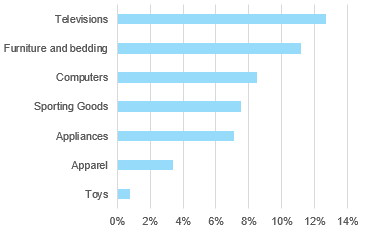

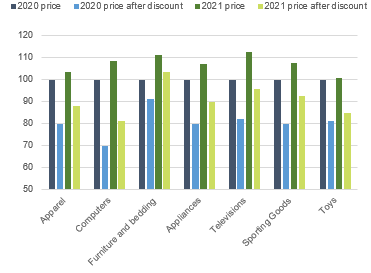

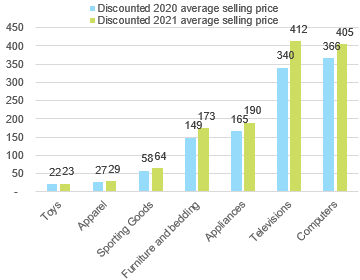

American consumers hunting for Black Friday bargains won’t find much in 2021 as supply remains tight, inventory low and discounts will apply to goods already more expensive. In fact, we expect consumers to pay between +5-17% more for toys, apparel, appliances, furniture, computers, sporting goods and TV sets compared to 2020. Black Friday marks the beginning of the holiday season for American discretionary retailers, but three factors have us believe this year’s Black Friday may not be so black for the consumer.

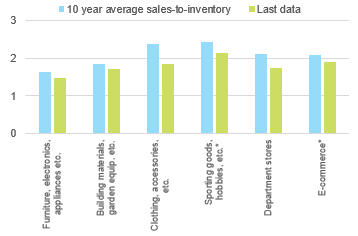

First, supply will be tight. Demand for popular consumer goods such as toys, computers, furniture or domestic appliances has been unusually high for more than a year, bringing production and transport capacities close to saturation for many categories. On top of this already tense supply-demand equilibrium, supply chains have also been impacted by a series of temporary disruptions ranging from a surge in Covid-19 cases hitting Asian factories (Vietnam in particular) and power outages in China through to missing semiconductors halting consumer electronics production. Looking at the inventory-to-sales ratio of the main segments of discretionary retail, we observe inventories are significantly below their 10-year average. Measuring the gap in current inventory levels vs their long-term average against current sales levels, we estimate that USD41bn in goods are missing from the inventories of US discretionary retailers.

Figure 1 - Inventory-to-sales ratio

First, supply will be tight. Demand for popular consumer goods such as toys, computers, furniture or domestic appliances has been unusually high for more than a year, bringing production and transport capacities close to saturation for many categories. On top of this already tense supply-demand equilibrium, supply chains have also been impacted by a series of temporary disruptions ranging from a surge in Covid-19 cases hitting Asian factories (Vietnam in particular) and power outages in China through to missing semiconductors halting consumer electronics production. Looking at the inventory-to-sales ratio of the main segments of discretionary retail, we observe inventories are significantly below their 10-year average. Measuring the gap in current inventory levels vs their long-term average against current sales levels, we estimate that USD41bn in goods are missing from the inventories of US discretionary retailers.

Figure 1 - Inventory-to-sales ratio