Updated on 25 September 2025

The APAC chemicals sector is undergoing significant transformation, presenting both massive growth opportunities and critical operational challenges. Based on our latest analysis, we've compiled the most important questions for businesses operating in or trading with this dynamic region. This FAQ provides expert answers on everything from regional growth drivers to major supply chain risks.

Summary

Key takeaways

- India Growth: India's chemicals production is expected to increase by 6.4%, driven by massive government investment in infrastructure.

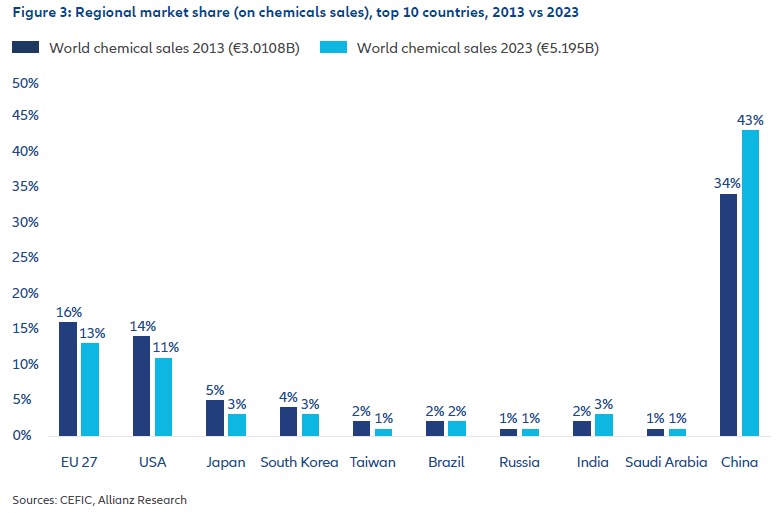

- China Dominance: China holds a 43% market share in global chemicals sales, but its focus on self-sufficiency is the primary source of global oversupply.

- East Asia Pressure: Oversupply is forcing companies in South Korea, Taiwan, and Japan to diversify into high-value specialty chemicals to counter cheaper imports.

- Sustainability Investment: APAC companies are investing around USD 35 billion in R&D, prioritizing green chemistry, bioplastics, and low-carbon alternatives.

Where are the biggest growth opportunities in APAC?

The biggest opportunities lie in countries with robust domestic demand and significant government support: India and Southeast Asia. India's chemicals production is expected to increase by 6.4%, driven by government investment in infrastructure and the construction sector. In Southeast Asia, countries like Malaysia are prioritizing specialty and electronic chemicals, while Vietnam is becoming a hub for large-scale, eco-friendly plastic (PBAT) production.

How is China's dominance evolving?

China is the dominant player, holding a 43% market share in global chemicals sales as of 2023. The key evolution is the increasing focus on self-sufficiency. While this supports domestic production (e.g., strong output growth of +10% in 2024 ), it is also the primary source of the global oversupply, particularly in petrochemicals. Furthermore, China's competitive pricing is supporting exports, but this is being countered by trade barriers from the US which could alter its growth trajectory.

What is the impact of oversupply on East Asian markets?

The oversupply, mainly from China, is directly impacting East Asian neighbors.

South Korea is feeling the pinch severely, with major firms like LG Chem reporting significant profit declines. Similarly, in Taiwan and Japan, companies are diversifying into specialty chemicals (like fine chemicals for semiconductors) to enhance profitability and counter pressure from cheaper imports. The competitive pressure is so high that some major Japanese producers have been forced to shut down facilities.

What role does sustainability play in the sector's future?

Sustainability is driving innovation and future investment. Regulatory pressures are pushing for green chemistry and circular economy initiatives. APAC companies are investing around USD 35 billion in R&D, a significant portion of which is dedicated to new chemicals processes and sustainable technologies. This focus on low-carbon alternatives, such as green methanol and bioplastics, is a high-priority area for R&D spending across the region.

Conclusion

The APAC chemicals sector is a dynamic landscape of massive opportunities and complex, interconnected risks. From the competitive pressures in East Asia to the sustainable growth being driven in India and Vietnam, staying ahead requires current, localized market intelligence.

Our expertise and commitment

Allianz Trade is the global leader in trade credit insurance and credit management, offering tailored solutions to mitigate the risks associated withbad debt, thereby ensuring the financial stability of businesses. Our products and services help companies with risk management, cash flow management, accounts receivables protection, Surety bonds, business fraud Insurance, debt collection processes and e-commerce credit insurance ensuring the financial resilience for our client’s businesses. Our expertise in risk mitigation and finance positions us as trusted advisors, enabling businesses aspiring for global success to expand into international markets with confidence.

Our business is built on supporting relationships between people and organizations, relationships that extend across frontiers of all kinds - geographical, financial, industrial, and more. We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others. At Allianz Trade, we are strongly committed to fairness for all without discrimination, among our own people and in our many relationships with those outside our business.