- UK insolvencies forecast to rise 3% year-on-year in 2020, down from 6% in 2019

- UK GDP growth forecast to creep up 1.0% from 0.8% previously

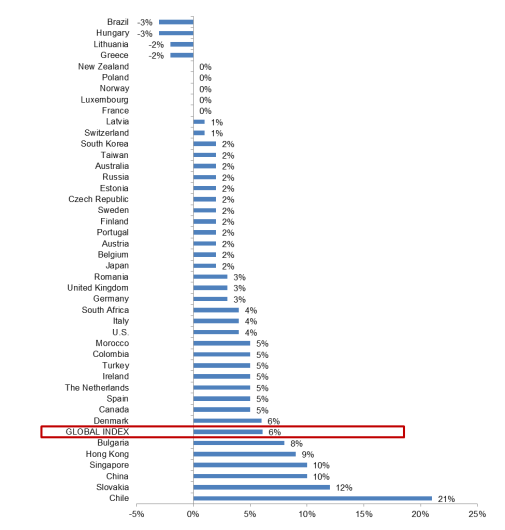

- Global insolvencies expected to increase 6% year-on-year

London, 24 January 2020: The number of UK business failures will rise 3% year-on-year in 2020 as the political situation stabilises and GDP strengthens, according to forecasts from Euler Hermes, the world’s leading trade credit insurer.

The findings come from the insurer’s annual global insolvencies outlook report. It predicts the growth rate of UK business failures will slow compared to the 6% increase recorded last year. Euler Hermes has also revised its GDP growth forecast for 2020 up to 1% from 0.8%, due to the stabilisation of the political landscape following last year’s general election.

However, firms still face a number of structural issues to managing cashflow. These include weak investment as they work through excess stock acquired to compensate for a potential hard Brexit at the end of last year, weak demand, which is driving down prices, and the risk of leaving the EU without a trade deal at the end of 2020.

Euler Hermes forecasts global insolvencies will rise by 6% in 2020, a fourth consecutive year of growth, as developed economies and staple sectors such as industrials continue to slow. Ongoing trade disputes, geopolitical uncertainty and social tensions also add to the economic headwinds faced by firms.

Milo Bogaerts, CEO Euler Hermes and Ireland, said: “Good credit management and ‘know your customer’ will be as important as ever this year. Businesses are coping with record levels of bad debt. The most recent data from the Association of British Insurers* show the value of trade credit insurance. Claims received leapt to a record £271 million in the third quarter of last year, and the average bad debt paid was £67,300, the highest ever recorded.”

Euler Hermes’ research predicts that four out of five countries will post a rise in insolvencies in 2020, with Brazil (-3%) and France (no change) the major exceptions among developed economies. Chile will post the biggest rise year-on-year with a 21% increase, followed by Slovakia on 12% and China and Singapore on 10% each. Half of the countries analysed will register more insolvencies in 2020 than before the financial crisis.

Maxime Lemerle, head of sector research at Euler Hermes, said: “A calmer political situation and forecast increase to GDP growth will be welcomed by UK firms but the economy is not out of the woods just yet, as evidenced by another year of increased business failures.

“Uncertainty around the UK’s future trading relationship with the EU, the ongoing US-China trade dispute, rising levels of protectionism and falling consumer spending all weighed heavy on businesses in 2019. While we expect trade growth and GDP levels to pick up this year, a recovery will be limited.”