Executive Summary

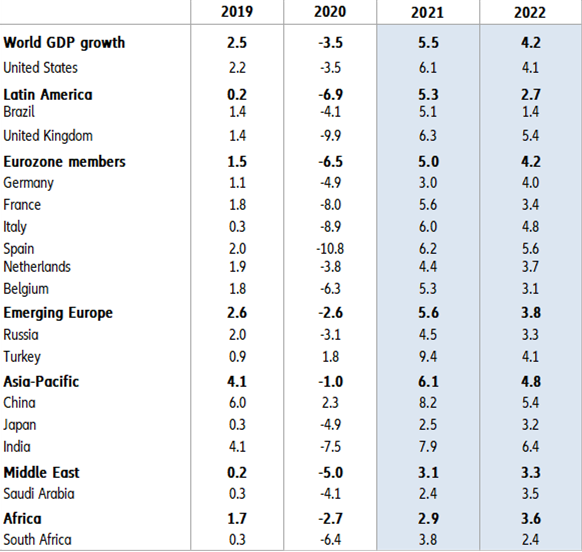

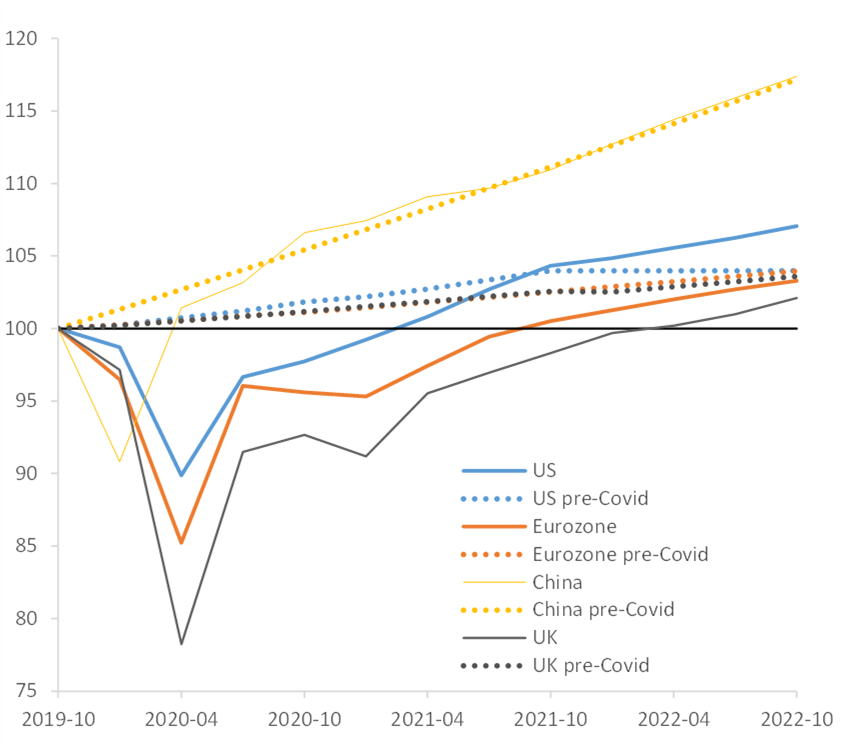

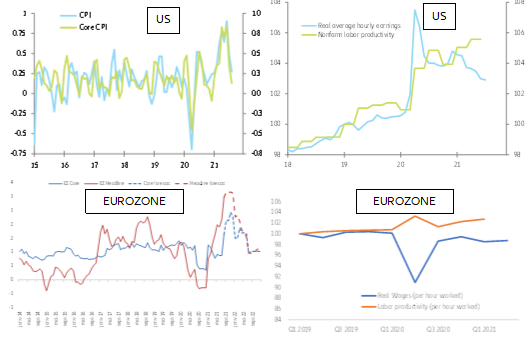

- Global growth remains strong but increasingly uneven amid evolving virus dynamics and the gradual removal of policy support. Growth momentum softened over the summer despite a positive impulse from trade. The delta-related uncertainty and soft stops will cost (only) -0.2 to -0.5pp of GDP growth in advanced economies in 2021. Overall, while we expect global growth to remain strong at +5.5% in 2021 and +4.2% in 2022 amid significant monetary accommodation and fiscal impulse, economic slack remains sizable with significant variation across countries. Vaccination rates, unwinding of supply bottlenecks and policy choices will critically influence the scale of catch-up. Output will remain below its potential level until the end of 2022, and the output loss relative to the pre-crisis trend is likely to be considerable, especially in Emerging Markets, where scarring tends to be higher. Their recovery continues to lag because of undervaccination and less room to manoeuvre for additional policy support, as well as the Chinese slowdown. Inflation is likely to accelerate this year as the recovery becomes entrenched, mainly reflecting transitory factors that are likely to wane early next year. While inflation expectations remain well-anchored, pockets of elevated inflation are visible in some sectors with stronger pricing power (automotive, building materials, and, to some extent, in retail and warehouse services). Overall, we expect inflation to reach 2.2% in 2021 and 1.5% in 2022 in the Eurozone and 4.1% and 2.2% in the US, broadly in line with the respective inflation targets.

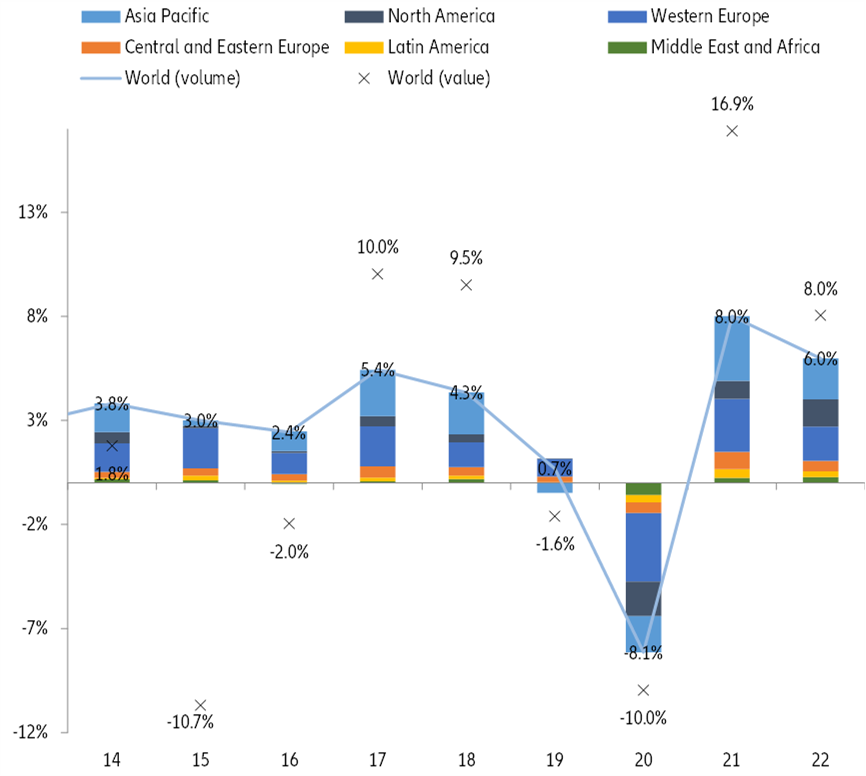

- Price and capacity pressures on global trade are likely to persist going into 2022, albeit less acutely. The reopening boost to services has eased, while labor and materials shortages are weighing on manufacturing and construction. Supply-chain disruptions worsened over the past few months and triggered a more visible manufacturing slowdown during the summer, which could amplify adverse spillover effects to Emerging Markets. The rush for restocking amid historically high domestic production shortfalls and low inventories continues to accelerate the recovery in volumes and prices. While restocking should become less of a driver for trade flows in 2022, companies are likely to operate in a “just-in-case” environment as the normalization in shipping capacity is unlikely to occur before 2023. Hence, on the back of the frontloading in 2021 (+0.3pp to +8% in volume), we have revised slightly on the downside our 2022 forecast for global trade growth: -0.2pp to +6%.

- Risks to the outlook are broadly balanced, but pandemic-related uncertainty remains high. Higher vaccination rates, together with a stronger release of pent-up demand and a faster than-expected global recovery, could provide a stronger growth impetus. However, as long as vaccination rates remain below the coverage required to reach herd immunity and continue to differ significantly between most advanced and Emerging Markets, virus mutations will raise the prospects of renewed lockdowns and keep the recovery uneven. In addition, tighter financial conditions or a premature withdrawal of policy support could undermine the recovery and increase private and public sector vulnerabilities, with the potential for cliff-edge effects in some countries and further adverse distributional effects.

- Unwinding policy support requires a careful balancing act to ensure an effective rotation towards private demand and sustainable growth. The fiscal impulse in most countries remains positive, with both China and the US expected to remain expansionary while the Eurozone has delayed structural tightening due to the supplementary spending in France and Germany. While several Emerging Markets have already started tightening their monetary stance, most central banks in advanced economies have remained accommodative but normalization is on the horizon. U.S. Federal Reserve is likely to gradually pivot towards dialing back its accommodative stance, with stronger inflation and growth outturns suggesting economic slack diminishing more quickly than anticipated. Tapering is likely to commence later this year but uncertain virus dynamics and inflation pressures make it difficult to pin down the scale and timing. Capital markets have been unfazed by reemerging uncertainty about the pace of recovery, but risk sentiment underpinning historically high valuations remains crucially dependent on continued policy support. The existing pre-positioning by market players has reduced the downside risks of market disruptions and dislocations in capital flows, especially in Emerging Markets. Against the backdrop of a stabilizing recovery, we expect asset prices to move sideways over the near term as we enter a consolidation phase. Besides accelerating the vaccination rollout, the key policy priority is to calibrate support to the pace of the recovery, while gradually shifting to more targeted measures focusing on growing firms and sectors. Another important challenge is to identify the potential size of the reallocative needs and the role that policy should play in facilitating reallocation in response to the scale of structural transformation.