As a head of risk underwriting for trade credit insurer Allianz Trade, I help our clients navigate different types of credit risks and advise them on how to protect their cash flow . A common question that comes up is, “How can I safely trade with foreign companies, especially in emerging markets?”

Selling goods or services on credit is always risky. For the company extending credit, the deal may offer more business, but it always comes with default risk: your customer may be unable to pay off their debt. What is even riskier is selling to clients in foreign countries, where macro-economic dynamics, payment behaviours and the legal system are unfamiliar.

As a head of risk underwriting for trade credit insurer Allianz Trade, I help our clients navigate different types of credit risks and advise them on how to protect their cash flow . A common question that comes up is, “How can I safely trade with foreign companies, especially in emerging markets?”

As a head of risk underwriting for trade credit insurer Allianz Trade, I help our clients navigate different types of credit risks and advise them on how to protect their cash flow . A common question that comes up is, “How can I safely trade with foreign companies, especially in emerging markets?”

The rise of emerging markets

Emerging markets have a high growth potential, which makes them lucrative in times of economic prosperity. They have become the core target of many conglomerates – and evenSMEs of developed markets – especially since the millennium. The 2000s have seen an unprecedented amount of money flow into emerging countries. Supply chains and direct investments have also changed their course towards many of them, for example in Asia.

The next phase was the inevitable growth of local companies producing or trading goods, which put these countries on a growth path. But high growth also means high volatility. And high volatility means higher credit risk. In times of turbulence, the companies in emerging markets suffer the most, due to:

The next phase was the inevitable growth of local companies producing or trading goods, which put these countries on a growth path. But high growth also means high volatility. And high volatility means higher credit risk. In times of turbulence, the companies in emerging markets suffer the most, due to:

- Insufficient capital accumulation, meaning that they are highly leveraged (they have more debt than equity)

- Volatilities in demand and supply, which negatively affects cash flow

- Political instabilities and populist monetary and fiscal policies resulting in volatile local currencies

- Uncertainty and/or inconsistency in regulations (tariffs, taxing, quotas, etc.) making it harder to do business

- Weak justice systems and longer collection periods for commercial disputes or insolvency cases

How to mitigate credit risk

Let’s assume that you are running a business selling products to domestic and export markets. Your sales teams and, if they exist, risk teams know most of your domestic clients very well, as you already have a trading history with them and know the companies’ owners. The challenges that these companies face are similar to your challenges, because you work in a related industry in the same country.

However, when it comes to export clients, most of this information is missing. So, you’ll either need to ask for collateral or find some mechanism to mitigate the risks. This is where trade credit insurance (TCI) comes in.

However, when it comes to export clients, most of this information is missing. So, you’ll either need to ask for collateral or find some mechanism to mitigate the risks. This is where trade credit insurance (TCI) comes in.

How trade credit insurance can help

A trade credit insurance company can offer specialised risk analysis thanks to a network of local risk experts. These experts have access to local data, for example through credit bureaus, or information providers. They also gather sectoral data from the country in which they are operating, and have access to an information network that includes other companies your customer might be trading with.

1. Knowledge of local financial metrics

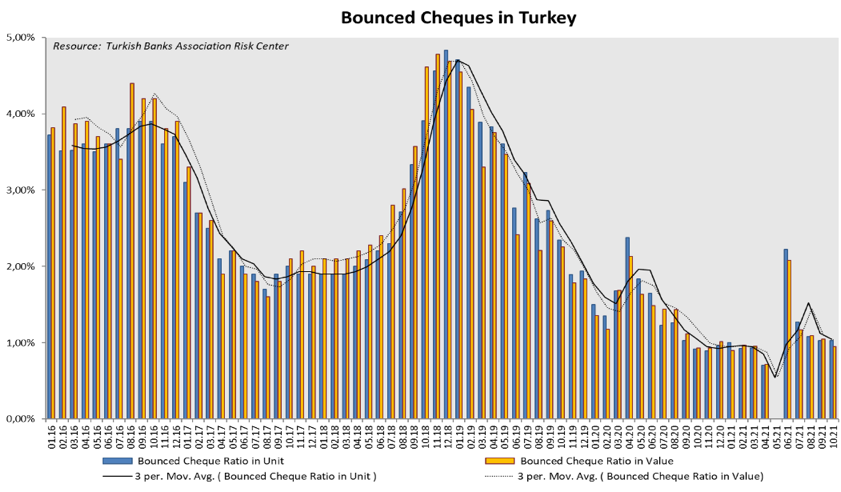

Let’s assume that you are selling goods on credit to a Turkish retailer. If you work with a TCI company to protect your receivables, it will monitor the financial performance of this retailer as well as its payment behaviour. Your insurer will also monitor payment behaviour trends amongst similar Turkish companies. For example, they’ll know that in Turkey , bounced cheques are a key metric.

2. Foreign exchange fluctuations

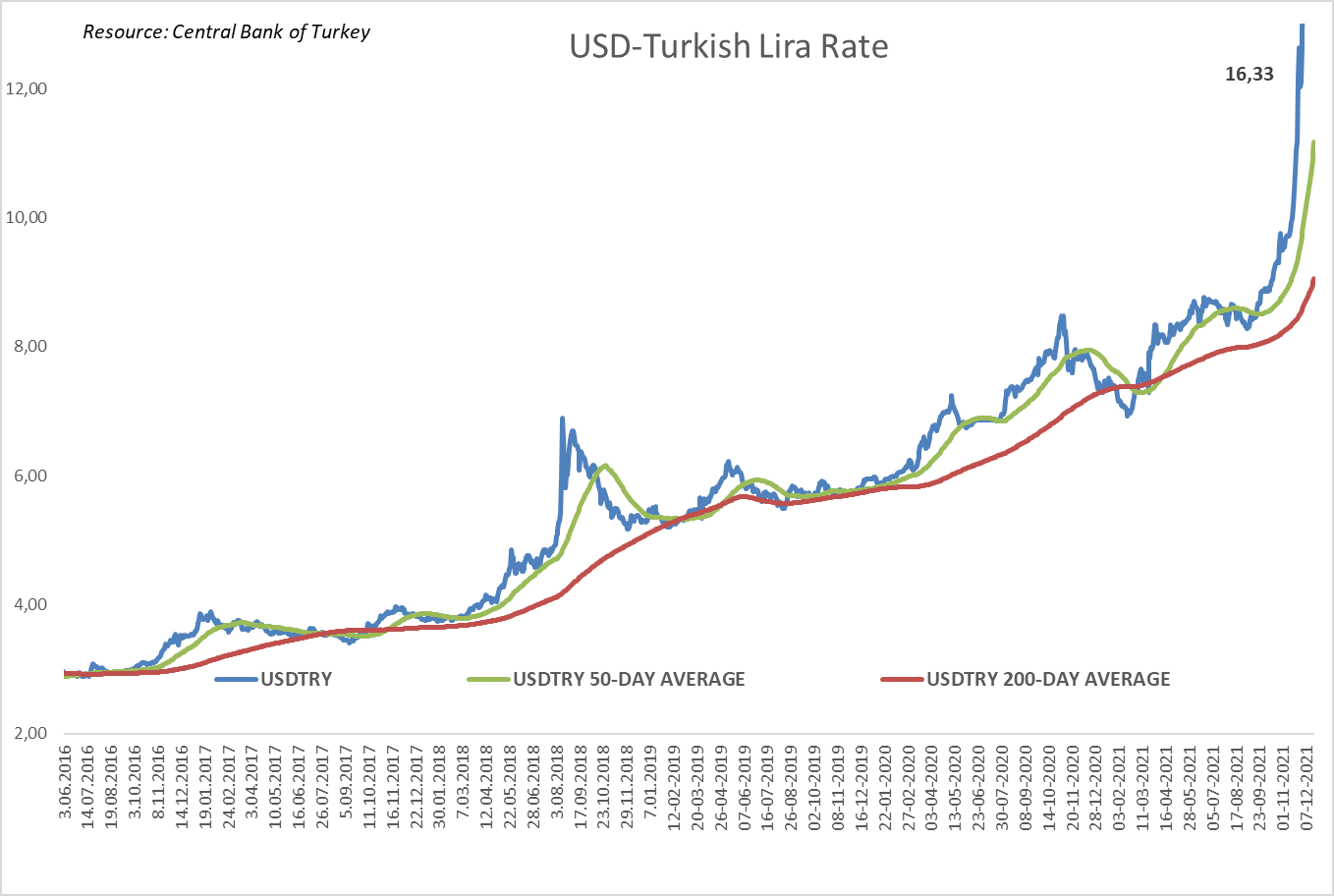

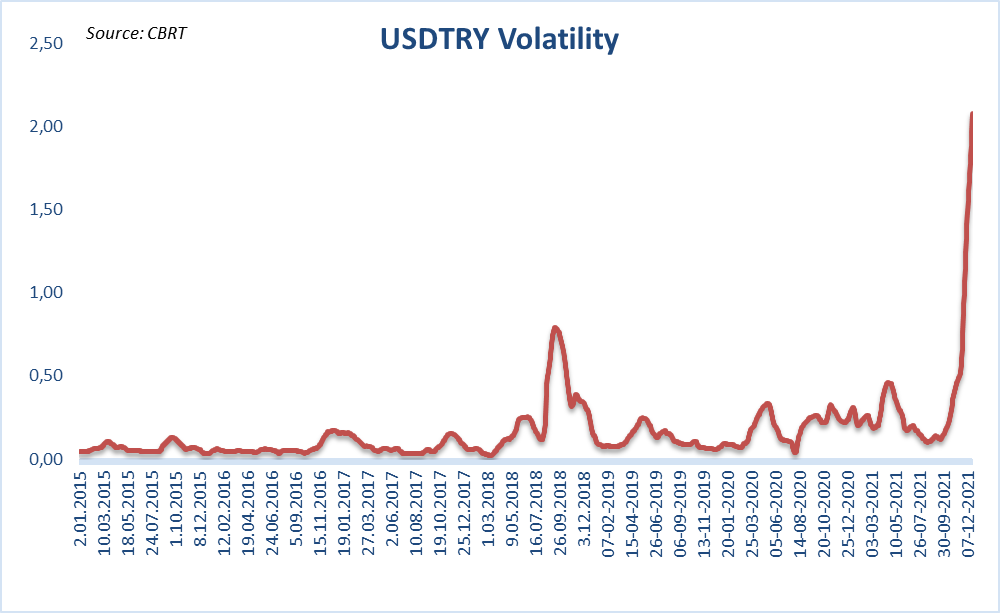

What about local currency volatilities? If your customer pays you in euros but sells goods in Turkish lira, how will exchange rate fluctuations affect them? A local risk expert will analyse your customer’s foreign exchange sensitivity and provide not just an insurance limit but also any information you’ll need to understand the risks you’re taking.

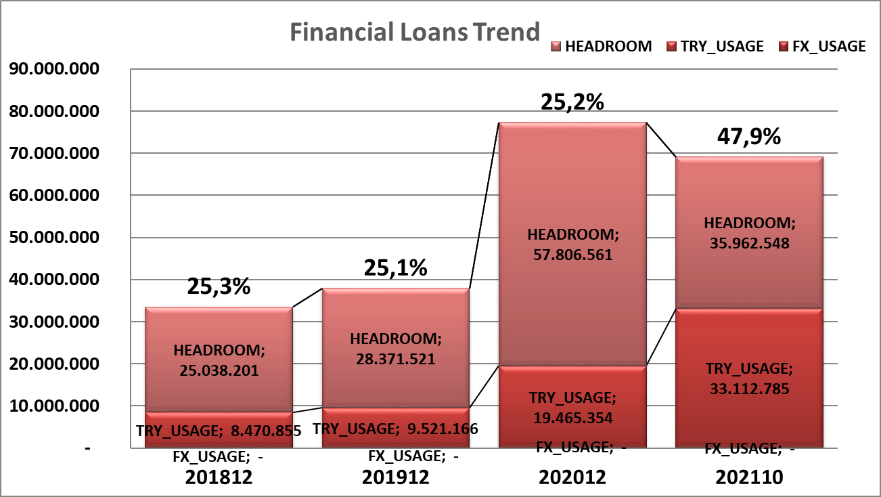

3. Access to credit bureau data

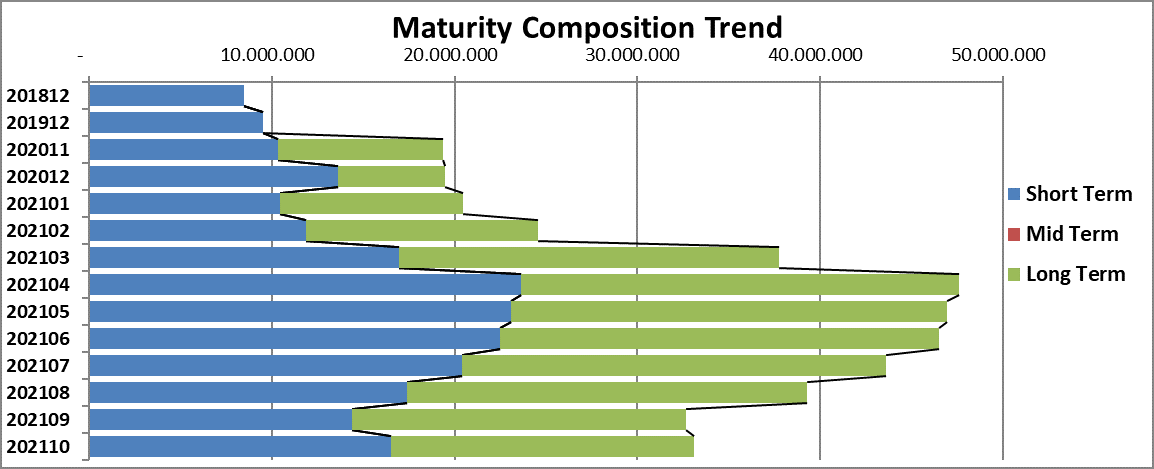

TCI companies may have access to valuable credit bureau data used to monitor outstanding loans to financial institutions. Companies are most likely to pay their debt to financial institutions on time, so any non-payment can indicate an early warning signal. Let’s assume your insurer provides you with this early warning signal for your Turkish customer. You could then use the below charts to review your risks and decide how to mitigate them on time.

Selecting your partners carefully

Most companies do not have enough time and data to evaluate their clients’ credit risk thoroughly, let alone in an export situation. And selling to emerging markets can be extremely tricky from a risk perspective, especially during turbulent times. One of the safest ways to navigate uncharted waters is to work with a trade credit expert that is not just as an insurer but also acts as a risk consultant. Local expertise and risk management knowhow is vital to mitigate any risks while ensuring that your turnover grows safely.