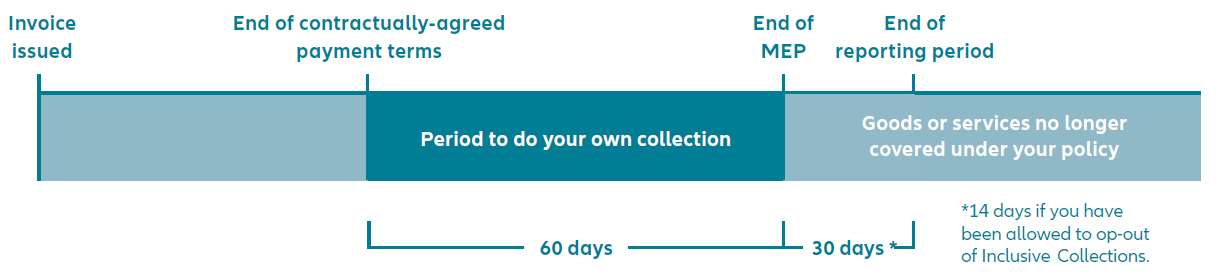

Late or non-payment is a sad reality in business. If your customer fails to pay on time, you need to report it to us so you are covered and we can act on your behalf. Read on for more information about when and how you should place a debt with us for collection.

If any circumstance described in Condition 4 of your Policy other than the ones mentioned below happens, then you must report it to us within 30 days (or 14 days if you have been allowed to opt-out of Inclusive Collections). It’s important to remember that you will not be covered for any further goods or services you supply to this customer.