Global outlook for the Construction sector

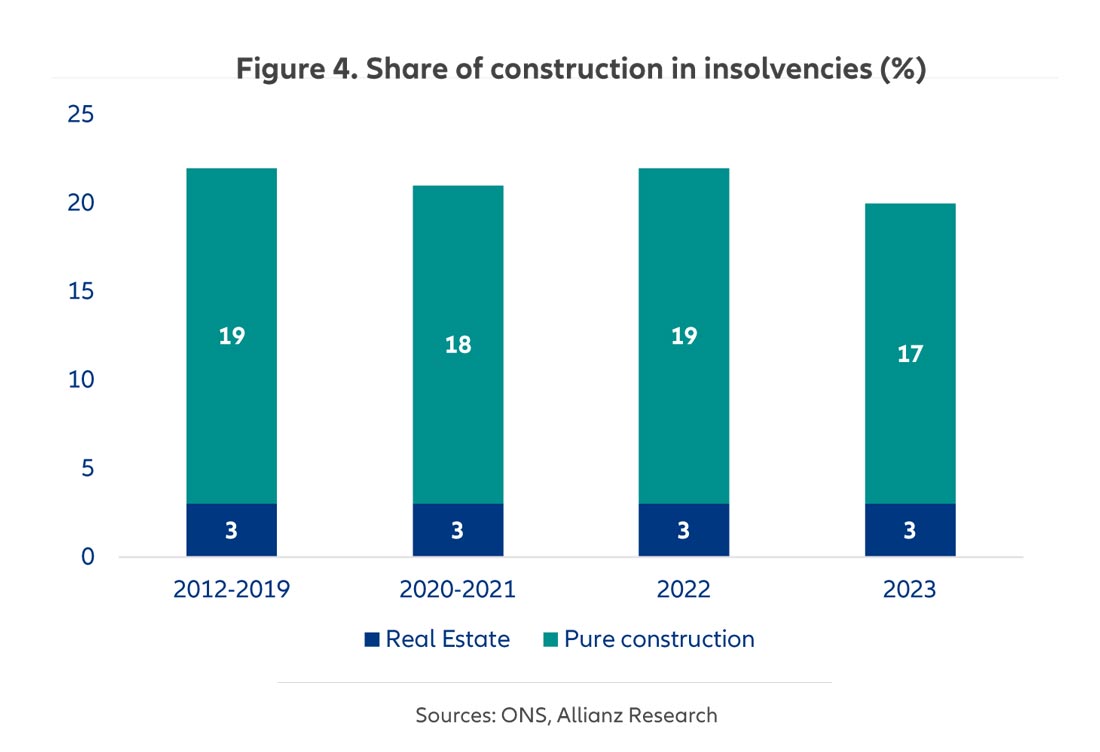

Drag on residential from higher interest rates to weigh on the global construction sector but resilient non-residential segment

Drag on residential from higher interest rates to weigh on the global construction sector but resilient non-residential segment

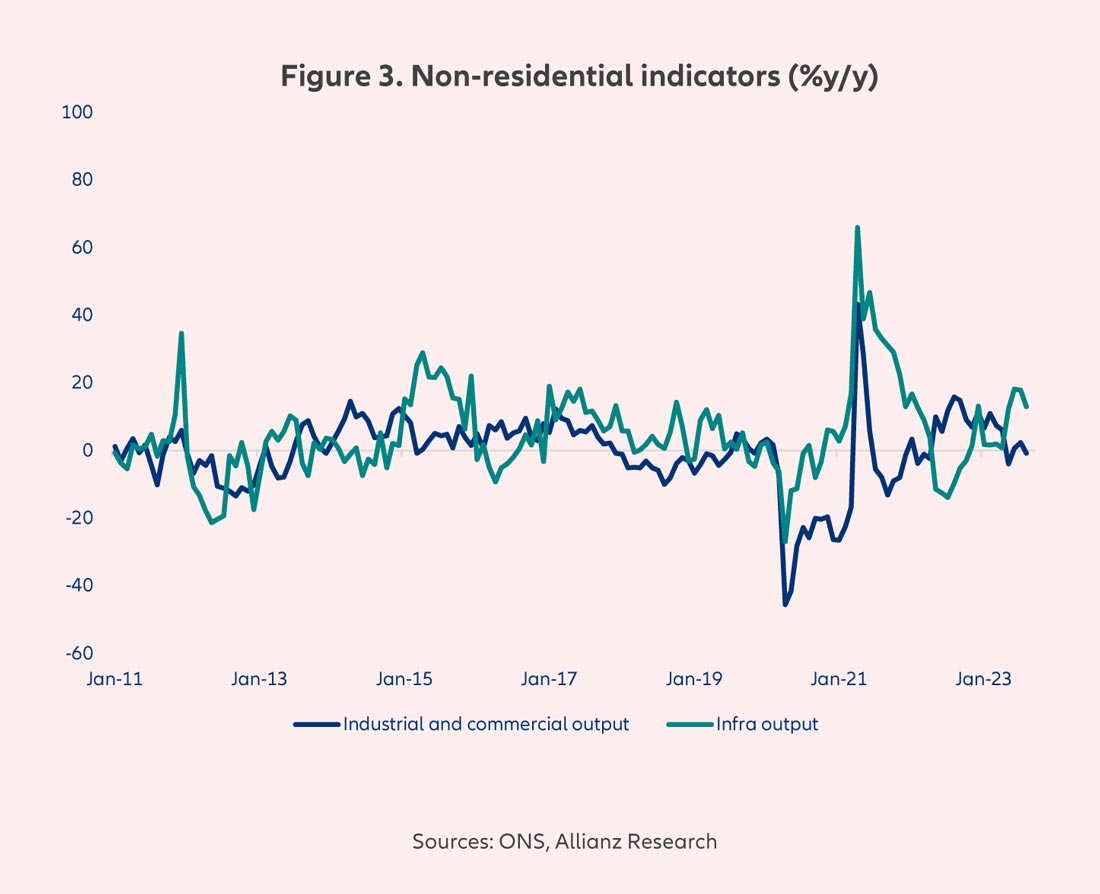

Despite profitability on the strong side, smaller firms in the sector grapple with liquidity issues as cash flow is crucial in construction since companies often have to pay for materials and labour upfront while being paid in instalments. Unsurprisingly, construction firms make up for about 30% of insolvencies in most countries.

From a longer-term perspective, the sector should continue to grow steadily: there is an increasing demand fuelled by urbanization, demographic shifts, and larger investment in infrastructure. By 2030, the industry's global output is projected to reach USD 15.5 trillion, with China, the United States, and India being the primary contributors, accounting for around 60% of this growth.

Looking forward, we see a number of key trends and challenges that will shape the industry:

Swipe to view more

|

Strengths |

Weaknesses |

|

High demand due to urbanization and population growth |

Highly cyclical |

|

Increased investment in infrastructure development |

Cost control and schedule management challenges |

|

Growing focus on sustainable and green construction |

Skill shortages in the industry |

|

Emergence of smart cities pushing advancements in construction |

Regulatory and environmental challenges |

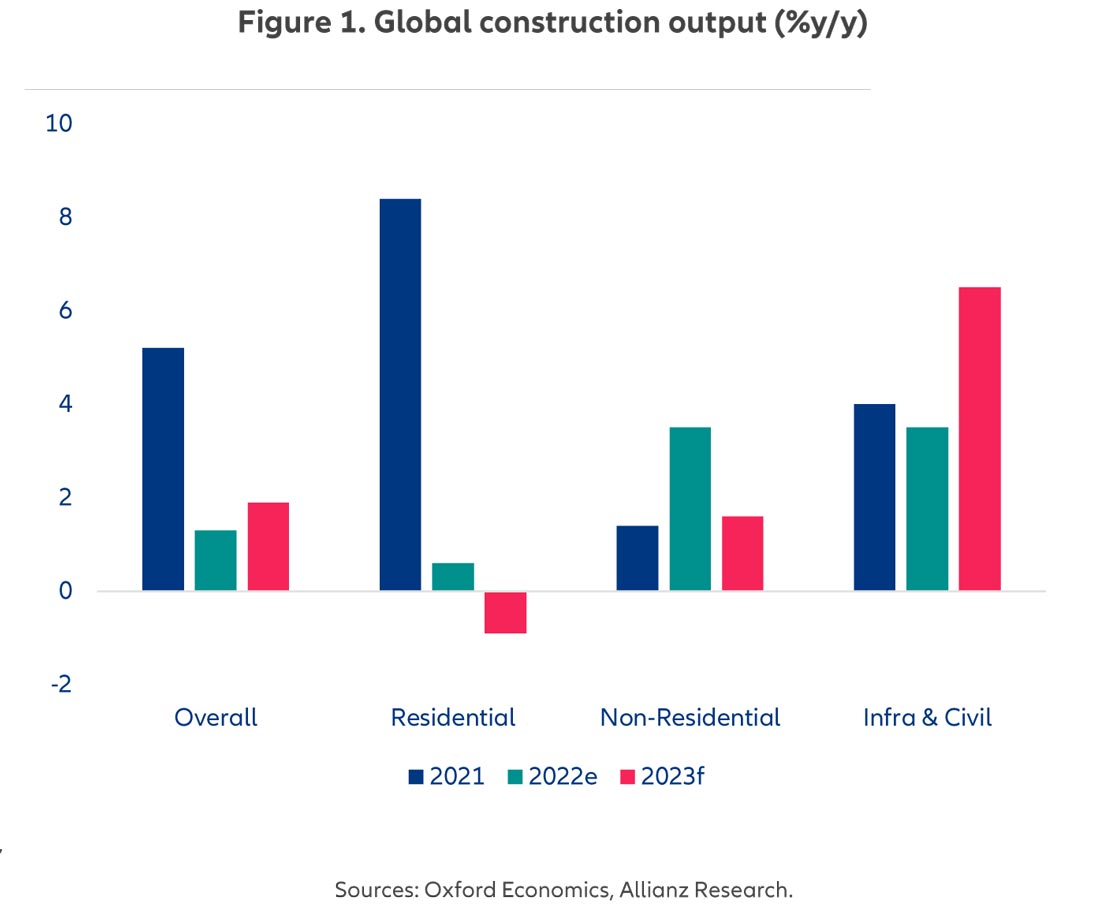

As interest rates have been rising fast in the UK, mortgagers have been on a downward trend and house prices have decelerated sharply. House prices only grew by 1%y/y in Q2 2023 while they grew by about 9% in 2021-2022. Housing starts in England have increased strongly (+33% as of Q2 2023), however construction firms have been reporting decreasing workload from private clients which points out that firms are clearing their backlogs and that the slowdown in new build is yet to come.

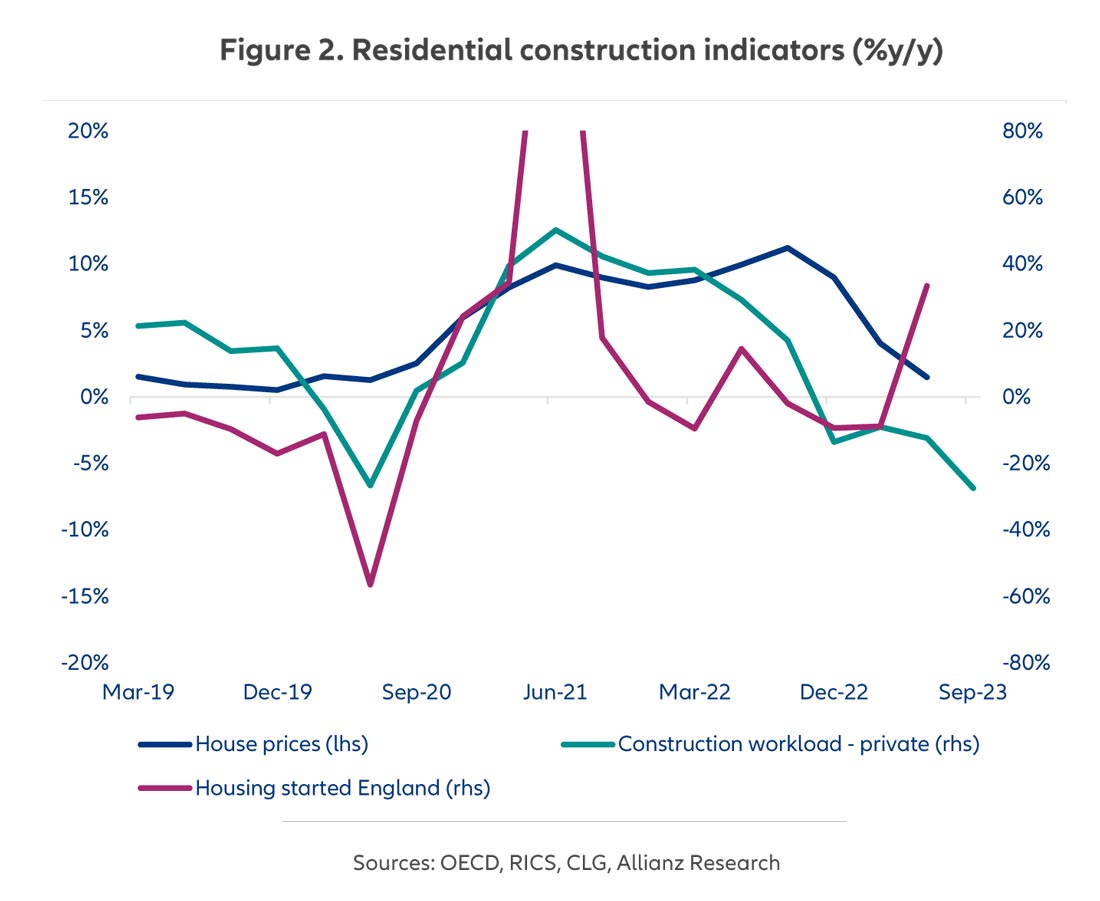

Growth of non-residential construction in the UK has been on a downward trend since Q3 2022. Industrial and commercial output declined by about -1% as of August 2023 while infrastructure output grew by about +13%. Economic uncertainty, rising rates and the legacy of Brexit are probably the main factors driving slow non-residential build. Going forward, both segments segment should slowdown.

Although the sector benefits from solid profitability it is mainly composed by SMEs that often work as subcontractors for large firms. As a matter of fact, they have lower pricing power, higher exposure to the business cycle, and a longer cash conversion cycle (i.e. they have to pay most of the inputs and their labour force months before getting paid by their clients). As a consequence, these smaller players tend to go bust as soon as their cash is mis-managed. In the UK, construction firms account for about a fifth of the country’s insolvencies.