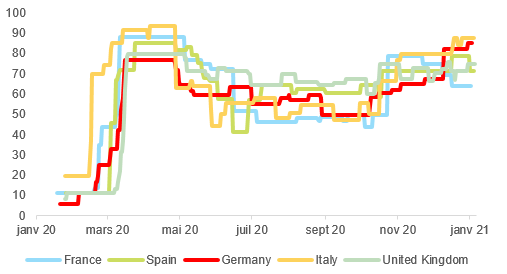

Figure 1 – Oxford Covid-19 Stringency Index

Figure 1 – Oxford Covid-19 Stringency Index

Over the course of the year, the German economy will move at a rapid pace through the entire economic cycle palette, from short-term economic gloom in Q1 to a vaccine-driven consumption boom in the second half of the year. We expect the sequencing to unfold as follows:

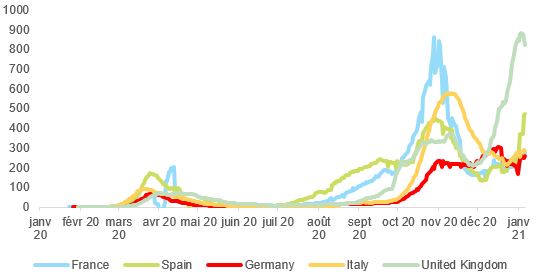

- Sharp downturn in Q1 2021: For now, the “hard” lockdown, which includes the closure of non-essential retail businesses and schools, and boasts a record-high stringency level, has been confirmed until end-January. However, judging by developments on the virus front – stubbornly elevated new Covid-19 cases and high ICU occupancy rates, together with rising concerns over the spread of the highly infectious Covid-19 strain B1.1.7. – we expect the easing of restrictions to gain traction only in March at the earliest. With every week of lockdown costing the German economy around EUR4bn – shaving off up to -0.5% of quarterly growth – a notable GDP setback is all but certain even though manufacturing sector prospects should remain favorable.

Figure 2 – New Covid-19 cases per million people

- A technical economic resurrection in Q2 2021: The Germany economy will only come out of hibernation in time for Easter as more favorable seasonal effects (i.e. warmer temperatures) together with progress on the vaccination campaign will allow for a gradual loosening of restrictions, and in turn the unleashing of demand pent up over the winter months. Base effects should further help to push the quarterly growth rate towards +3%q/q – the strongest quarterly GDP expansion on record excluding that seen in Q3 2020.

- Social spending boom in Q3 & Q4 2021: The easing of Covid-19 restrictions from Q2 onwards and the vaccination of the at-risk population by mid-year, sets the stage for the German economy to shift into over-drive, with GDP growth likely to register above +2% q/q in both Q4 and Q4. As uncertainty about the economic outlook recedes, the relatively solid labor market situation - the unemployment rate should come in at 5.8% in 2021 after 5% in 2019 and 6% in 2020 – bodes well for the deployment of precautionary savings. As a result, we expect the saving rate to move towards its pre-pandemic level by year-end. In particular, ‘social spending’ stands to benefit, which will drive the re-convergence between the services and the manufacturing sectors. The sharp acceleration in consumer prices towards 2% y/y in H2 2021 due to the marked pick-up in growth momentum, rising energy prices and strong base effects from the H2 2020 VAT reduction, should prove to be temporary and any calls for monetary policy tightening at that stage would be clearly premature.

Overall, we maintain our GDP growth forecast of +3.5% in 2021 – while acknowledging rising downside risks for H1 should the lockdown be tightened further and/or be prolonged and for H2 should the vaccination rollout fall behind our expectations. In 2022, we expect GDP growth to remain notably above potential at +3.8% as the achievement of herd immunity would allow for a return to economic normalcy while monetary and fiscal policy remain supportive. As a result, the German economy should reach its pre-crisis GDP level in H1 2022, whereas other economies in the Eurozone, including Spain and Italy, will need an additional year to heal.

Looming political paralysis could see Germany’s policy mantra switch from “whatever it takes” to “whatever is the bare minimum” during the crucial Covid-19 recovery phase. Key risks to the German economic outlook revolve around developments on the sanitary front, on the one hand, and the response of policymakers across the spectrum (health, fiscal, monetary etc.), on the other hand. On the latter, we see the risk of the ball being dropped on fiscal and European matters during the crucial Covid-19 recovery phase. A mix between policy paralysis and complacency could see Germany’s Covid-19 policy mantra switch from “whatever it takes” to “whatever is the bare minimum”. After all, with Chancellor Angela Merkel’s term coming to an end after a 16-year reign, Germany will turn inwards and focus on national politics: Until September the race for her succession will garner all the attention while after the vote, complicated coalition talks between the CDU and the Greens are likely to follow – if the 2017 episode is anything to go by. Hence, all important longer-term policy decisions will be postponed until 2022. Any progress on European integration will even have to wait until after the French presidential elections in April 2022.

Moreover, the German economy’s relatively better economic performance during the crisis increases the odds of fiscal policy complacency, with negative repercussions for European peers, in particular those that are lagging behind in their economic recoveries, should they be expected to follow suit. After all, Germany’s fiscal policy helps set the tone for its European peers. Germany’s resorting to a fiscal bazooka as a response to the Covid-19 shock was an important signal for its Eurozone peers to use their full fiscal room for maneuver. While German fiscal policy looks set to remain supportive in 2021 and 2022 – the risk of premature withdrawal is rather low during an election year and our baseline of a conservative-green coalition should see more social spending thereafter – it could well disappoint should the CDU opt for an earlier-than-expected return to pre-crisis fiscal hawkishness in an effort to appeal to its traditional conservative voters.