EXECUTIVE SUMMARY

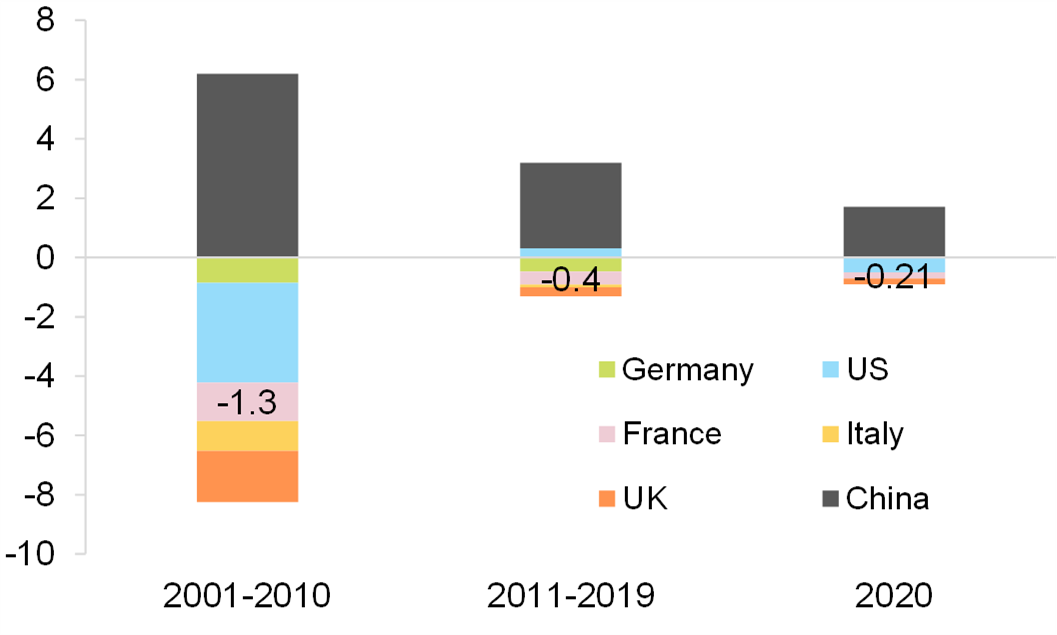

- European exporters, and France in particular, have lost significant market share over the past two decades as China emerged as a global exporter for manufactured goods. China’s remarkable export expansion has coincided with the dramatic decline of France’s export shares since 2001: -1.7pp, compared to -1.3pp in Germany and -1.1pp in Italy. With the Covid-19 crisis, the situation has only worsened: France has continued to lose export market shares (-0.2pp y/y), even as Germany and Italy have managed to preserve theirs.

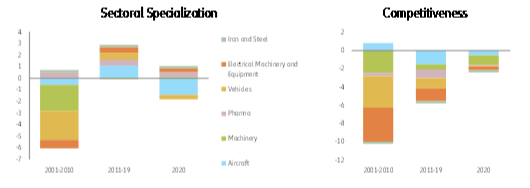

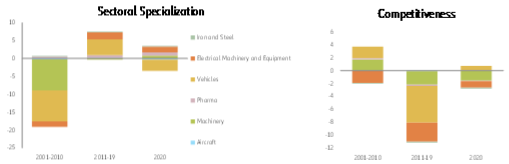

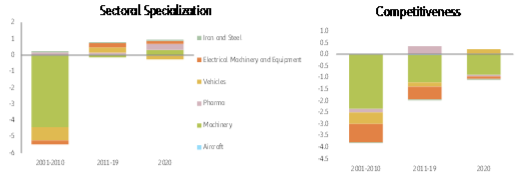

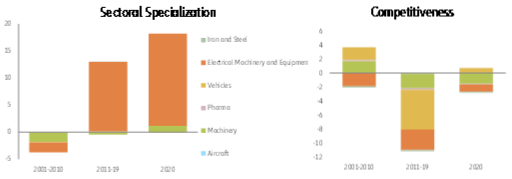

- What’s the culprit? Not sectoral specialization but rather weak competitiveness in flagship export industries, including aircraft, pharmaceuticals, vehicles, electrical machinery and equipment. Our decomposition analysis reveals that French and, to a greater extent, German exporters have specialized in sectors with dynamic growth worldwide. However, they underperformed their global peers in terms of export value growth due to weak competitiveness, in particular vis-à-vis exporters from China. For instance, between 2001 and 2019, German exporters seem to have suffered from poor (price) competitiveness in highly dynamic sectors such as machinery and electrical machinery and equipment in particular. However, Germany’s underperformance gap was smaller compared to France, thanks to its specialization towards fast-growing markets (notably China) and positioning in “high-end” industrial products. While Italy’s export performance has also suffered from the rise of China, its overall competitiveness has significantly improved since 2011, reflecting the cost-cutting reforms implemented after the Eurozone sovereign debt crisis. Italy’s export performance happens to be highly cyclical, strongly correlated with global demand dynamics. In 2020, its exports grew faster than the world average in the vehicles sector, a sign of the greater resilience of Italian exports during the Covid-19 crisis compared to French exports.

- Competitiveness in terms of price and quality explains around three-quarters of China’s export growth since 2001. Interestingly, taking all sectors together, we do not find that Chinese exports significantly benefit from a specialization in fast-growing sectors. China’s strong competitiveness in the machinery and electrical machinery and equipment sectors displays the opposite trend to competitiveness developments in Germany, Italy and France. European export market share losses in these sectors are certainly not only the outcome of China’s unbeatable cost competitiveness, but also the country’s astonishing success in climbing up the quality ladder.

- What does this mean for policymakers in Europe? Competitiveness is a complex issue that involves multiple dimensions (e.g. price, quality, regional specialization) so there is no silver bullet to quickly tackle structural issues. Nevertheless, bold and targeted policy action could boost export competitiveness. This would include measures to improve price competitiveness (e.g. tax relief, continuation of production tax cuts), as well as efforts to speed up the reallocation of the labor force via structural reforms that improve the flexibility of labor contracts. In addition, active and effective labor-training policies are essential to address skill shortages in fast-growing sectors. Finally, supporting industries with high growth potential, but also accompanying traditional industries during the low-carbon transition phase will be key to preserving the market share of European exporters going forward.