Q: Global trade is rebounding, despite uneven pace around the world. What trends are you seeing so far, and what are the driving force behind it?

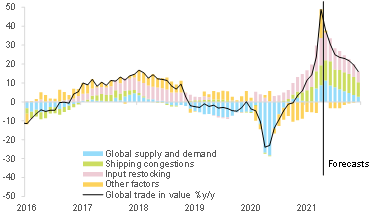

A: Global trade is certainly gathering speed and in the first half of this year the rebound was stronger than expected. In the first quarter, global trade has grown by 3.4% in volume terms, and outpaced by 8.6% of growth in value. The relative large gap in between the two numbers could be explained by global supply-demand imbalance.

While supply and demand was the key factor in global trade contraction throughout the Covid-19 crisis, it isn’t the biggest one in the rebounding stage. Our economists assessed the global rush for manufacturing inputs is the biggest contributor to recent trade flows. Especially for sectors such as transportation, textiles & apparel and computer & electronics, their stock level were not already high even before the crisis. Now they are shrinking even further.