In 2020, Japan’s life industry recorded a RoE of 11%. Three management levers explain this Phoenix-like rising from the ashes: first, managing the product mix. Protection-type policies such as traditional life insurance and “third sector” products (medical, long-term care insurance) offer better margins, based on mortality and prevalence assumptions, than savings-type policies that are investment-related. Therefore the industry has relentlessly shifted into these products, supported by more favorable regulation, which lifted the ban on life insurers’ participation in health insurance. Since then, life insurers have been able to benefit from high demand for medical coverage (e.g. against cancer), driven by the fact that the comprehensive public health insurance system requires co-payments that can be quite substantial in the case of critical illness. Another area of growth is care products that address

Japan’s aging society and changing behavior – older people are increasingly taken care of by nursing homes and other facilities rather than by their own families. Moreover, insurers developed new types of products, e.g. products with wellness benefits, and specialized products, e.g. infertility treatment insurance. In 2020, these “third sector” products accounted for a quarter of all premiums.

Second, managing risks. The mortality tables used by

Japan’s life insurers are very conservative. Mortality rates for life insurance policies are higher than actual ones and those used for “survivorship policies” (e.g. annuities) are lower. The result: Payouts are below initially assumed levels. Managing mortality and morbidity risks is key for the profitability of the industry.

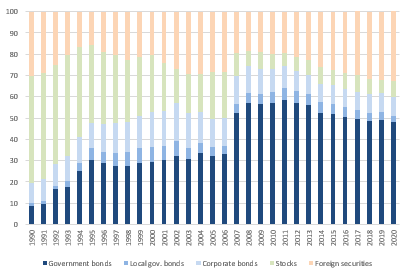

Third, managing assets. The most remarkable development is the shift into government debt and the high share of foreign bonds. Life insurers used to be the main creditors of the corporate groups (keiretsu) they belonged to; hence the high share of domestic stocks and loans in the asset portfolio. These times are gone for good (see Figure 3). Today, life insurers channel savings into government debt, helped by a (unique) accounting rule by which JGBs can be classified as “policy-reserve-matching bonds”, exempted from mark-to-market valuation (one reason why insurers shifted toward investment in super-long-term JGBs). At the same time, insurers looked for some extra yield abroad. Were it not for the inclusion of

Japan Post in 2007, the share of foreign securities would be already closer to 40% – a share unique to

Japan’s life industry. Although around two thirds of foreign bond holdings are currency-hedged, this huge portfolio is not without risk. While these hedges come in the form of short-term contracts, bond holdings are long-term in nature. Thus, Japanese life insurers hold a “rollover risk”, similar to the risks banks are facing in maturity transformation.

Figure 3: Securities by asset classes, in % of all securities