Executive summary

After more than a year in the firm grip of Covid-19, the global economy is finally seeing the light at the end of the tunnel, making it the right moment to check the pulse in Germany, France and Italy. In May, we at Allianz decided to interview 1,000 people in each country about their views on political and economic issues, as well as their expectations for the future. Are respondents embracing the promised path towards a more sustainable, more equitable world or does skepticism prevail?

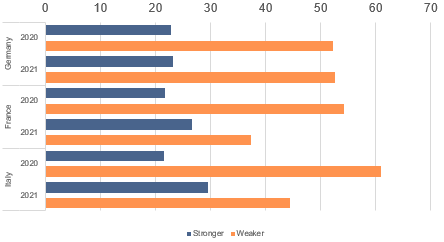

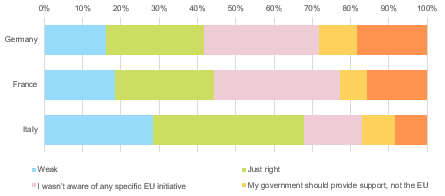

Building back stronger? Our participants don’t see programs such as Next Generation EU as a game-changer. As before, the vast majority – 45% of all respondents – believe that the Covid-19 crisis will weaken solidarity in the EU; only 27% think the opposite. German respondents (53%) are the most skeptical in this regard (France: 37%, Italy 44%). Part of the explanation could be ignorance. As many as 30% of German and 33% of French respondents stated that they had not yet heard of the programs. In Italy, on the other hand, the biggest beneficiary of EU funds, this proportion was only 15%. Against this backdrop, the overall approval rate of only 30% for the EU measures combating Covid-19 comes as no surprise.

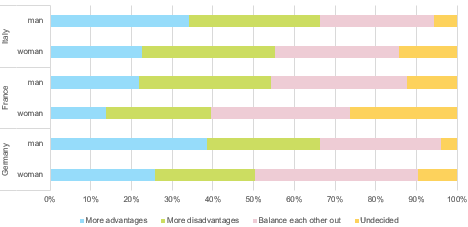

As a result, EU skepticism hasn’t crumbled yet. As before, there are more respondents that see more disadvantages than advantages in EU membership in France and Italy, namely 29% vs 18% and 32% vs 28%, respectively. In Germany, the number of EU supporters (32%) only slightly outweighs the number of EU opponents (26%). There is a noticeable gender gap in the perception of the EU: In all three countries, significantly more male respondents see the EU in a positive light compared to female respondents. In Germany, this gender gap amounts to 13pp, in Italy 11pp and in France 8pp.

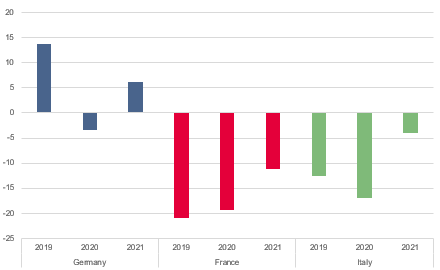

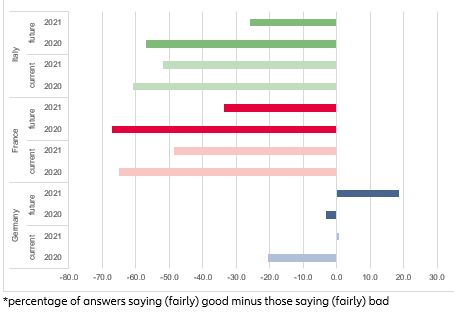

The dissatisfaction with the EU might be partly explained by the perceived gaps in national economic performance. While 72% of French and 75% of Italian respondents rate the current situation as bad, only 48% of German respondents do so. The discrepancy is even more pronounced when it comes to future prospects: 64% of respondents in France and 61% in Italy view the future with great concern – but only 38% of German respondents feel the same. This lack of economic convergence could be one of the reasons why many respondents in France and Italy still doubt the benefits of EU membership. Old beliefs die hard.

There is also some assimilation, but of the wrong sort: The differences between the three countries in the assessment of their governments’ crisis management have leveled off as dissatisfaction has grown in Italy and especially so in Germany. Critics of the crisis management outnumber supporters among respondents in France (54% vs 41%) and now even in Germany (52% vs 45%); just a year ago, the percentage of critics was only 26% in Germany. In Italy, on the other hand, critics are on par with supporters – 48% vs 48% – but this, too, translates into a rise of dissatisfied people, albeit by only 6pp. In France, however, there has been virtually no change in the (negative) assessment.

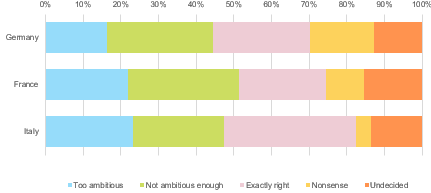

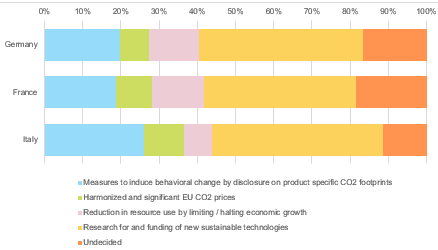

Building back greener? There is little agreement on the course of decarbonizing the economy i.e. in terms of pace and instruments. Only 28% of all respondents agree with the goal of reducing emissions by 55% by 2030. The highest approval ratings are in Italy (35%), while respondents in France (23%) and Germany (26%) are much more skeptical. However, the reasons for rejection vary widely: 27% of all respondents think the target is not ambitious enough. On the other hand, 31% of all respondents think it goes too far. The least preferred instrument is CO2 prices, which are generally considered the most effective means of combating global warming. Only 9% of all respondents agree with this.

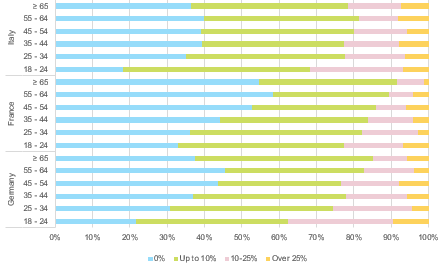

The widespread rejection of CO2 prices as steering instruments also becomes clear when asked directly about a CO2 tax. Only 22% each of the Italian and German respondents would be prepared to accept price increases of 10% and more. In France, this percentage is as low as 14%. While there is correlation between support for a CO2 tax and age, the income level does not seem to play a role in the assessment of the tax. It seems that the pros or cons of a CO2 tax are less a question of money than of attitude. Responsibility for the climate ends at one's own wallet – regardless of how big it is. Again, old habits die hard.

The unforgotten crisis: 50% of all respondents hold the view that their society is still suffering from the aftermath of the refugee crisis. At 53%, this proportion is the highest in France (Italy: 51% and Germany: 45%). In contrast, only 12% believe the refugee crisis is under control. These results have consequences for the options available to policymakers today. Despite Europe facing a sharp decline in its working population, only 13% of all respondents support an active immigration policy (France: 9%, Italy: 11% and Germany: 18%).

Building back more digital? The lockdowns were a showcase for the blessings of digitalization. Nonetheless, attitudes have hardly changed, especially in France. As before, slightly more French respondents see more risks than opportunities in digitalization. In Italy and Germany, on the other hand, proponents of digitalization are clearly in the majority (44% each against only 18% in France). But even this figure remains well below the 50% mark: the majority remains skeptical or undecided about digitalization. Old fears die hard.

The looming crisis: Rising debt levels are a big concern for the participants in all three countries. Only a small minority of a total of 13% of respondents share the view that debt is not a problem at present, thanks to low interest rates. The vast majority advocate a policy of debt reduction, with spending cuts (28%) and growing out of debt (41%) being the favored instruments. Higher taxes enjoy by far the lowest popularity: only 8% of all respondents would consider them. However, directly asking about the need for higher taxes in the wake of the Covid-19 pandemic leads to higher acceptance: 22% of all respondents consider them inevitable but still 67% outrightly reject them. Many respondents hope that economic growth will fix the debt problem – a clear mandate for fundamental reforms. The worry is that policymakers might opt for the easy way out – increasing taxes – an option that is abhorred by the vast majority of respondents.

Young hope: Most respondents – especially in France and Italy – paint a relatively gloomy picture of the future – but not when asked about their personal prospects. Of German respondents, 56% are positive, alongside 46% of French and 49% of Italian respondents. What's more, there are hardly any differences among younger respondents: 70% of German, 69% of French and 65% of Italian respondents between the ages of 18 and 24 rate their personal future as good. The majority of those surveyed – but especially the younger ones – firmly believe in their own future, in change for the better. It is up to decision-makers in politics and business not to let them down. Young hopes should never die.