Swipe to view more

|

Strengths |

Weaknesses |

|

Pricing power for farmers in the upstream segment, and for some specific products and brands in the downstream segment |

Vulnerable to climate change: more frequent and severe floods and storms affect crops and livestock, limiting food supply |

|

Continuous growth potential: strategic sector considering the vital role of feeding an exponentially growing population |

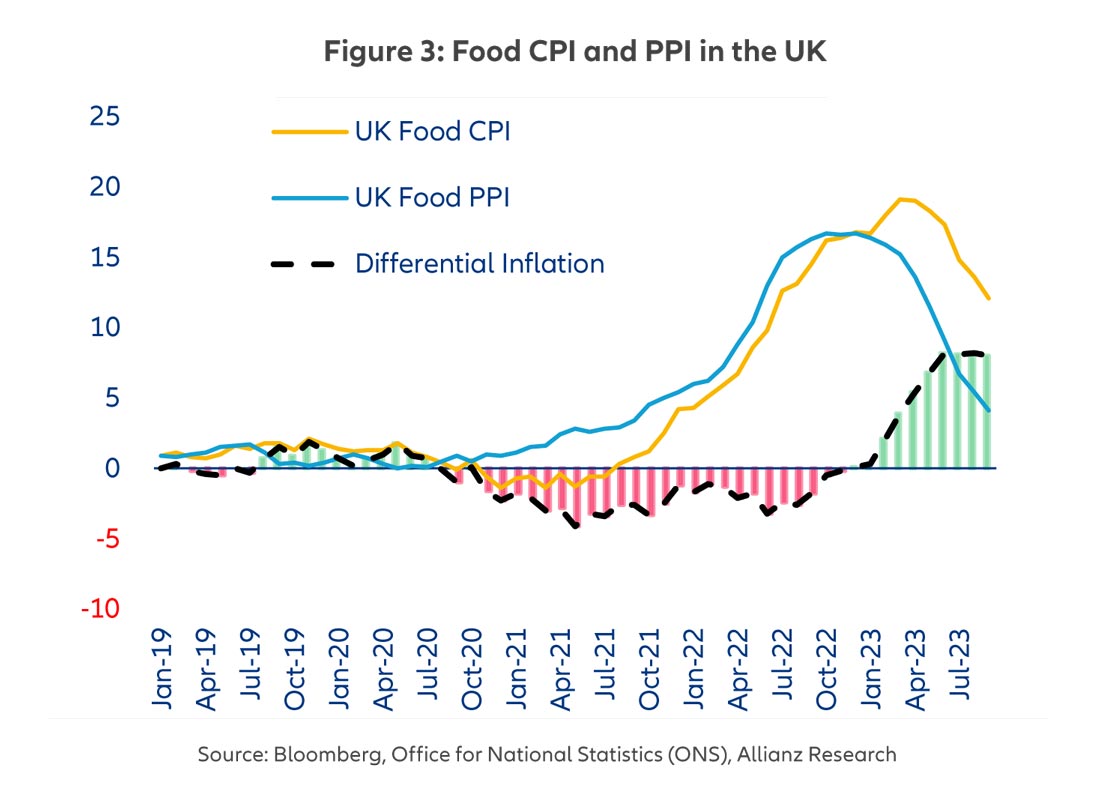

Food-processing and packaged-food companies continue to struggle with high input costs, which could lead to further pressures on margins in fragmented segments where low prices are key to attract clients |

|

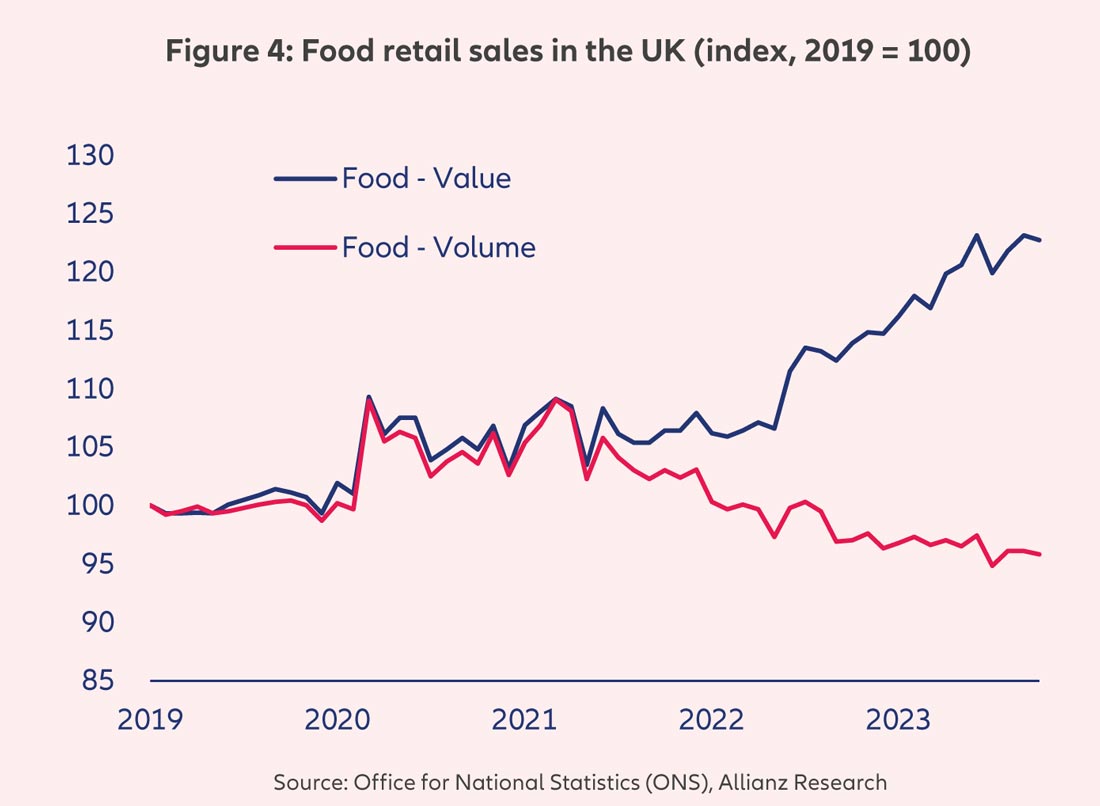

Increasing revenues, despite inflation, given the non-cyclical nature of the sector and the strategic pricing that have made companies resilient |

Labor shortages in the food and farming industries in the UK are leading to higher personnel expenses |

Looking forward, we see a number of key trends and challenges that will shape the industry:

- Geopolitics: The invasion of Ukraine has affected the global food supply and therefore prices. Before the conflict, Ukraine supplied 12% of the world’s wheat, 15% of corn and 50% of sunflower oil. As geopolitical tensions continue, we expect continued volatility in agricultural prices.

- Growing population: As the world’s population hits 8.05bn people in 2023 (UK: 68mn people, +0.35% y/y), ensuring access to food is key to avoid a global food crisis in the coming years.

- Climate change: Changes in temperature, humidity and rainfall patterns, as well as the frequency of extreme weather events (storms, droughts, wildfires) and the prolongation of the “El Nino” phenomenon into 2024 will continue affecting farming practices and food output capacity.

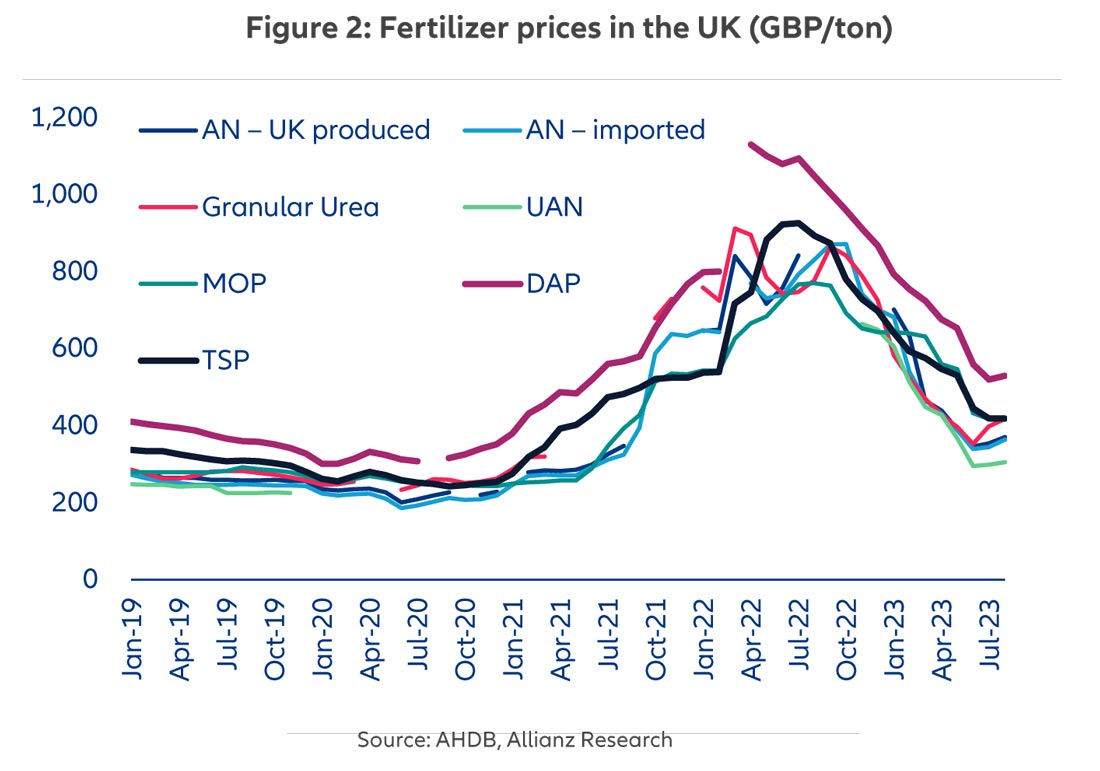

- European energy crisis: With natural gas and electricity prices to remain above historical levels, we expect the price of fertilizers to remain relatively high as well in the short term.

- Veganism: Much of the world is trending toward plant-based eating and this global shift could be here to stay, representing a considerable decrease in consumption of animal meats and animal-derived products. In the UK, it is estimated that around 8% of the population is already following a plant-based diet.

- Online distribution: Through apps and websites, virtual grocery shopping has become more attractive, especially for young people. This trend will continue to gain momentum and we believe that it will become a challenge for physical retailers.

Sector Overview:

It is estimated that around 70% of UK land area is used for agricultural production. However, as not all land is suitable for growing crops – and the land in some regions suitable only for certain crops – most of this land area is grassland for grazing.

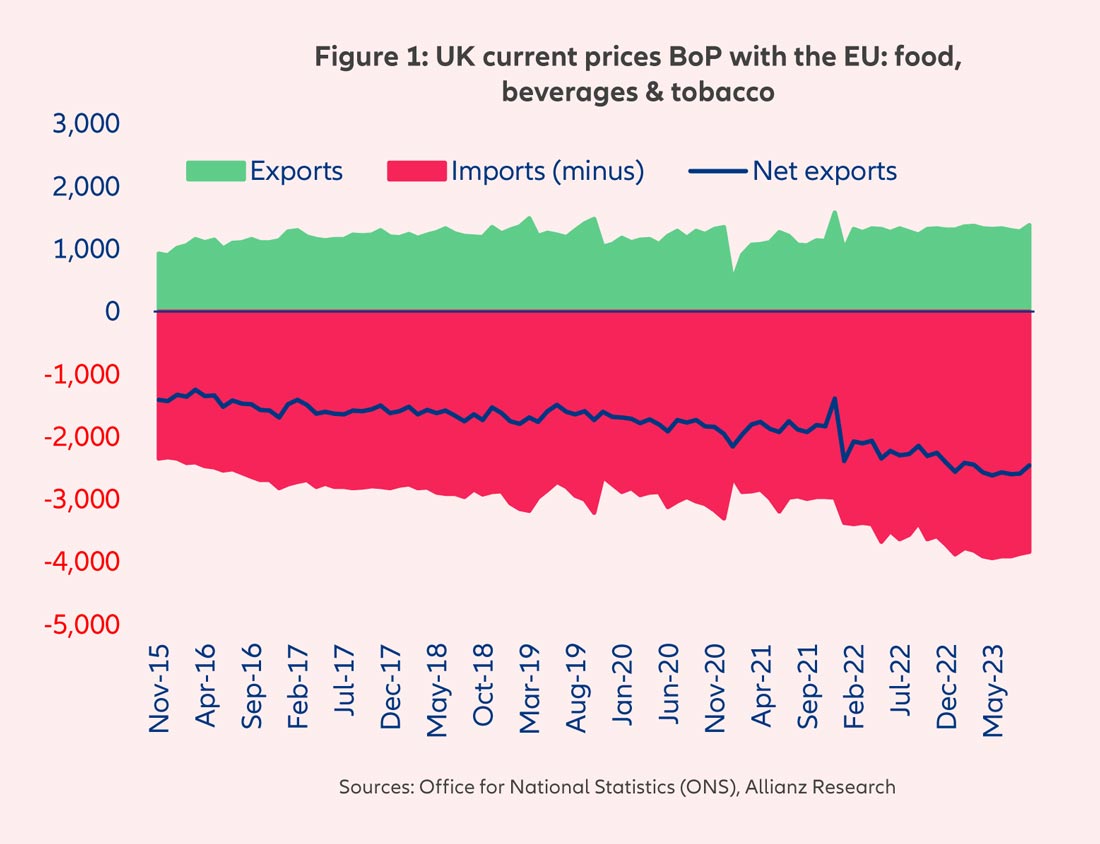

To secure the national food supply, the UK relies both on its own production (around 60% of its internal food consumption) and on imports. But despite the fact that UK’s self-sufficiency index has remained stable over the last two decades, even through major changes such as Brexit in 2020, the UK is actually a net food importer, importing more than it exports, both relative to the rest of the world and also with respect to the EU (Figure 1).