EXECUTIVE SUMMARY

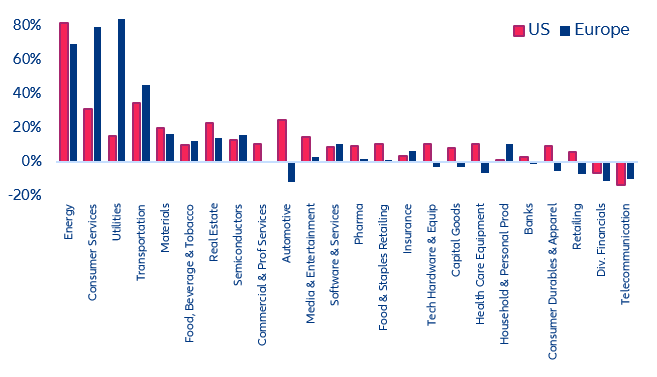

- The post-pandemic party is coming to a close. While the latest earnings season was better than expected on the revenue side, with only four out of 24 sectors posting a decline, half reported y/y declines in earnings. Forecasts and guidance also indicate fading momentum: Q3 revenue growth rates have been revised downwards for Latin America, APAC and emerging markets, and for 15 sectors globally.

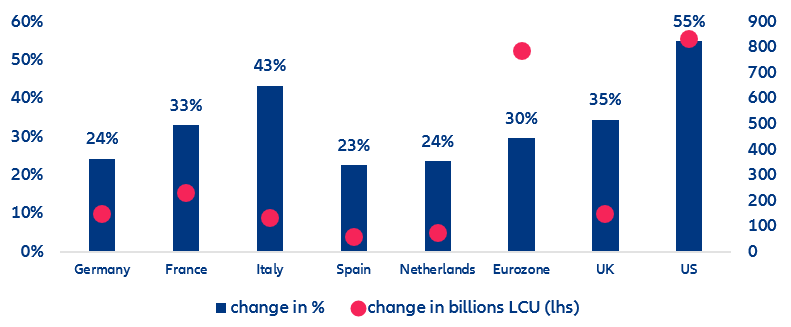

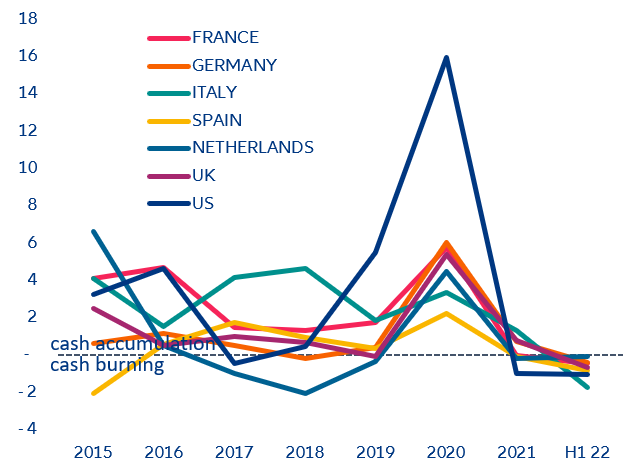

- Cash buffers are still high but waning. Despite exceeding 2019 levels by 30% in Europe and 50% in the US as of Q2 2022, cash buffers are decreasing as most firms in both the US and Europe have been burning cash in 2022.

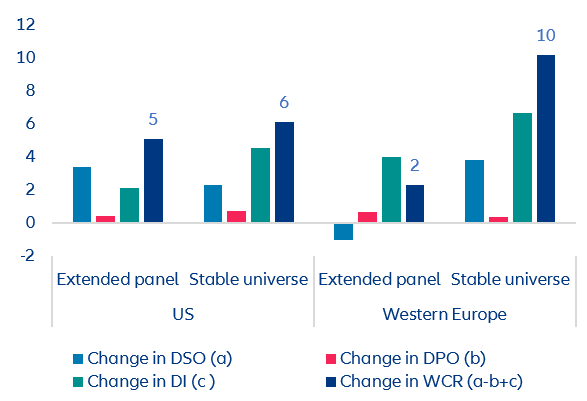

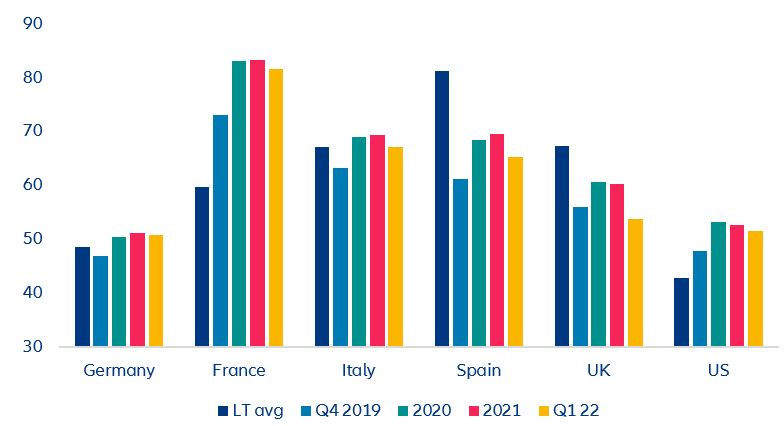

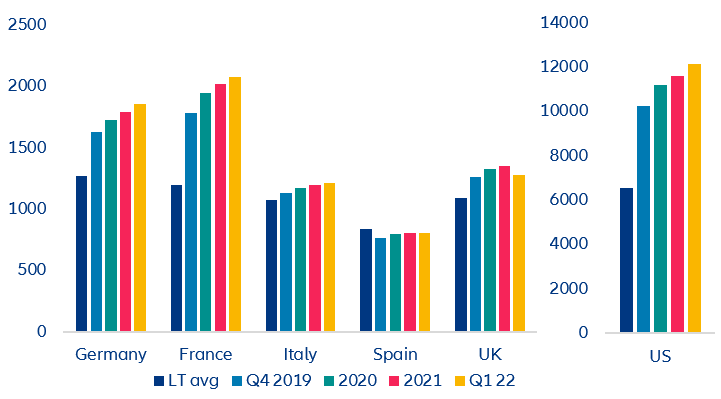

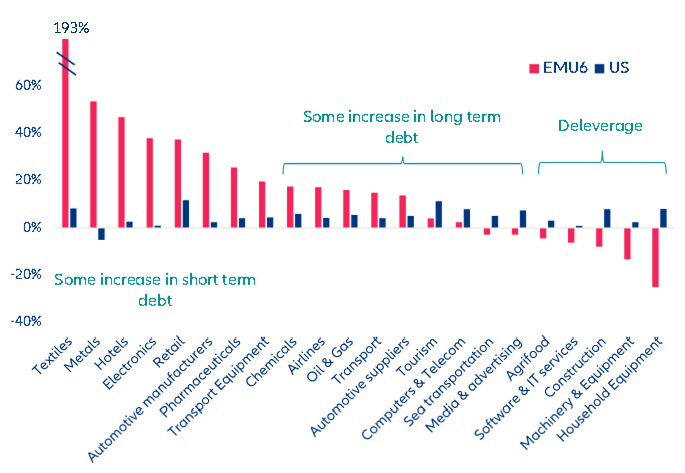

- Due to the inflationary environment, working capital requirements (WCR) climbed +6 days of turnover to reach 71 in the US and +10 days to 64 in Europe. This has led firms to build up leverage. Meanwhile, higher interest rates are also pushing up interest expenses, especially in Europe (+20% adjusted for change in long term debt).

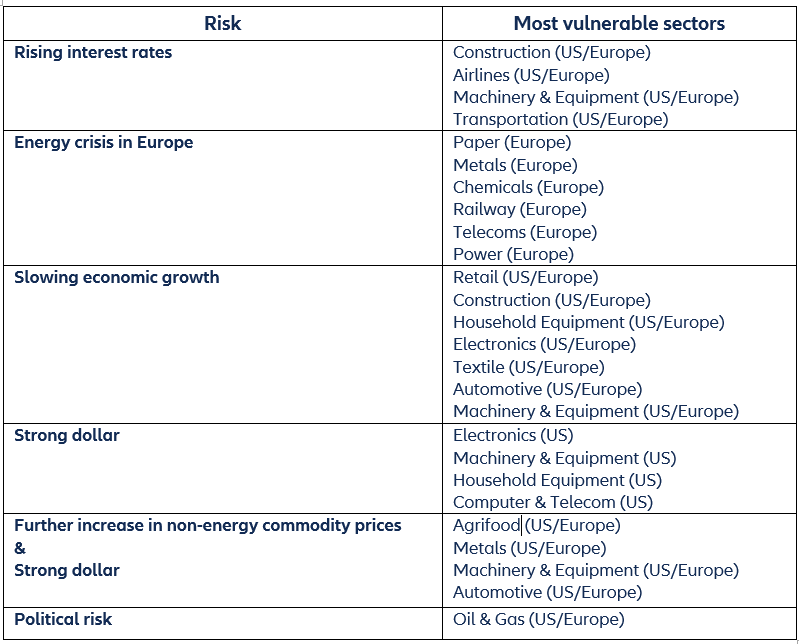

- As a result, countries, sectors and firms now face different challenges. The energy crisis could be a major blow in Europe for energy-intensive sectors (Power, Paper, Metals, Railways, Chemicals etc.) while the strong dollar could harm exporting sectors in the US. Discretionary spending and construction are also at risk while energy should continue to fare well – although it is at risk of facing political action (e.g. a “superprofit” tax).

Earnings held steady in the first half of 2022 but momentum is fading.

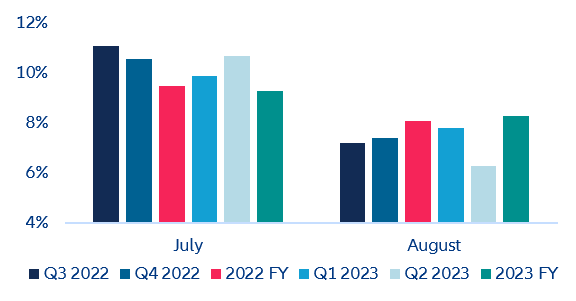

The Q2 earnings season brought positive surprises globally, with more than half of listed companies beating consensus estimates for revenue and earnings per share (58% and 54%, respectively). However, expectations were widely revised downwards some weeks before the earnings releases due to the continued war in Ukraine, persistent supply-chain issues and semiconductor shortages caused by lockdowns in China, as well as increasing raw material prices.

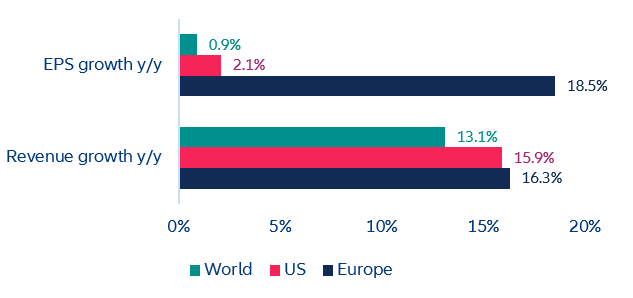

Europe was the region that surprised the most. Despite the proximity to the Russia-Ukraine conflict, 64% of European companies exceeded revenue expectations and the average revenue growth rate was +16.4% y/y (+12.5% y/y in the Eurozone). In the US, 63% of firms also beat estimates, with revenue growing by +15.9% y/y. However, there was a larger gap between corporates on both sides of the Atlantic when it comes to reported EPS: While earnings grew by +18.5% y/y in Europe (+4.7% y/y in the Eurozone), they rose by only +2.1% in the US (+0.9% y/y world average). This indicates that companies on the Old Continent were better able to absorb increasing production costs compared to their American peers.

Figure 1: Revenue and EPS growth rates by region in Q2 2022