Understanding your invoices

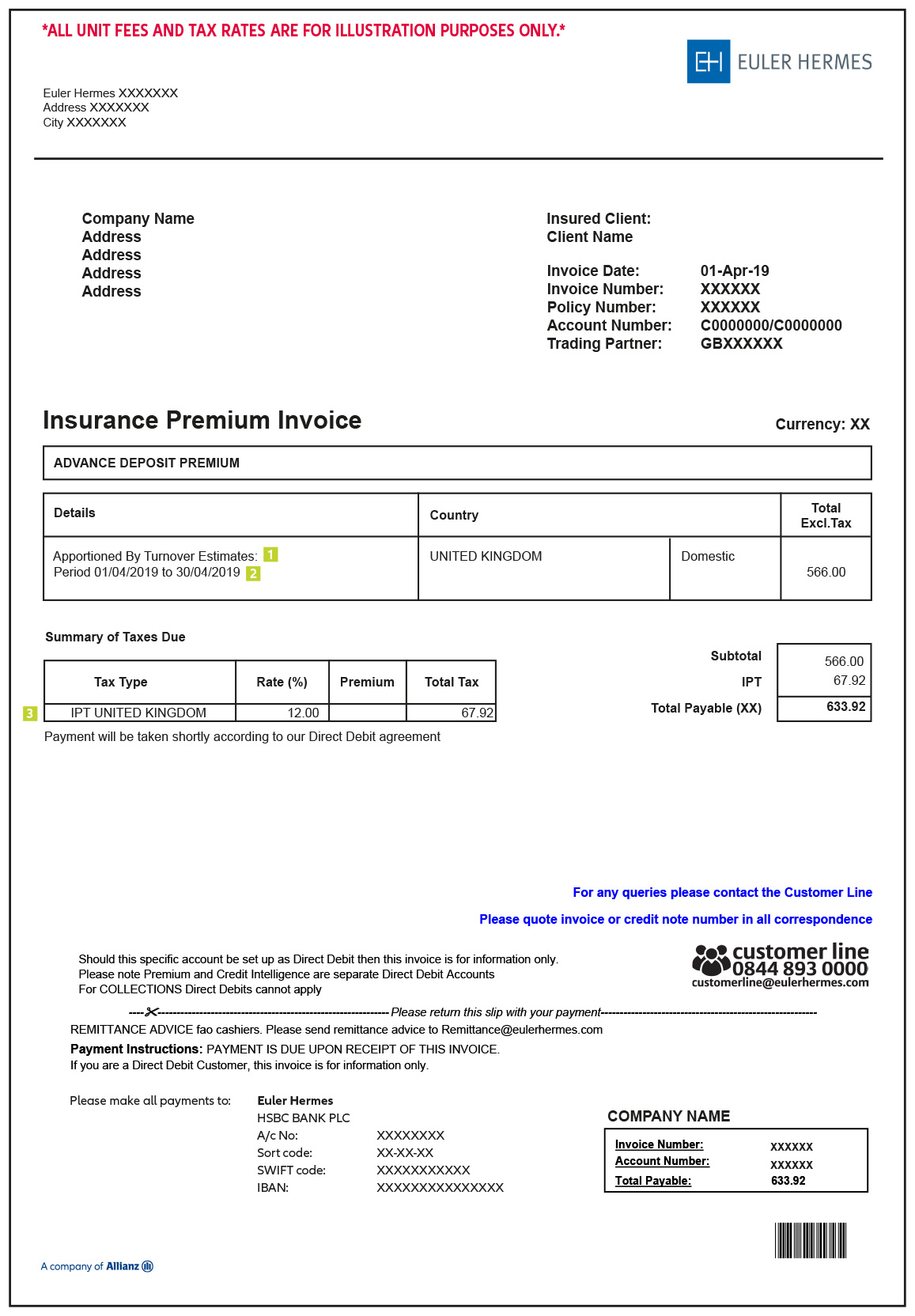

Insurance premium invoice

1. Apportioned by turnover estimates

Based on your estimate insurable turnover for this period, this is the premium to pay.

This is a monthly invoice for April and the premium amount is one twelfth of the annual figure.

2. Period covered by the invoice

Invoices will always state the period covered. The frequency of premium payment is detailed in your Policy Schedule.

3. IPT

IPT stands for Insurance Premium Tax which is payable on all or part of your premium in accordance with local tax regulations. In the UK, it is set at 12% for domestic turnover.

For more information on IPT, read our guide How to fill out your Turnover Declaration and go to “What information should I include?” > “How the figures break down”.

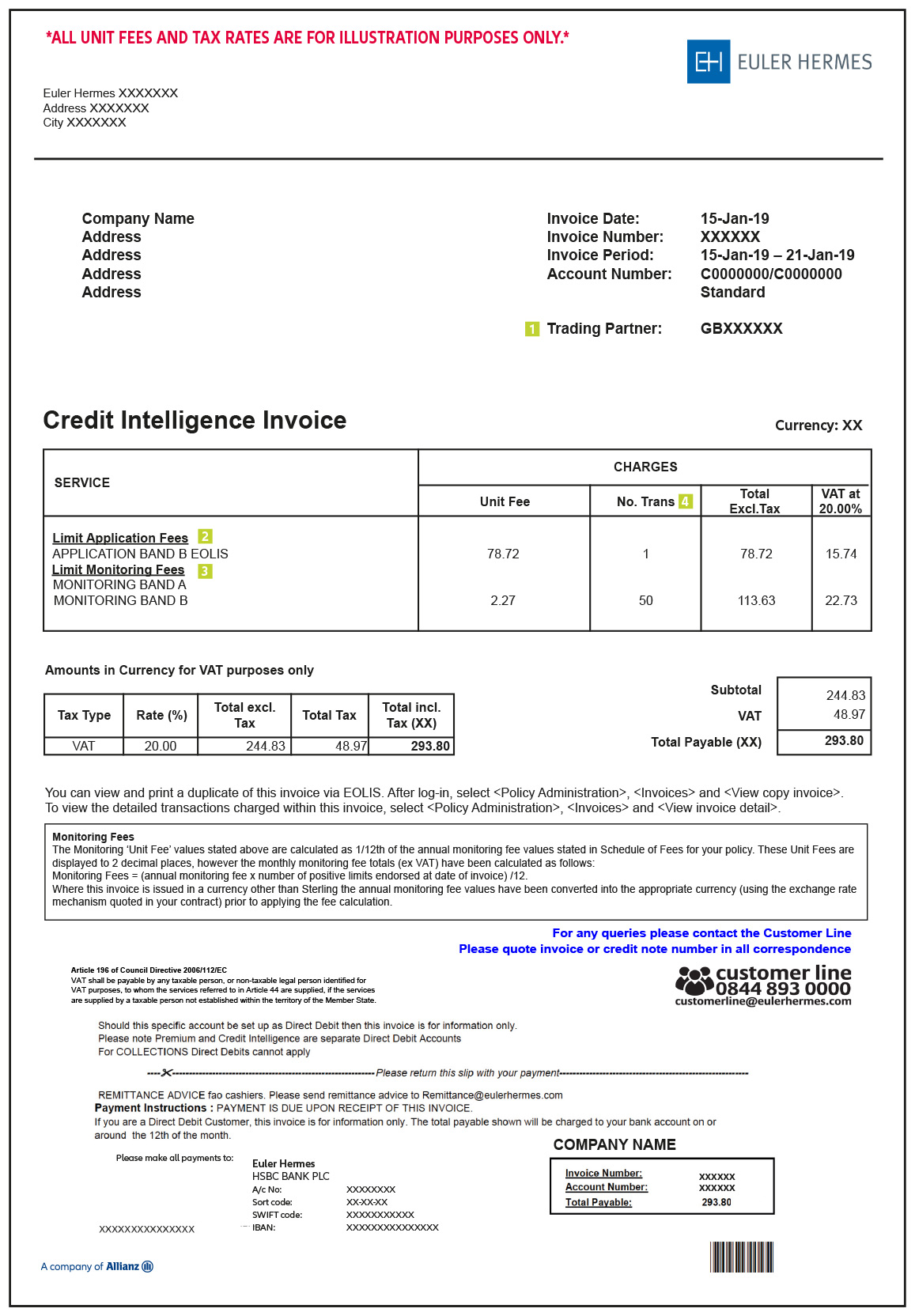

Credit intelligence invoice

1. Trading Partner

This is a code for our own reference corresponding to the Allianz company you’re trading with: Allianz Trade.

2. Limit Application Fees

A customer’s country will fall into either Band A or Band B.

Credit limits applied for in Band A countries are charged at 27.27 per application.

Band B applications are charged at 78.72.

3. Limit Monitoring Fees

The fee for monitoring is 27.27 divided by 12 for Band A and 78.72 divided by 12 for Band B.

4. No. Trans

It refers to the number of applications, or number of limits that we are monitoring that month.

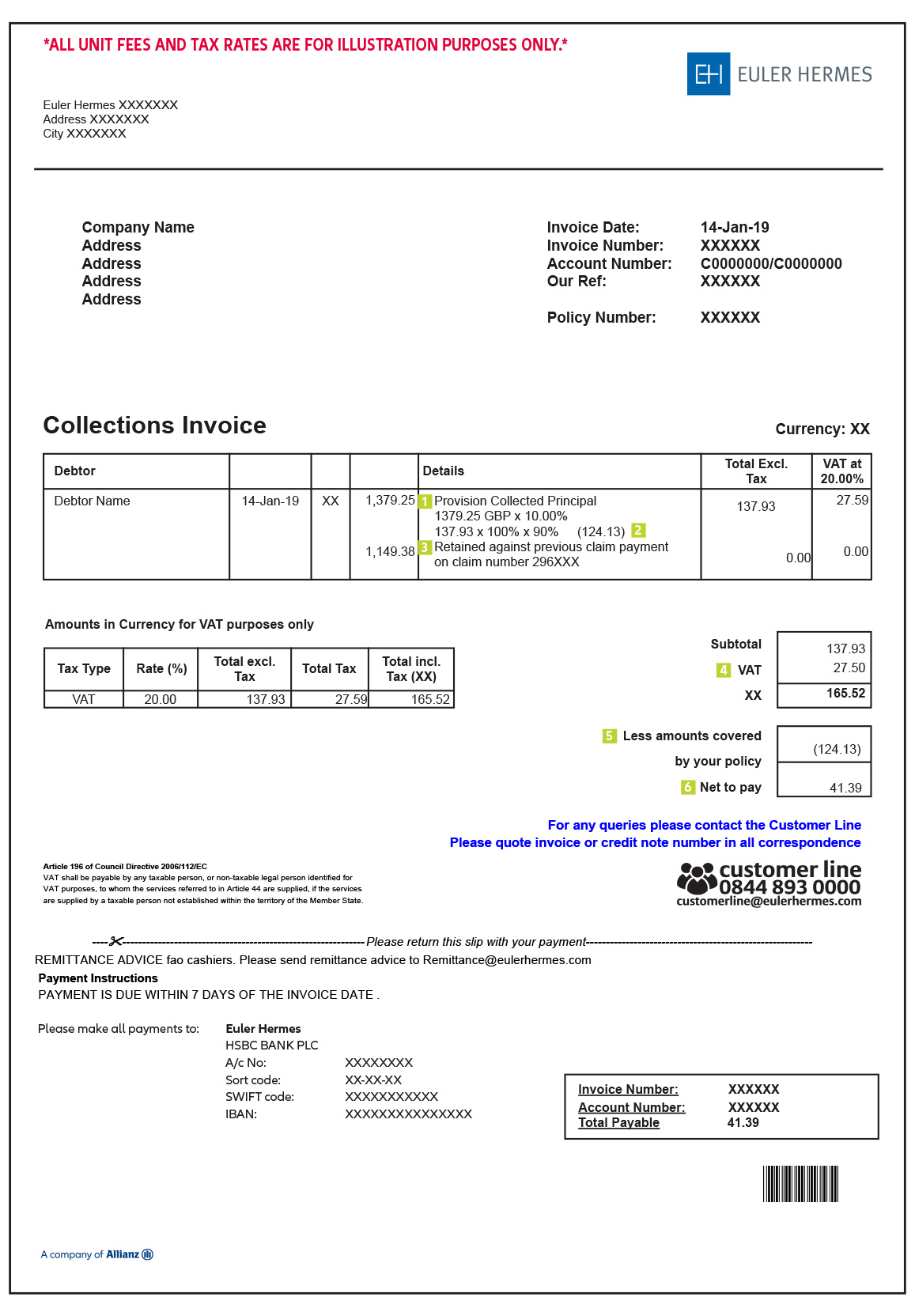

Collection invoice

1. Provision Collected Principal

This is money received by you or us from your customer.

In this example, we charge a 10% commission fee as per your contract with us.

2. Indemnification formula

Fee x Debt covered percentage x Policy indemnity percentage. Please refer to our guide: Understanding the indemnification of collection and legal costs to know more.

3. Retained against previous claim payment

After you have been paid a claim, any Salvage we receive will be shared between you and us.

4. VAT

We have to charge VAT on collection service fees (20% in UK and 23% in Ireland). So, in this example, the initial commission fee before indemnification is 137.93 so we add 20% VAT which is 27.50. We are unable to indemnify the VAT.

5. Amount covered

This corresponds to the amount we will indemnify under your Policy – see point 2 above.

6. Net to Pay

This is the difference between the Total (Subtotal 137.93 + VAT 27.50 = 165.52) and amounts covered by your Policy (124.13).