Executive summary

- Covid-19 entails longer payment delays and rising inventories among large corporates. Global firms’ liquidity needs, as measured by Working Capital Requirements (WCR) will increase by +5 days to 74 days in 2020 or USD8tn (+USD140bn). These liquidity needs are unfortunately not on the radar of policymakers, yet they represent the equivalent of close to 10% of global money supply. As a result, suppliers will continue to play the invisible bank to their clients, use more short-term credit lines from banks and look for additional funds from shareholders.

- Payment delays, as measured byDays Sales Outstanding (DSO), will increase by +2 days to 66 days in 2020, and by another 2 days to 68 in 2021, it is the highest level over the last decade. After two consecutive years of decreases, DSO will increase twice as much as during the financial crisis on the back of the Covid-19 cash crisis. As output shrinks and uncertainty rises, companies will use longer payment terms as a commercial strategy to restore market shares.

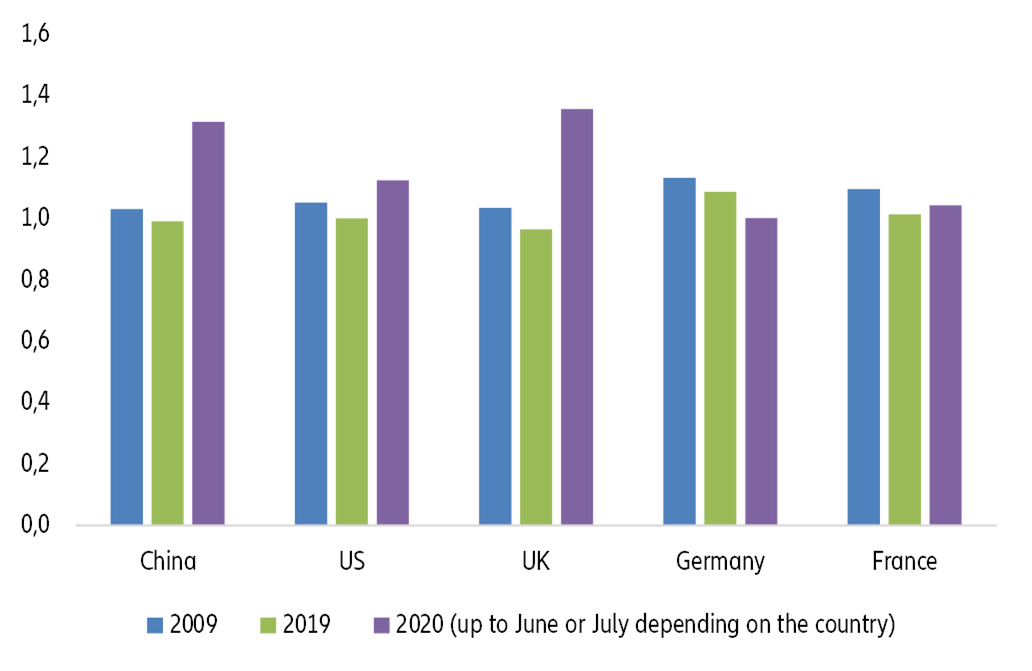

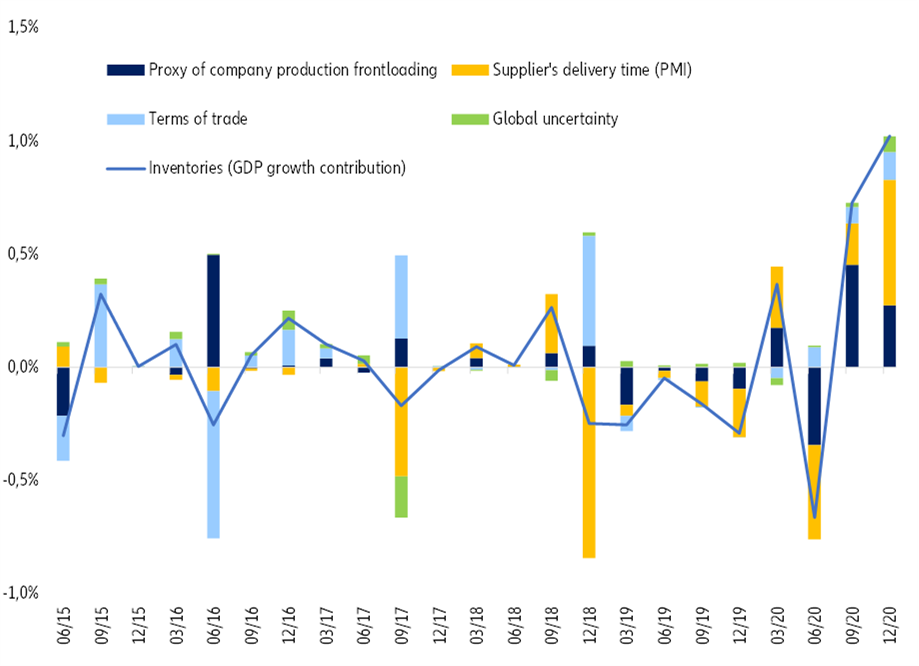

- Global stocks, as measured by Days Inventory Outstanding (DIOs), will increase by +3 days in 2020. The prolonged supply-chain disruption likely due to future targeted lockdowns and the precautionary stockpiling of companies will push inventories up in H2 2020. In the Eurozone, we expect inventories to contribute +1.7pp to real GDP growth after -0.3pp in H1.

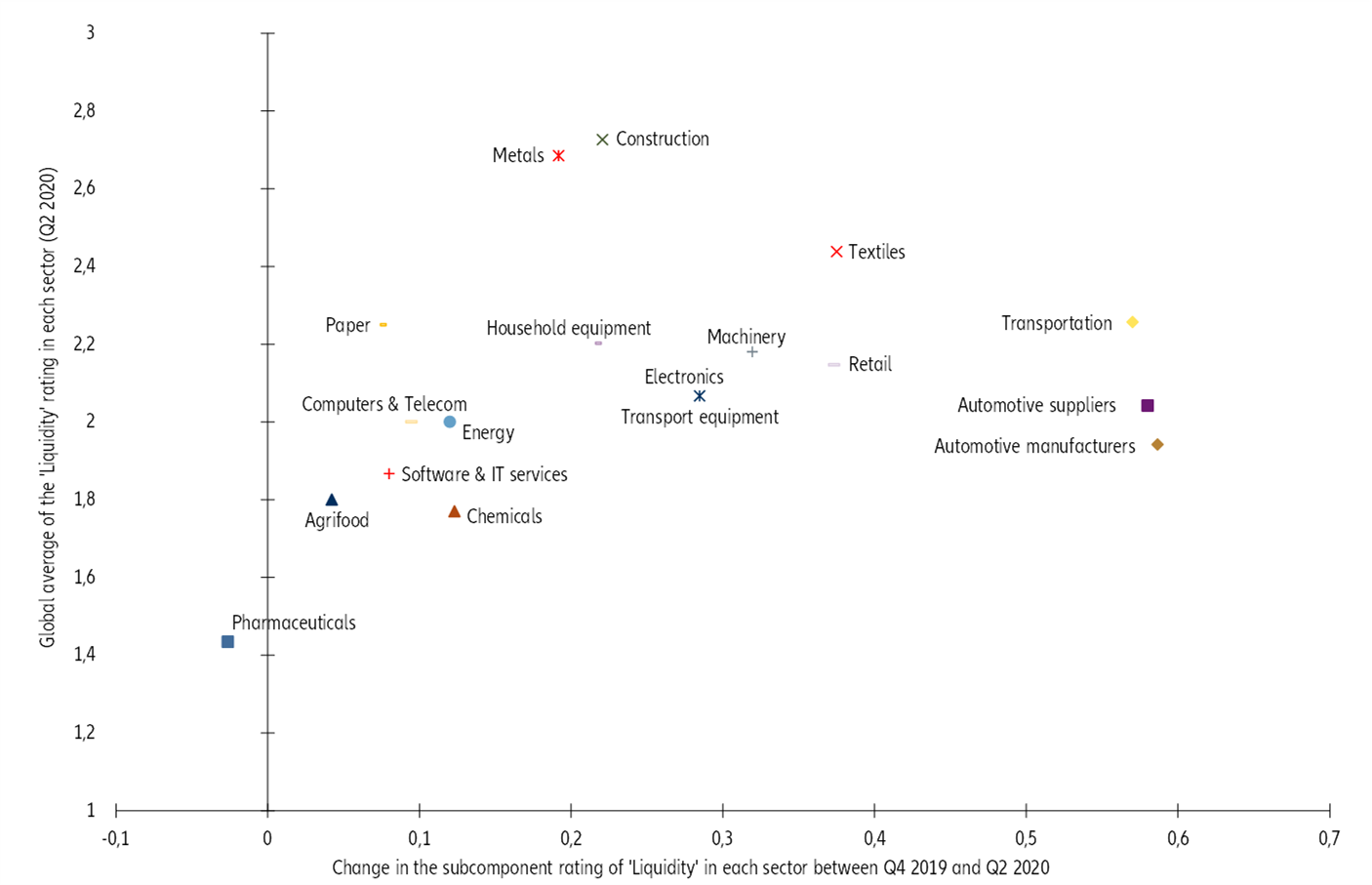

- Transportation, automotive, textiles and (non-food) retail should be most liquidity-stressed. They will register the highest increases in WCR in 2020 (above +5 days) and deteriorating profitability, possibly entering distress territory, should they lack support from banks and investors in the coming months. Metals and construction also appear to be very fragile considering their current liquidity positions. In contrast, pharmaceuticals and agrifood are in the best positions.

Record level in global WCR in 2020 pushes company financing needs to USD8tn

We expect global WCR to bounce back to 74 days (+5 days) in 2020, with almost two thirds of this rise explained by an increase in inventories as companies will look for an edge to avoid any supply-chain disruptions from expected targeted lockdowns in the coming months. This comes after a -1 day decrease in global WCR in 2019, less than expected due to unchanged suppliers’ payment terms and a very modest correction in inventories (-1 day). In 2020, we expect rising WCR to account for USD8tn of total financing needs worldwide , amounting to nearly 10% of the global money supply (M2). Against this rise, companies are likely to balance between (i) extending suppliers’ payment terms, (ii) using more short-term credit lines with credit institutions and (iii) asking for additional funds from shareholders.

In 2019 already, rising inventories had increased WCR in six countries: Denmark saw its DIO soar by +10 days, Spain by +8 days, Bulgaria by +6 days, Russia by +4 days and Turkey by +2 days.

Since the outbreak of Covid-19, policymakers have taken swift and unprecedented action to encourage banks to keep providing an emergency liquidity lifeline to the private sector, despite the risk of rising non-performing loans . So unless public loan guarantee schemes are extended, banks might become more reluctant to lend in 2021, putting at risk companies’ needs for financing their additional WCR, along with the ongoing recovery.

In terms of sectors, transportation, automotive, textiles and (non-food) retail should register the highest increases in WCR in 2020 and could be most at risk of a liquidity crisis. Metals and construction also appear to be very fragile considering their current liquidity positions, i.e. the expected cash balance of companies in the medium run.

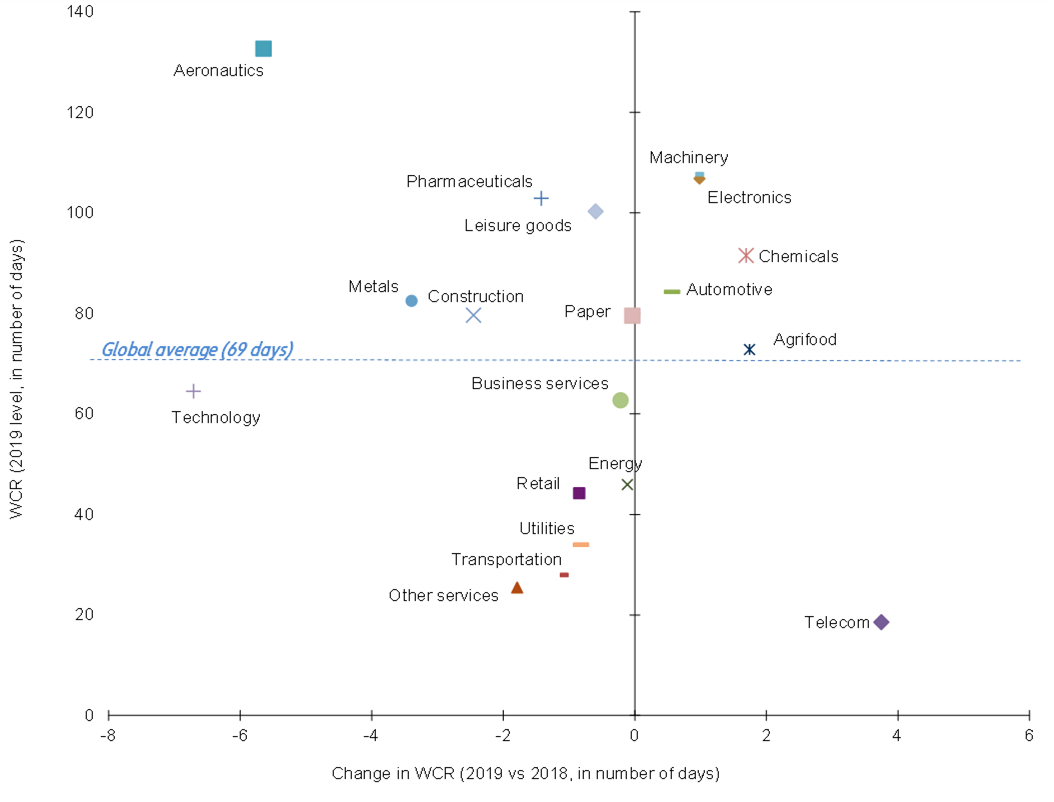

In 2019, telecom, agrifood and chemicals saw the highest rises in WCR in by +4 days and +2 days for the two latter, respectively (see Figure 1 below). Chemicals also suffered from high levels of WCR, above the global average of 69 days, while the other two sectors enjoyed lower WCR, giving them some leeway to cope with this rise. Meanwhile, aerospace suffered from extremely high WCR (above 130 days) and will suffer further from the strong fallout of the airlines crisis due to the travel bans in H2 2020.

Figure 1 – Working capital requirements (WCR), level and change 2019/18