Overall, the prolonged high Brexit uncertainty has significantly reduced the pockets of resilience for the UK economy. Hence, GDP growth in Q4 2018 and Q1 2019 should prove much weaker and for annual GDP growth in 2019 we expect a meager 1.2%. While labor shortages should keep wage growth above 3% y/y, potential growth is damaged. In addition, households have less leeway to boost spending as the savings rate stands at low level of 4.4% and positive wealth effects are diminishing as housing prices are adjusting downwards and the stock markets are underperforming European peers.

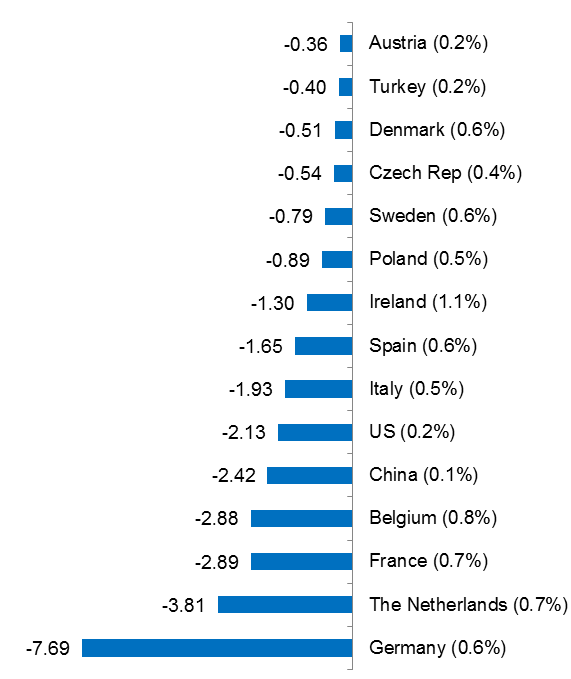

The sterling depreciation (more than 10% since the Brexit vote) has increased import cost and triggered a fall in non-financial corporations’ margins. Real import growth in 2018 is expected below 1%, the lowest level since 2011. This translated into lower outlets of Western European companies into the UK. We estimate that the Eurozone as a whole missed around EUR60bn of potential outlets on the UK market since the Brexit vote.

The lack of consent within the Conservative party has created massive uncertainty regarding the future Brexit process and leaves both parties into what looks like a “prisoner's dilemma”. Despite the win of the confidence vote, the Prime Minister Theresa May has been having major difficulties in convincing her party to go for a soft Brexit.

It may take a last minute decision to avoid the costs of a hard Brexit, which are significant and underestimated by many prominent proponents of Brexit. In our view, a “no deal Brexit” would trigger two consecutive years of recession in the UK and cut Eurozone growth by at least -0.5pp per year. Sterling depreciation would depreciate, possibly hitting 0.88 Euro per GBP in late 2019. In addition to external trade disruption, the domestic economy will shrink with private consumption contracting by -1% and business investment by -4%.

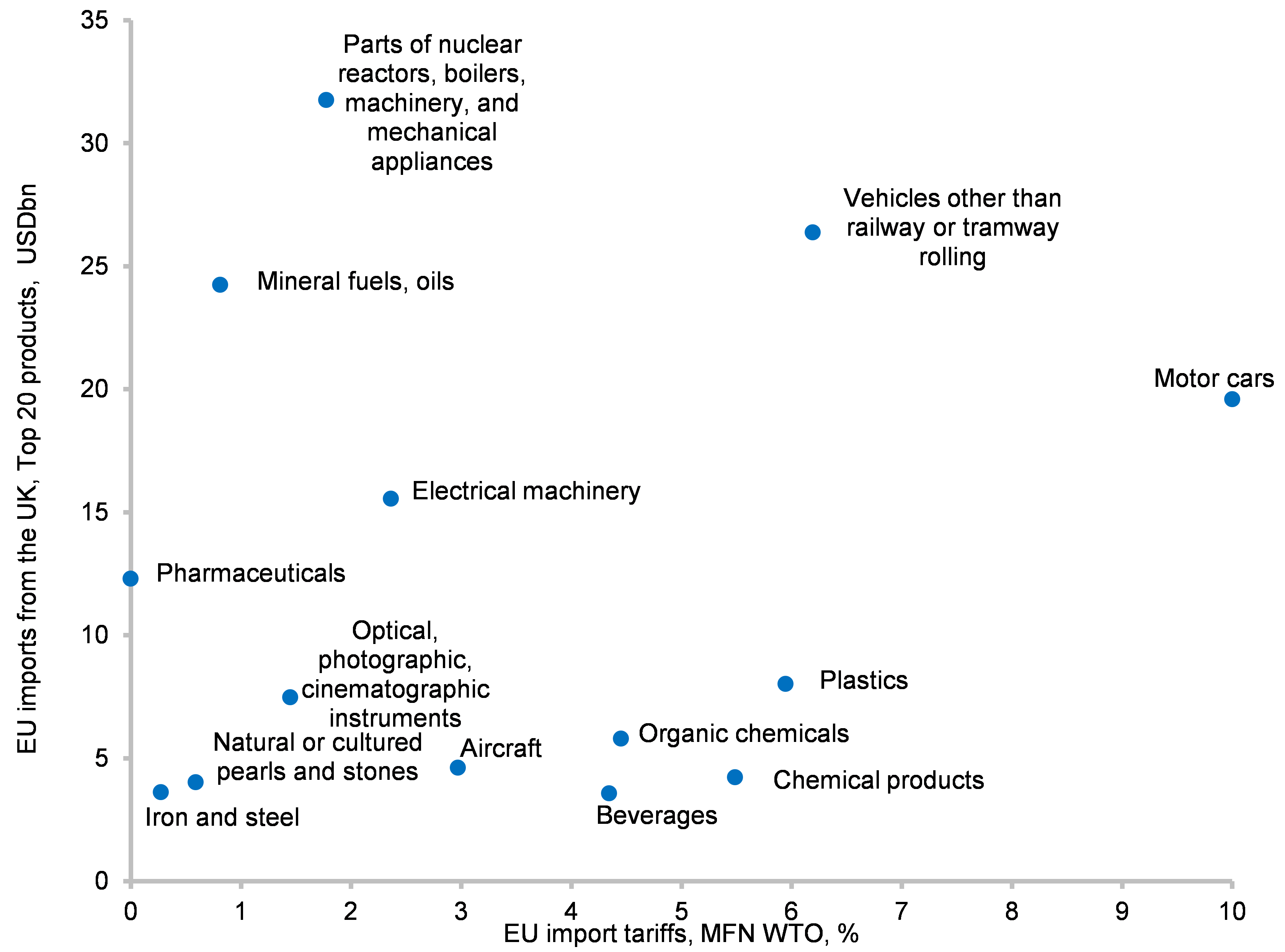

A no-deal Brexit would disrupt the supply chains between the UK and the European continent as custom checks would be introduced possibly as soon as March 29, 11pm GMT. The EU and the UK import tariffs would reach 5% on average, with the EU levying for example 10% on cars, 6% on chemicals and plastics and 4% on beverages (see Chart 2). The UK would trade under WTO Most Favored Nations conditions and would lose not only the access to the Single Market but also most of the 50 FTA it benefits from thanks to the EU membership. Businesses are preparing for the worst through contingency planning and stockpiling, but we believe this would not be enough to mitigate the shock. Business insolvencies would rise in Great Britain by 20% at least in 2019. Export losses for UK companies would reach more than GBP30bn on the back of tariff introduction and the services sector could register close to GBP40bn of losses as it loses the “passporting rights” and the “equivalence status” will require time before implementation.

Chart 2: EU’s WTO MFN applied import duties – top 20 products imported from the UK