- A surety bond can refer to various bond obligations, used extensively throughout construction industry to protect a developer or project owner. They can also be applied to a variety of scenarios where a business has a contractual or security obligation to fulfil.

- There are different types of surety bonds that can be procured, each individually designed to meet the specific obligations being guaranteed. They pay out under specific circumstances if certain contractual obligations aren't met.

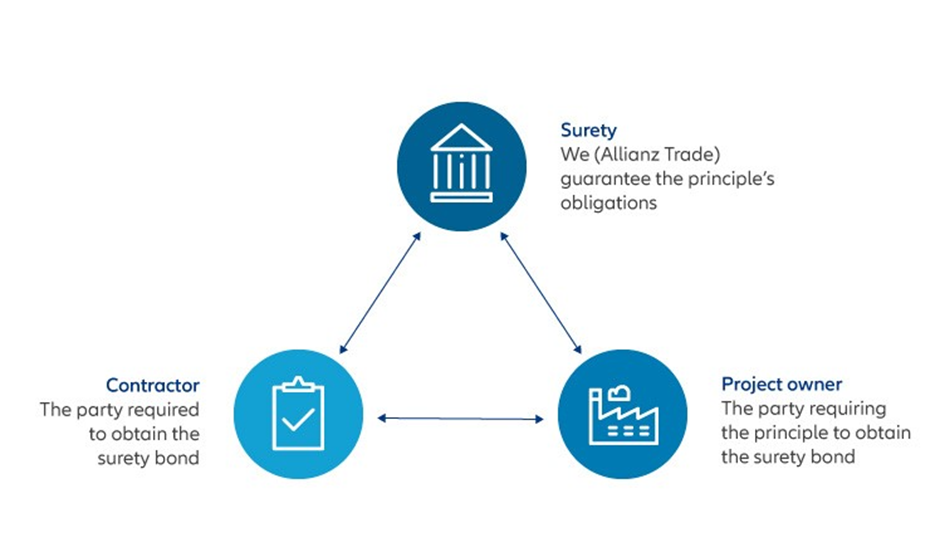

- Surety bonds are an agreement between three parties; your business (the contractor), the surety bond company (such as Allianz Trade) and your employer or client (the project owner).

Let’s look at an example.

Imagine a school in need of a new gym. The board of directors ask a range of local contractors to tender for the job, shortlisting those who will guarantee their work with a surety bond, and choose the one they like best.

What happens if the contractor becomes insolvent with the project half-completed?

With a surety bond in place, the school is protected. The insurer will pay out, ensuring the school can afford to engage a new contractor and complete the work.

Simply put, if your business fails to comply with the terms and conditions of a contract, a surety bond company like Allianz Trade will compensate your client (the project owner) for any losses and damages.

A surety bond is therefore a guarantee that many clients will insist upon, particularly in the construction industry.

What are the benefits of surety bonds?

The exact benefits of a surety bond depend on the type of bond taken out and the underlying scenario. In our simple school gym example, it is the project owner who benefits from the financial security, whilst the contractor also benefits from being able to win the project in the first place.

In this example, the range of benefits for the project owner can include protection from:

- The overall risks of using contract workers

- Work not being completed to the right standard

- Contractors unable to pay for subcontractors, supplies and materials

- The construction firm becoming insolvent

- Situations where their bid system requires them to use potentially unreliable low bidders

In addition to the financial protection, the project owner also has the reassurance of working with a contractor who is willing to guarantee fulfilling their obligations.

What are the types of surety bonds available to contractors?

A construction bond (also known as a performance bond or contract bond) provides a guarantee that a contractor will fulfil their obligations under a construction contract. It provides financial compensation to a project owner if the contractors fail to meet their contractual obligations, as set out under the bond wording.

There are a number of different types of surety bonds that contractors might want/need to use, on a range of projects and for different trade sectors. These include:

- A retention bond: Can be used to release locked up cash that a client holds to cover any faults in your work. The retention bond provider acts as the guarantor instead, agreeing to pay up to the amount that would have been retained if you, the contractor, fail to carry out the work satisfactorily, or resolve defects.

- Advance payment bond: Acts as security that specialist equipment that may need to be paid for up front, will be used to carry out the work contracted. The bond ensures that the monies are appropriately spent in the delivery of the project whilst aiding the contractors project cash flow.

- Section bond: Covers public body works where construction impacts on existing public infrastructure (roads, sewers etc).

- Bid bond: A bid bond protects the contractor and ensures the agreed bid price is honoured if a developer can't pay.

How to get a surety bond?

If a surety bond is required under your contract, then your first step will be to arrange a surety bond facility. Each bond is usually tailored to an individual contract and having a surety bond facility in place will allow you to arrange the issue of bonds quickly.

Here is an overview of the process:

- Identification - you contact the surety bond company and explain your need, providing security in support of a contract. You can do this quickly and easily online with us at Allianz Trade.

- Risk analysis – underwriters assess your company’s information, analyse your risk profile and carry out due diligence.

- An uncommitted bond facility is established – the surety bond facility structure is established for your company and will include an estimate of the maximum limit (aggregated) of surety bond coverage. Your company’s financial status will be reviewed regularly.

- Arrange bond for project – use the facility for arranging multiple bonds and projects. Keep in mind that each bond will be agreed separately and due diligence is ongoing.

Surety bond requirements in more detail

Before a surety bond is issued, due diligence needs to be carried out by the surety bond company. The larger the project, the bigger the bond and the more thorough this process needs to be.

Surety bond requirements assessed during the process may include:

- Financial assessment – is your company creditworthy?

- Reputation and governance of company – do you have experience on this type of project?

- Minimum underwriting criteria – is the contractor’s business large enough (e.g. turnover or net worth) to meet any minimum?

- Project contracts – contract documents and financing may be examined, particularly on larger projects.

- Sanctions checks – to ensure that you are not working for sanctioned entities or individuals.

What is the cost of a surety bond, and who pays?

Projects where a surety bond is required can range in size from a school extension to large infrastructure, multi-year projects.

The cost is based on the size of the project, the strength of the balance sheet and the risk of default.

While a contractor will apply and pay for a bond, there may be instances where the surety bond can be charged back to the project owner. There is no standard approach, but adding the surety bond as a project cost, payable by the project owner, may be part of negotiations under the terms of the main contract.

Why choose Allianz Trade for your surety bonds?

Part of the global Allianz insurance group, Allianz Trade is trusted by over 62,000 clients around the world.

We have an unparalleled understanding of credit risk, with 83 million businesses monitored across all sectors in over 160 countries.

We’re a UK leader in surety bonds, with an industry-respected AA Standard & Poor rating that characterises our financial strength and security.

We understand what companies want from a surety bond and evaluate each client on an individual basis, tailoring solutions to their unique needs and circumstances.

Thanks to our global insights and surety teams, we can provide centrally-managed surety programs to companies operating in multiple countries.

Visit our surety bond page to find out how we can help and request a quote online.