- Rising Covid-19 infections will hold back the recovery of passenger demand in H2 2020. After a summer season cut short in Europe and North America by rising Covid-19 infections, along with continued low willingness to fly, global air traffic as measured by Revenue Passenger Kilometers (RPKs) contracted by -75% year-on-year in August, following an -80% drop in July. As sanitary restrictions tighten again, we now expect full-year 2020 air traffic to be down 60% - vs. a 40% decline in our previous forecast - compared to 2019 and to recover to its pre-crisis level only in 2024.

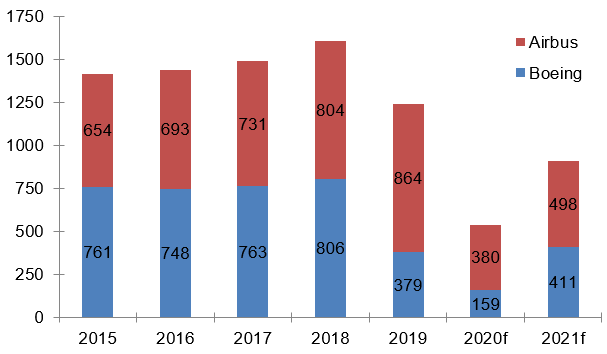

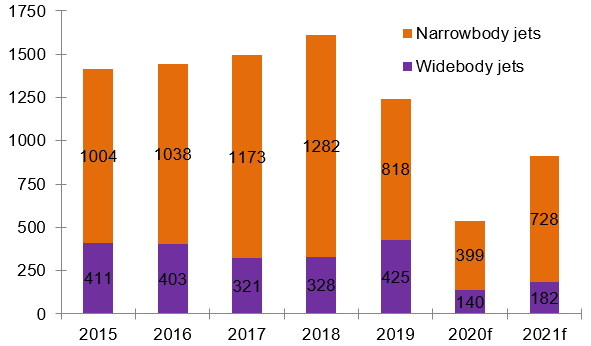

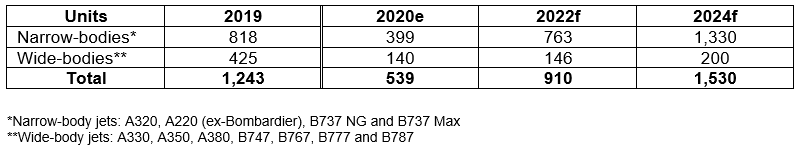

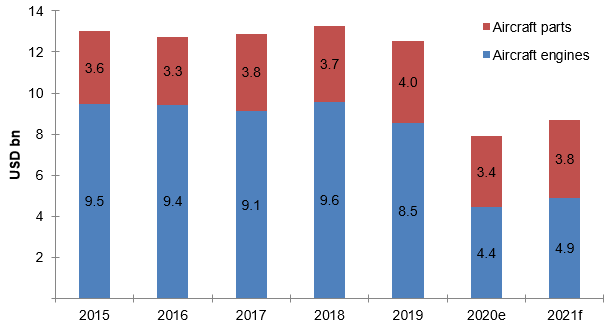

- This has dealt a blow to new plane deliveries, especially for wide-bodied jets. The challenges facing airlines have been passed onto the upstream global aircraft industry by the deferral of new plane deliveries, along with a slump in new orders, if not outright cancellations, depending on the type of aircraft. Breaking down the data, we find that the Covid-19 crisis has hit demand for wide-body (twin-aisle) aircraft more than narrow-body (single-aisle) ones since long-haul international travel has suffered the most. Taken together, we expect Airbus and Boeing to see a drop in new plane deliveries by -57% and -26% in 2020 and 2021, respectively, compared to 2019. In this context, aircraft manufacturers have had no choice but to slow down their production-rates to around 40 aircrafts a month, well below their target of 60 a month a year ago.

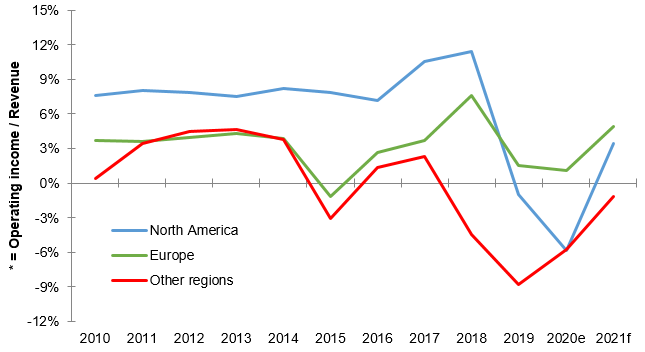

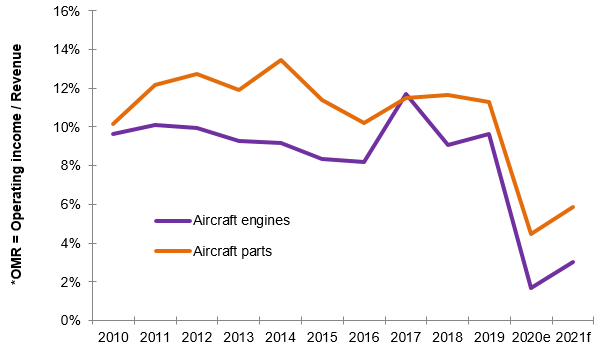

- Lowered production rates put aerospace players’ profitability at risk. We expect plane makers as a whole to post a USD4bn operating loss in 2020 and the average aircraft manufacturers’ operating margin rate to plunge into the red at -2.5% after an all-time high of 9% only two years ago. This gloomy outlook stems from Airbus and Boeing’s (most) profitable wide-bodies facing the highest production rate cuts. However, aircraft part and engine suppliers should get away with an operating margin rate divided by three to around 3% in 2020 and 2021, compared with their global average of 11% over the latest decade.

- In the long-run, European aircraft manufacturers and suppliers are heading for a harder time. Unlike U.S. players, which can count on large and unchanged defense budgets, European players will not only have to wait for the production rates of new planes to bounce back but also cope with losses of capacities, given the vast R&D spending required to meet ambitious expectations for the development of a zero-emissions hydrogen-powered plane by 2035.

Rising Covid-19 infections hold back the recovery of passenger demand in H2 2020

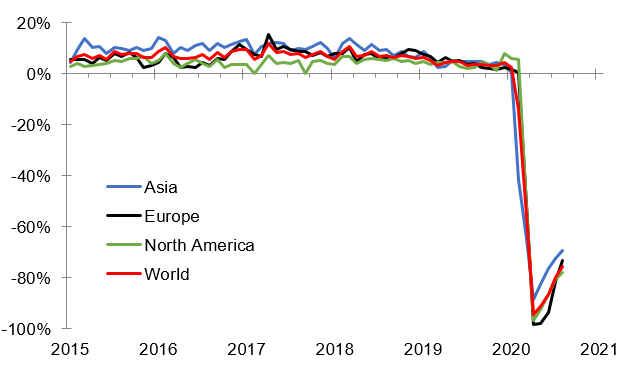

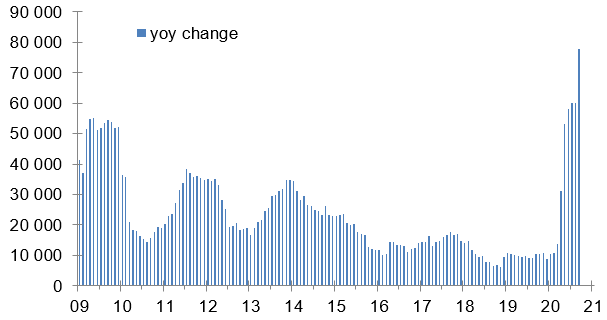

After a summer season cut short in Europe and North America by rising Covid-19 infections, along with continued low willingness to fly, global air traffic as measured by Revenue Passenger Kilometers (RPKs) contracted by -75% year-on-year in August, following an -80% drop in July (Figure 1). Looking ahead, with the lack of convenient testing and compulsory quarantines on arrival, global air passenger demand will take longer to recover than previously expected. For the full year 2020, we now expect air traffic to be down -60% (vs. a -40% decline in our previous forecast) compared to 2019. It will still be 35% below the 2019 level in 2021, and is not likely to recover to its pre-crisis level before 2024.

Even as domestic markets in the EU and Asia are seeing a slight rebound, we do not see overall demand soaring again unless business travel strongly resumes by the end of the year. Amid low demand, airlines have significantly curtailed flights, leaving them strapped for cash. This is now hitting the aerospace industry, which is seeing deferrals in the delivery of new planes, in addition to a fall in new orders, if not order cancellations, depending on the type of aircraft manufactured. In this context, aircraft makers are unlikely to be able to deliver more than half the output planned before the Covid-19 outbreak.

Figure 1: Air (passengers) demand, RPK change (m/m)