political, economic and market risk.

- Secure your cash flow, enhance business credit and reassure your financial partners and investors.

Introducing Trade Match

by Allianz Trade Economic Research

An foreign trade online tool

that highlights export credit

risks and opportunities

across 17 sectors in 70 countries

around the world.

3. Offer better credit terms to your clients

Options to mitigate against credit risk:

Rely on competitive business credit terms with confidence, even if you haven’t known a customer for a long time.

With credit insurance, you can offer competitive credit terms with confidence, even when you haven’t known a customer for a long time. When you are worried about offering new customers favourable business credit terms, credit insurance will give you the peace of mind to proceed.

There’s more…

Through the Allianz Trade early warning system, you can continuously monitor customers to see if they still fall within your credit terms risk appetite so you can adjust as required and reduce risks.

And finally, if invoices are not paid, we have you covered.

4. Improve your financing

Having credit insurance cover signals good governance and management, due diligence and reliability.

On average, accounts receivables represent 40% of business assets. Securing 90% of these assets with the financial strength of Allianz Trade, an AA-rated Allianz company will reassure your banks and financial partners.

This makes it more likely to get better financing arrangements. Banks are reassured, knowing their loans will get paid if things go wrong, and are therefore more willing to provide favourable terms. This reduces your cost of finance through overdrafts to deal with cash flow variations.

5. Grow your business with existing customers

Growth but not at any cost

When a company grows too fast it can encounter problems, and if is not well managed it may bring the company down.

Having credit insurance cover signals good governance and management, due diligence and reliability.

It is only natural to want to grow your business with existing customers. there is an element of trust. However, as your business with one of your customers grows, their risk can increasingly become your risk.

With Credit Insurance, you can avoid the risks of high customer concentration. We monitor risks of your customer portfolio at all times and provide an early warning system to help you manage your exposure to insolvencies.

We are here to help