Executive summary

- The Covid-19 outbreak is sending the U.S. economy into an unprecedented recession: Our central scenario anticipates a -2.7% contraction of economic activity for the year 2020, taking into account a two-month lockdown period and a U-shaped recovery starting in Q3. The impact of the crisis on the U.S. retail industry is also unprecedented and will have lasting consequences on all segments. However, we find a clear divide between food retail, which is resilient, and discretionary retail, which is cyclical, at least for the eighteen months to come.

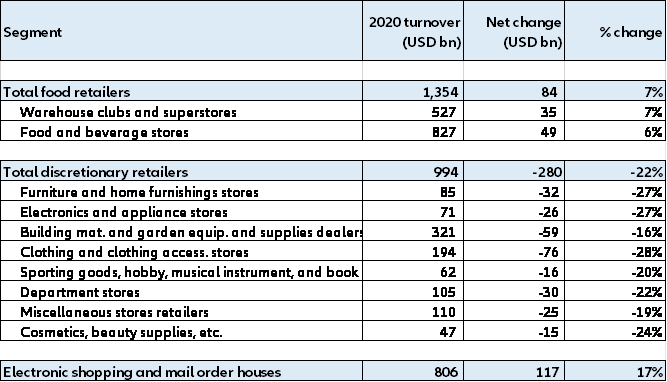

- Food retailers will experience their best year since 2001, with annual turnover up 7%. The shift from restaurants, cafeterias, canteens, etc. to grocery and superstore aisles has provided a considerable boost to food sales under lockdown, but additional health and safety measures have a material impact on profit margins. The capacity of incumbent food retailers to capture a sizeable share of the booming online food and beverage market is good news for their top line, but detrimental to their profitability. Accounting for less than 3% of total food and beverage sales, online penetration will continue to accelerate after the crisis and become the new battleground for food retailers for good.

- E-commerce growth will accelerate to 17%. The segment has benefited from a near-monopoly on non-essential goods under lockdown and is seeing an acceleration in online grocery sales. We believe the crisis will durably transform shopping habits and further accelerate the penetration of e-commerce across segments. Despite accelerating growth, the challenge for a majority of online pure-players remains largely unchanged: will turnover growth ever turn into profits?

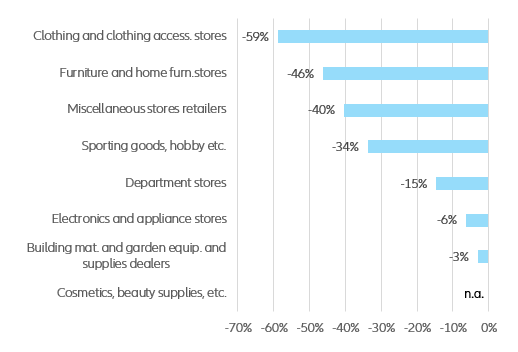

- If past years have been a so-called “retail apocalypse” for discretionary retailers, then 2020 will be hell, with aggregate turnover down -22% and no single sub-segment in green territory. Mandatory store closures have smashed store sales and we anticipate only a slow recovery in demand throughout the year amid high unemployment and depressed consumer confidence. The exit from lockdown will coincide with fierce price competition, with retailers rushing to clear their inventories, and the same additional costs food retailers had to bear to prevent a second wave of contamination.

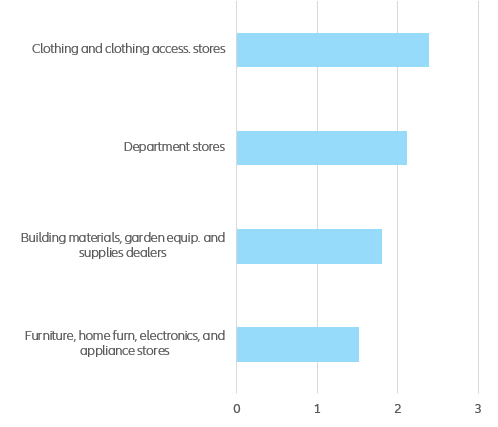

- Strategies to reduce the cash burn (fire sales, freeze in rent payments, cuts in jobs – 1.7m or 29% of discretionary retail jobs have already been cut) will not be enough for many household names that were already struggling before the crisis – bankruptcies have only just begun. Announced policy measures (bridge loans, tax breaks, checks to Americans…) will provide relief in the short term, but only businesses that were sound and viable will be capable of recovering durably. We believe that 30,000 to 50,000 stores could disappear by the end of 2021, the equivalent of 6-10% of the U.S. discretionary retail footprint.

U.S. retailers are faced with a unique combination of lockdown and economic recession

The U.S. government declared the Covid-19 outbreak a national emergency on 13 March 2020, paving the way for statewide lockdown measures affecting the vast majority of American businesses. Retail has been no exception, with only so-called essential retailers authorized to remain open – food stores and general merchandise stores selling predominantly food, as well as pharmacies and building material retailers. The immediate impact of the Covid-19 outbreak has therefore been felt very differently across the industry.

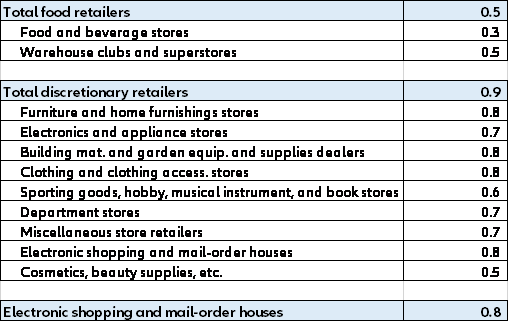

As of 18 May, restrictions on retail activities have been progressively lifted across many states. However, adding to the already challenging environment, consumer confidence has collapsed, with jobless claims soaring, the unemployment rate jumping from 4.4% in March to 14.7% in early May and, for the year 2020, an expected -2.7% contraction in U.S. GDP. The fast deterioration of the economic environment will further widen the divide between food retail, which is resilient, and discretionary retail, which is cyclical, at least for the eighteen months to come (see Figure 1).

Figure 1: Retail sales - nominal GDP growth correlation across segments (1992-2019)