In what is a crowded field for business concerns this year, macroeconomic developments remain a top five risk globally in the Allianz Risk Barometer 2024, and ranks seventh in the UK. Yet economic growth is forecast to weaken to just over 2% globally in 2024, and undershoot the long-term average significantly, according to Allianz’s research. We forecast 2024 GDP growth at +0.6% in the UK, compared with +1.4% in the US and +0.8% in the Eurozone.

Heightened geopolitical risk will only add to economic uncertainty in 2024, as countries that account for 60% of global GDP head to the polls, including in India, Russia, the US, and the UK. Unsurprisingly, given ongoing conflicts in the Middle East and Ukraine, UK respondents to the Allianz Risk Barometer rank political risks joint fifth alongside climate change, which jumped three places since 2023.

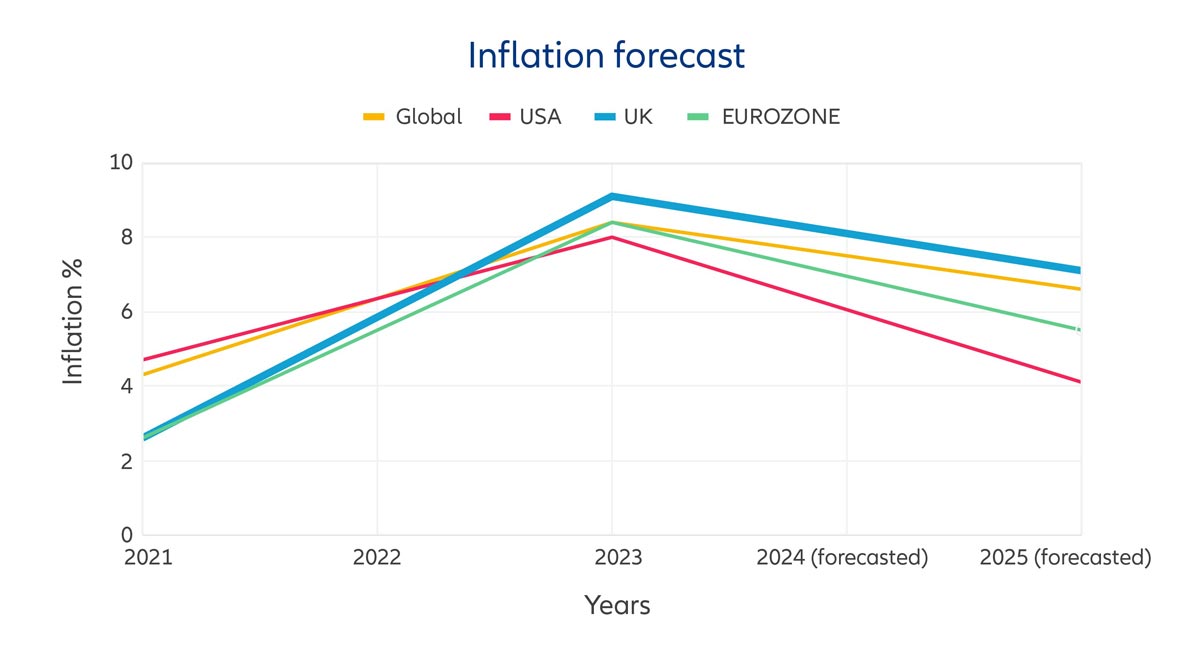

2024 could become a year of transition, in which the wild ups and downs of growth, inflation and interest rates experienced since the Covid-19 shock settle down and pivot to more usual levels. Yet, with the large number of elections this year and their potential for upheavals, this outcome is far from certain, according to Ludovic Subran, Chief Economist at Allianz.

“First and foremost, of course, is the US election – which could end with a possible return of Donald Trump to the White House. Trump II is likely to be more disruptive than Trump I, for one simple reason: eight years later, the world is a different place, fragmented and torn apart by a multitude of conflicts and wars. An isolationist America is always bad news for the rest of the world (at least for the free one), but in times like these the risks are even greater than usual,” he says.