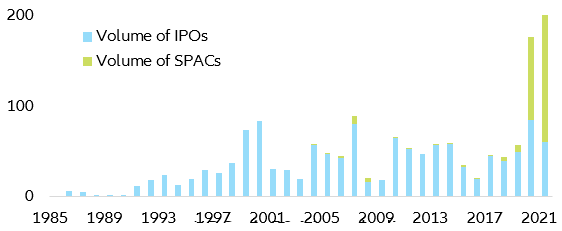

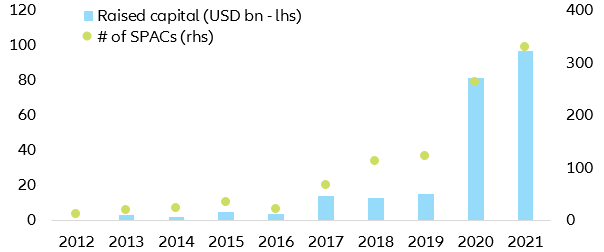

Figure 1: SPACs vs IPOs (in USD bn)

Figure 1: SPACs vs IPOs (in USD bn)

In addition, the early 2021 increase in long-term interest rates added further pressure to SPAC valuations. This is particularly the case as de-SPAC transactions tend to target early-stage businesses with high growth, meaning they tend to have “long duration” cash flow profiles. In this regard, active SPACs have even “longer duration” because they have not yet purchased a business, meaning that the future cash flows are virtually 0 until a proper target is found. All in all, the underlying nature of SPACs makes them “long” and even “ultra-long” duration, which in a period of stable but mildly increasing interest rates looks rather counterproductive.

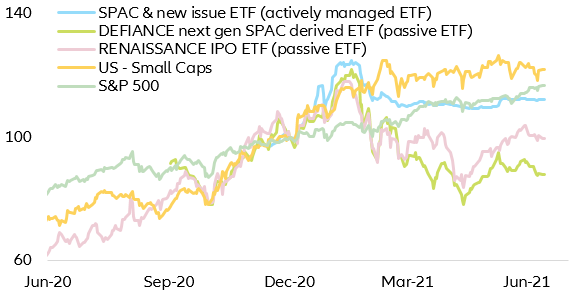

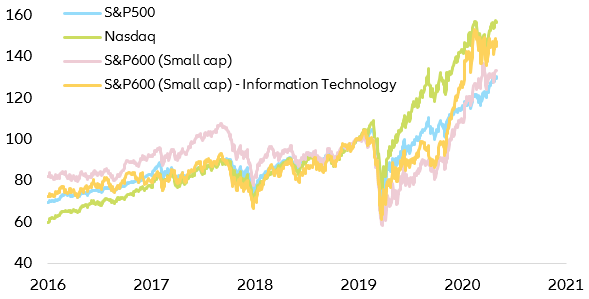

All these mounting headwinds for the industry translated into an abrupt market rotation, with the S&P500 outperforming by as much as ~29% (+16.7% S&P500 vs -12.2% US SPAC ETF) the US traded SPAC markets and by ~17% the IPO Index (+16.7% S&P500 vs -0.3% US IPO ETF). This abrupt change in investor’s appetite has left more than half of US traded SPACs trading at a discount. Overall, this structural underperformance does not imply that there is no value in SPACs as the SPAC & New Issue ETF (an actively managed fund combining SPAC and IPOs in the last 12 months) has seen +12% return in 2021, representing a ~-5% underperformance vis a vis the S&P500. This signals that through active management and careful asset selection, one can still get an interesting return enhancer even in times of a market meltdown (Figure 2).

Figure 2: US SPAC & IPO EQ Indices vs S&P500

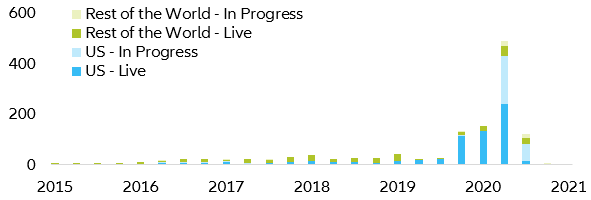

Figure 3: SPAC market

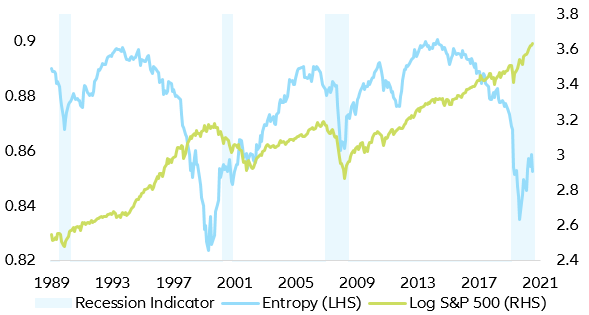

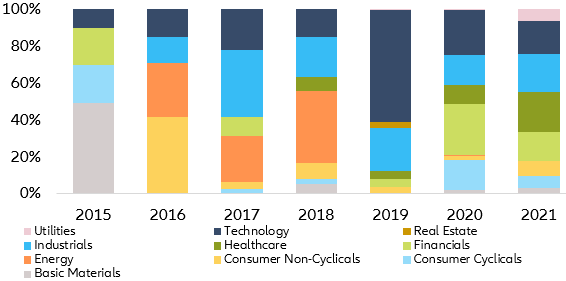

In this context, some sectors are set to remain far more vulnerable than others when it comes to SPACs and de-SPACs. This is specially the case as the increasing number of tech- and fintech-driven SPACs (around ~40% of traded SPACs are currently targeting these sectors) is driving the sector to bubble-like behavior and, in turn, increasing the technology equity sector concentration risk (Figure 4). Of course, this is not only due to SPACs: The already heavy portion of the technology sector in broad US equity indices (~25%) paired with the extremely exuberant earnings expectations is adding to the sector’s fragility, leaving the whole market at and unstable equilibrium point (Figure 5).

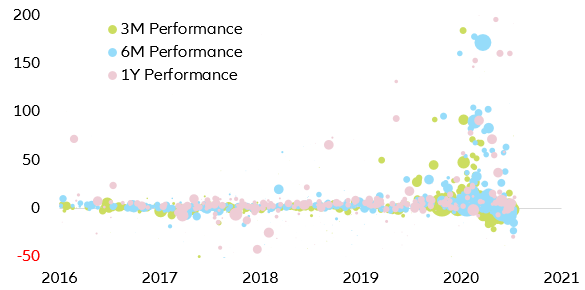

Figure 4: US equity market concentration risk

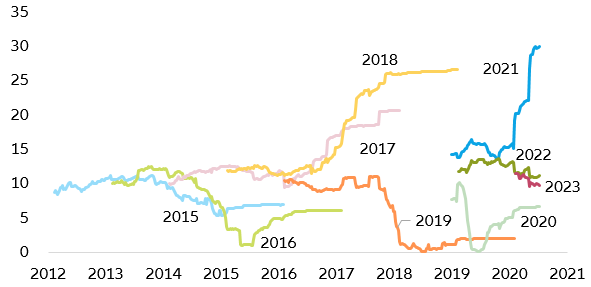

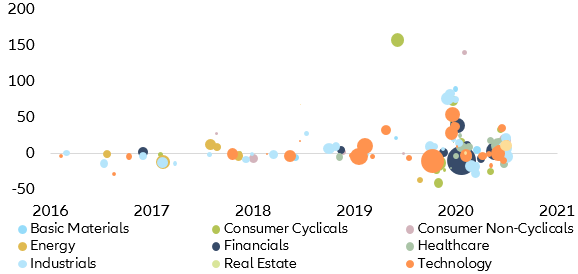

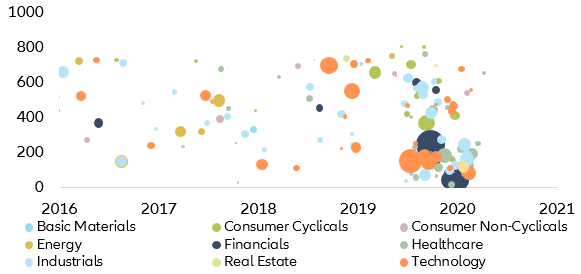

Moving to the extremes of the return distribution, that is to say, periods of high market volatility, also tend to heavily impact traded SPAC performance both in a positive and negative way. Because of that, the recent equity bull run paired with the increasing appetite of small private companies to go public has set the stage for a remarkable SPAC performance, with an average return of 5 to 10% in the six months after the SPAC IPO . Nonetheless, and despite the decent return, the variance around SPAC performance is striking, adding to the case for a careful asset/management selection (Figure 6 & 7).

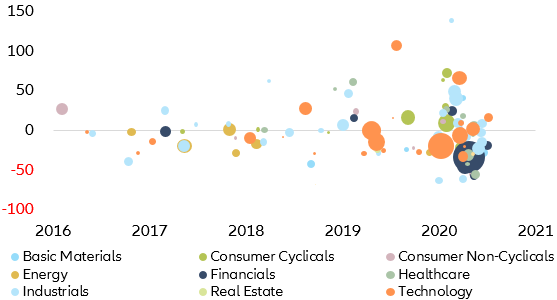

Figure 6: Performance of traded SPAC after IPO (in %)

Figure 8: SPAC target sectors

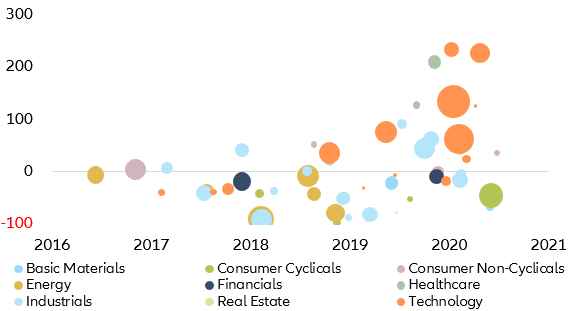

Contrary to this “at par” and even negatively skewed performance throughout the life of the SPAC, the last month before the merger is extremely interesting. During this period, successful SPACs that have managed or are about to find a decent merger candidate (well considered by market participants) generate lots of expectations, thus thriving and outperforming the broader equity market by generating decent double-digit returns right before the merger (Figure 9).

Figure 9: SPAC last one-month pre-merger performance (in %)

Figure 10: # of days from SPAC IPO until de-SPAC (in days)

What happens after De-SPACing? As in the case for traditional IPOs, the initial IPO fever quickly dissipates as soon as investors lock in tactical gains and exit their long-standing positions. Because of this, the average performance of the freshly traded company tends to have a negative bias (0 to -10%) three months after the merger is completed (Figure 11).

Figure 11: Three-month post-merger performance (in %)

Figure 12: 12-month post-merger performance (in %)

Figure 13: SPAC market (# of SPACs)

From a broad sector perspective, the tech and fintech sector should be avoided due to the extreme market competition for a profitable deal and the underlying ultra-high equity valuations. Nonetheless, and if the investor manages to select the right SPAC/SPAC manager (a manager with the right background, expertise, and network), both short- and long-term returns may prove extremely appealing. Consequently, as in the case of private equity investments, the investor capability to select the right SPAC and the right market environment will be the key determinant of the success of the investment. All in all, SPACs are like PE investments: if you choose right you will be extremely profitable, but if you choose the wrong one you may lose a great part of your initial investment (Table 1 & Figure 14).

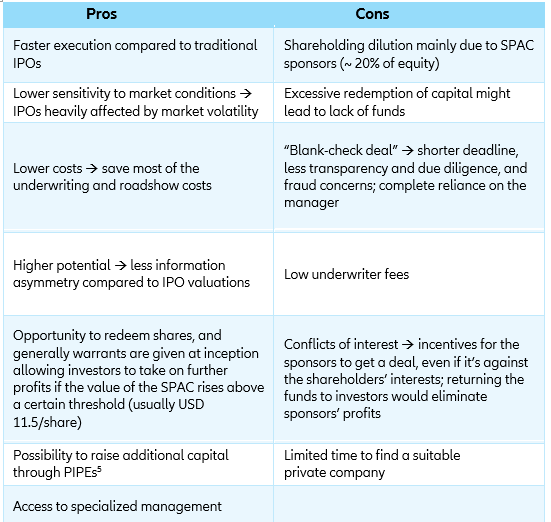

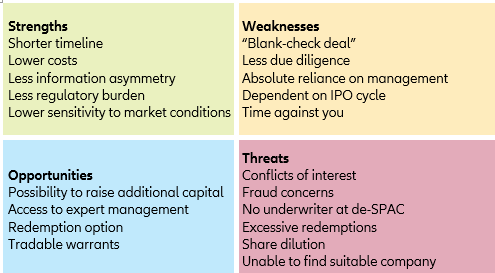

Table 1: SPAC pros & cons