Even profitable and successful companies can be weakened when faced with late payments or a customer insolvency. There is much to do to protect your business: picking the right customers to trade with, implementing processes to ensure invoices will be paid on time, integrating cash flow forecast management in all your investment decisions, or taking out a trade credit insurance policy.

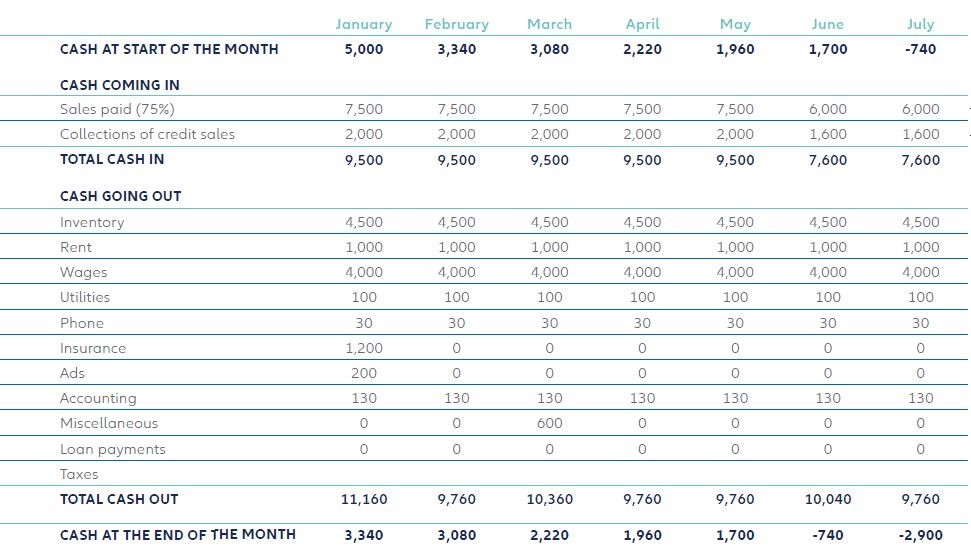

It all starts with having an up-to-date cash flow statement and creating a cash flow forecast. Let’s have a look at the benefits of a cash flow forecast, how to calculate cash flow and how to make a forecast.