Let’s have a look at the main measures

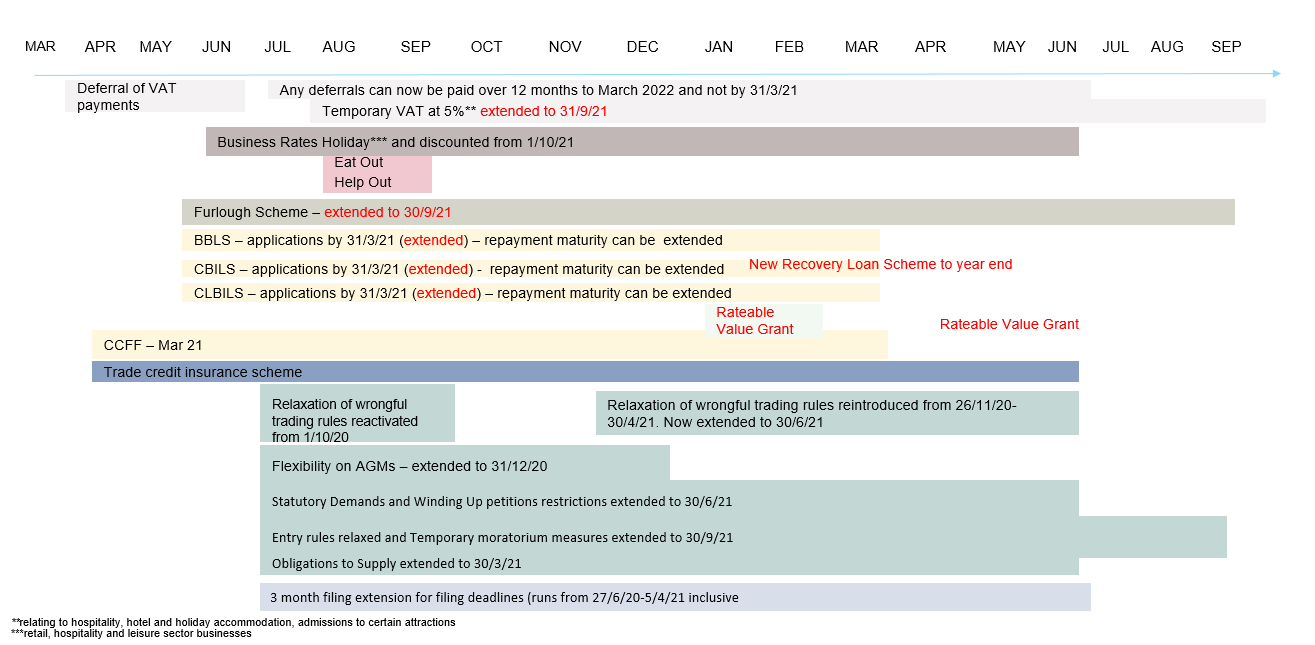

Furlough scheme – The government pays 80% of salaries up to a limit (£2,500 per month ). Employers then need to decide to bring employees back to work their normal hours, reduce their hours or terminate their employment. It has been extended to 30 September 2021, having previously been scheduled to run to 30 April 2021.

Winding up petitions are suspended until the end of June. This helps businesses to protect their assets from creditors.

VAT Deferment – Any VAT deferrals can now be split into smaller, interest-free payments to March 2022 as opposed to payment in full by 31March 2021.

CBILS (Coronavirus Business Interruption Loan Scheme) and BBIL (Coronavirus Bounce Back Loan) both expired at the end of March. They are being replaced by the Recovery Loan Scheme until the end of 2021. It applies to businesses of any size from £25,000 to £10 million. The government guarantees for up to 80% of the loan.

VAT Reduction: 5% VAT for hospitality and leisure has been extended to 30th September 2021 before rising to a 12.5% interim VAT rate from October 2021 until April 2022.

100% Business Rate holidays for retail, hospitality and leisure are now in place until the end of June 2021, with a two-third discount thereafter for the rest of year.

Trade Credit Reinsurance Scheme: the government is supporting the economy, by guaranteeing for up to 90% of losses. This has been extended from March to June 2021.

However, the government has also reintroduced the “Crown Preference” rule as of December 2020. Read more about this to find out if your business is affected and it can miss out on credit re-payments.