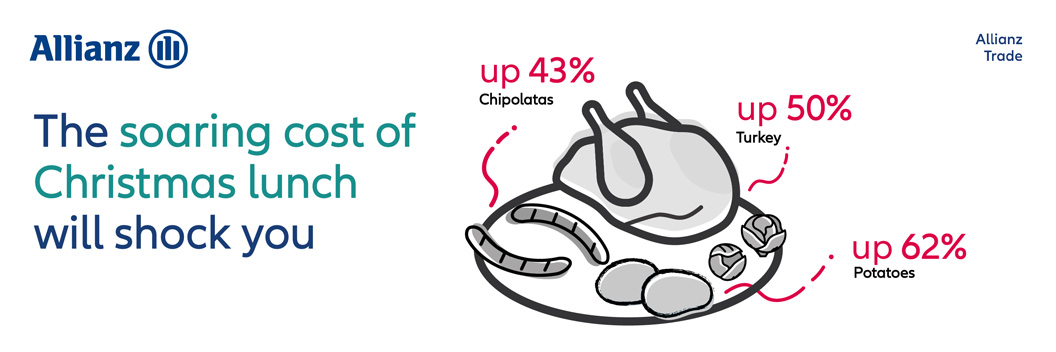

The soaring cost of Christmas for small businesses, perhaps signified by the price of your staff Christmas lunch, may be a shock this year. Traditional festive ingredients such as turkey and some vegetables are up to 62% more expensive than in 2021, according to some surveys.

Research for the BBC found the price of seven yuletide foods rose by 22% in the last year, with chipolatas seeing the sharpest hike at 43%. Another survey by Eastern Daily Press found some Christmas lunch ingredients like vegetables, milk and potatoes all rose significantly in 2022, with the steepest increase being potatoes at 62%.

It can be hard to keep track of all the inflationary factors that have buffeted small businesses recently. Although supply chains disrupted by the pandemic are easing gradually, this has still been a significant inflationary factor in 2022. Russia’s invasion of Ukraine caused further, unforeseen rises in electricity, oil and food prices.

A tight labour market has forced firms to put up wages across the board, including in the UK. One cause of labour shortages in this country has been freedom of movement ending post-Brexit. But more recently, employees leaving the UK workforce due to poor health and an exodus of workers over 50 have compounded the problem, according to Office for National Statistics (ONS) analysis. Meanwhile, vacancies remain at historically high levels, says the ONS.

In a Chamber of Commerce survey, most exporters said the UK’s post-Brexit trade deal with Europe has also pushed up costs.

2023: A year of sustained uncertainty for businesses

Furthermore, knock-on effects from the 2022 summer drought will cause prices to keep climbing into next year. Avian flu and a carbon dioxide shortage caused by surging natural gas prices have exacerbated the problem as Christmas approaches. The price of CO2 – which is used in slaughter processes, packaging and, of course, fizzy drinks – has bubbled up by an eye-popping 3000% in the last year, according to the Energy and Climate Intelligence Unit.

So what does it all mean? Combined with interest rate shocks and an impending recession, these challenges could stress even the best-run businesses. It’s why our economic insights team predicts a wave of global bankruptcies next year. For small business owners, these failures will increase the risks of allowing trading partners to defer their payments to you.

One solution to help protect businesses from the impact of non-payment is trade credit insurance. This type of insurance policy steps in when a customer can’t pay a bill, perhaps due to some of the above factors.

How to ease the cost of Christmas stress for your small business

Extending credit to customers weighs on your working capital and cash flow. It exposes you to late or non-payment – affecting your ability to plan, grow and perhaps even survive as a business. Bad debt can be difficult to recover, especially if your client becomes insolvent or bankrupt.

2022 research from Barclays showed 58% of UK businesses were owed money through late payments, fuelling stress and cash flow problems. Late or non-payment also takes up valuable internal resources to track, chase, gather evidence, and respond to complications. It also takes time and resources to assess the impact on your cash flow and capital and how to respond. In more extreme cases, debt collection and legal fees can cost you even more.

This is where trade credit insurance can help you avoid these problems by providing protection and compensation for a bad debt. If a client doesn’t pay you on time, the insurer reimburses a percentage of the outstanding credit. This coverage is flexible and can cover all or part of your client portfolio.

In doing this, trade credit insurance plays a critical role in supporting the UK economy. In 2020, the Government Actuaries Department estimated that this cover underwrites £350 billion of economic activity – in more than 630,000 UK businesses – each year.

But this type of insurance provides many other benefits, too. It can finance your receivables while they are being collected, or even assign them to a third party.

Information from your insurer can also help you move zombie companies onto pro forma terms to protect cash flow and extend additional credit to those seizing new opportunities.

These benefits can help you speed up business growth, reduce costs and get better funding from banks – giving your small business peace of mind and confidence over Christmas and into the new year.

How Allianz Trade insurance can help

Our market-leading trade credit insurance protects your cash flow by insuring your receivables, enabling you to trade domestically and abroad without the risk of bad debt.

Partnering with Allianz Trade also connects you to the latest credit risk data and can improve your access to finance through improved lending confidence.

As business challenges grow, now is the time to assess the many risks to your business. Having trade credit insurance can help you relax over the festive season and into the New Year knowing your cash flow is protected, so why not get in touch?

Find out more about cash flow management and the benefits of trade credit insurance with our handy tips.