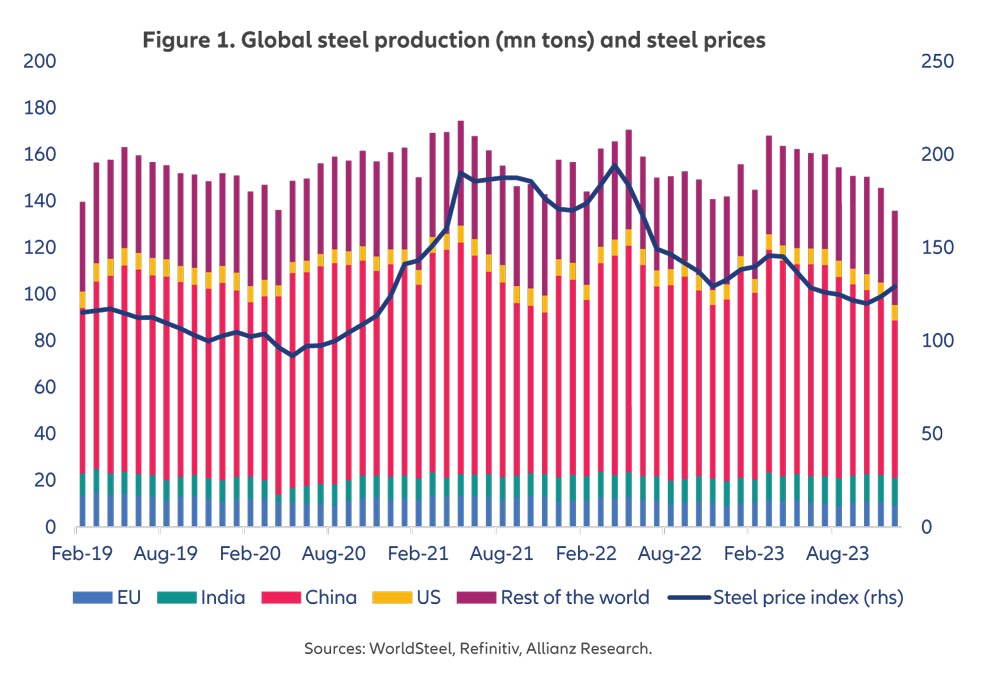

In 2023, base metal prices and steel prices remained broadly stable (decreasing slightly by about -3% y/y and -6% y/y respectively). Demand remained robust, especially in the auto and the renewables sectors, while supply constraints were still present which prevented a further slide in prices. Production was also slightly stable in 2023 – steel production grew by +0.4% compared to 2022. Furthermore as energy and transportation costs eased in 2023, the global metals and mining sector was able to improve its profitability. Compared to pre-pandemic levels, the sector’s net income increased by about +10% p.a. over the last five years and its revenues grew by close to +20% p.a. over the same period. Indeed, the outlook for demand is likely to remain positive going further as the global base-metal mining market size is poised to reach USD744.14bn by 2030.

Despite some volatility, prices remain high and demand also supports the sector

Looking ahead, we see a number of key trends and challenges that will shape the industry:

- Pivot in interest rates: Since 2022, central banks around the world have sharply increased interest rates. With slowing economic activity and cooling inflation, rates should decrease over the next quarters, which could provide a tailwind to the metals sector since it is highly capital-intensive.

- (Geo)politics: In response to the Ukraine conflict, metal prices have increased sharply and any issue around the world from a miners strike to tensions between nations could generate large price swings.

- Public policies on critical materials: In recent years, most developed countries have defined what they see as critical materials/minerals and have also designed roadmaps to increase production and guarantee supply (eg. the US Energy Act, the EU Critical Raw Materials Act). These policies could have a significant impact on firms in the sector going forward.

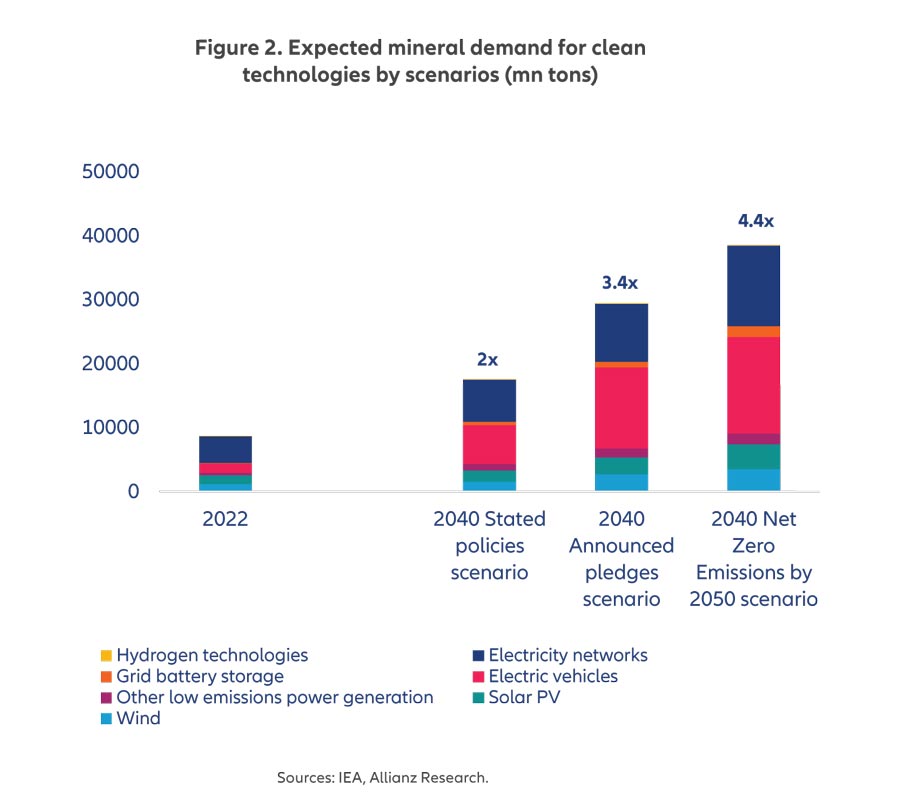

- Green regulation: Green regulation will be both an opportunity and a challenge for the sector. The shift to clean technologies will require much more metals and boost demand. But the metals sector has historically been a heavy polluter and will be required to become greener itself. This will imply higher costs and production challenges.

- Exploration & mining projects: Uncovering new mineral resources will be key for the sector’s supply chain, output and profitability going forward.

Watch our latest video series with Xenia Broking delves into the Metals sector:

Sector strengths and weaknesses:

Strengths

- Increasing demand: The metals sector will definitely benefit from increased demand thanks, to the greening of our economies.

- Higher metal prices: Metal prices are likely to remain at levels higher than historical averages. Although market dynamics can mean prices very unpredictable such as Nickel.

- Public policies focusing on critical raw materials: Securing critical raw materials and minerals as become a policy matter in many parts of the world and this is definitely a support for the sector.

- Strong liquidity position: Overall, firms in the metal sector and including mining companies tend to have strong liquidity positions.

Weaknesses

- Supply-chain weaknesses: The metals supply chain is both highly fragmented – since mining, refining and smelting can be scattered across the globe – and also highly concentrated as a few countries dominate activities (e.g. copper is extracted mostly in Peru & Chile; most of the refining occurs in China).

- Volatile prices: Nickel prices have dropped around 40%, and some mines have cut production, or mothballed until they bounce back. This has been caused by an increase in supply from Indonesia, driven by Chinese investment. Indonesia has grown market share from just 2% in 2015 to over 45% of global market share.

- High exposure to (geo)political risks: Because of its supply-chain fragmentation across the globe, the sector is highly exposed to geopolitical risks. In some specific regions such as Africa or Latin America, the sector is also vulnerable to domestic social/political risks.

- Increasing ESG pressures: Metals companies are facing increasing pressure from ESG regulation regarding their water use, pollution and biodiversity impacts.

- High capital intensity: Firms in the sector need to spend massive capex in order to maintain continuous investment and maintenance, as well as adapting to environmental regulations, and improve efficiencies.

Market focus – UK

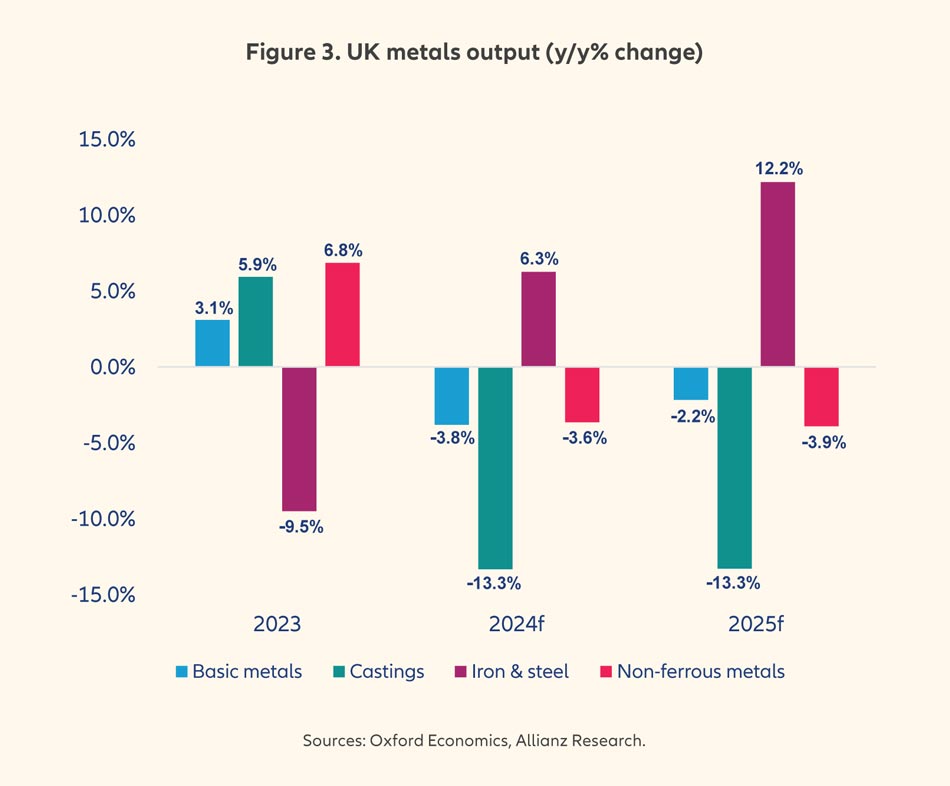

The metals sector, which includes basic metals, castings, non-ferrous metals and iron & steel, accounted for close to GBP31bn of sales in 2023 in the UK, down from GBP34bn in 2022 – mostly because of lower volumes in iron & steel (see Figure 3). As volumes are expected to decrease in 2024 in most segments, coupled with lower prices, the turnover for the sector is likely to decrease by close to -15%. The sector will be challenged by tight financial conditions and higher interest rates that are weighing on construction activity. Furthermore, as the automotive sector and the wind sector are also experiencing a slowdown, the outlook for demand is tilted to the downside. The wind sector has faced major cost issues with soaring input prices, labour shortages, fixed price contracts, and supply chain delays. In the UK, day sales outstanding (DSO) for the sector stood at 64 days in late 2023, in line with the global average for the sector (62 days). With most companies having DSOs between 60 and 90 days, this confirms that the liquidity position of firms in the metals sector is rather solid.