EXECUTIVE SUMMARY

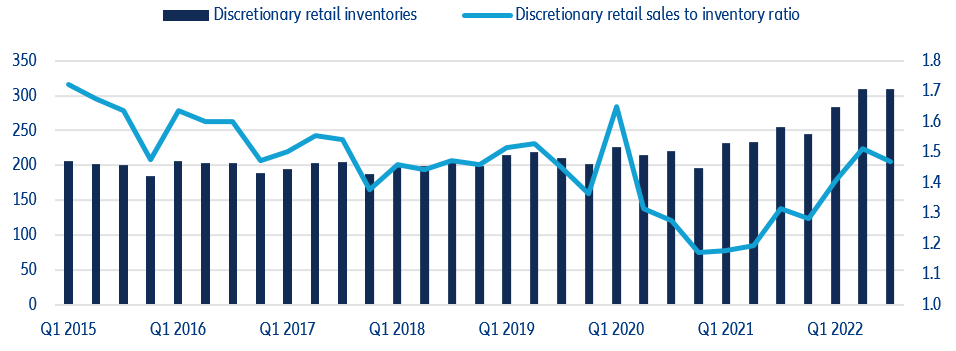

- US discretionary retail sales (durable goods, apparel, entertainment and leisure goods) peaked in Q3 2022, mostly driven by prices. In the same period, retailers had an estimated USD54bn in additional inventories vs 2021. With the US economy anticipated to slip into a recession in 2023, retailers are expected to make the most out of Black Friday and the holiday season to avoid a possible inventory glut.

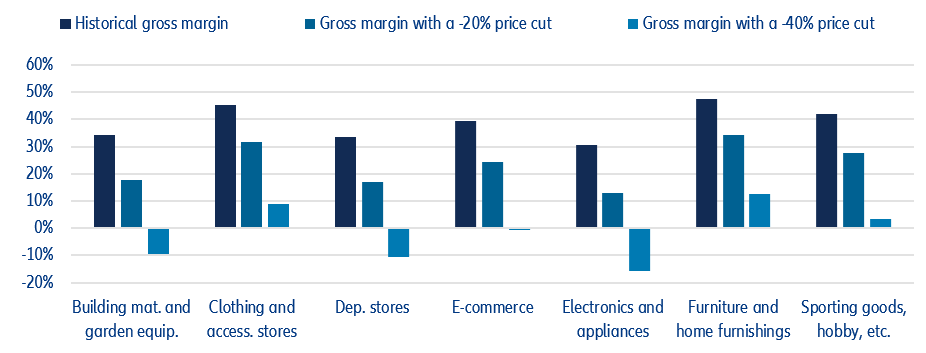

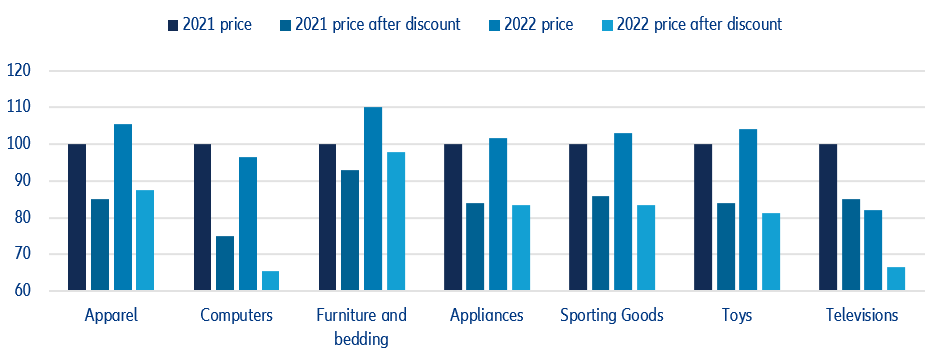

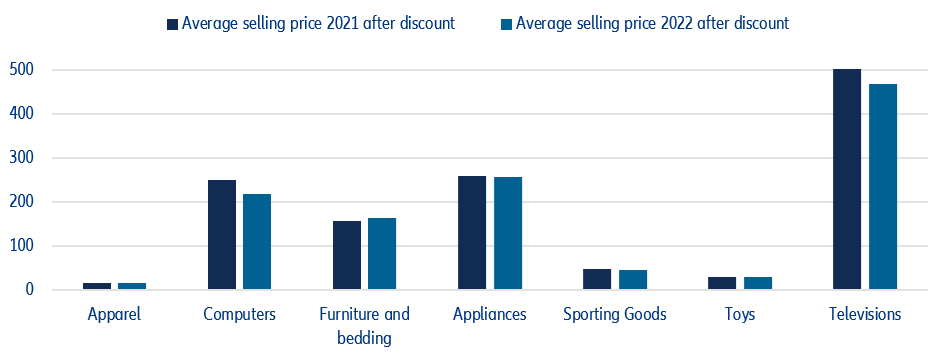

- For the holiday season, retailers will have to strike the best possible balance between volumes and prices, on the one hand, and profitability and liquidity on the other. Retailers expecting high demand and keeping prices relatively high may preserve their profit margins, but face the risk of disappointing sales volumes translating into rising inventories and deteriorating liquidity. On the other hand, retailers expecting low demand and granting generous discounts may see satisfactory sales volumes and inventories going down, but at a substantial cost: an average -20% price cut dilutes gross margins by -13pps (furniture retailers) to -17pps (electronics retailers) depending on product segments.

- In contrast, the prospect of stalling sales, and high inventory, could mean consumers are in for great deals. Discounts are expected across all product categories, with computers and televisions featuring prominently. Factoring in both the increase in retail prices caused by inflation and expected rebates on discounted items, we find that consumers are likely to save an extra USD30 for a discounted computer and USD130 for a discounted TV set compared with last year. The average discounted price for toys, appliances and sporting goods would be marginally lower, while apparel and furniture would still be more expensive.

Discretionary retail sales peaked in Q3 2022, driven mostly by price increases.

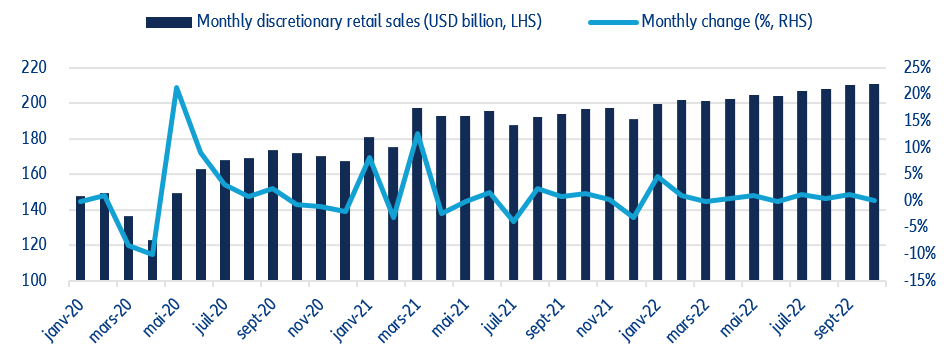

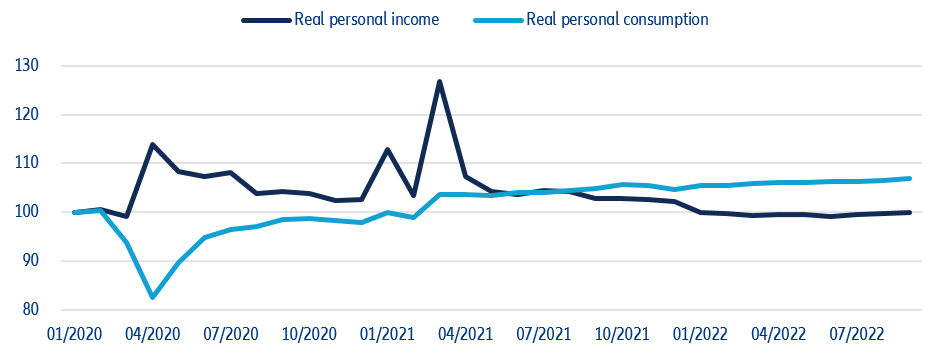

In the US, the great retail binge is coming to an end just ahead of the critical holiday season. Monthly discretionary sales peaked at USD211bn in October 2022, up from USD148bn in January 2020 prior to the Covid-19 pandemic (Figure 1), driven by a mix of spending moving from services to goods (2020), generous government support to households (2021) and a surge in inflation (2022). However, growth is now essentially driven by prices rather than volumes: We estimate that they rose by an average +4.2% y/y, explaining most of the +7.1% increase in retail sales over the period. In other words, the same basket of electronic goods, apparel, furniture, toys and recreational products cost US households USD8.5bn more in October 2022 vs 2021.

Figure 1: US discretionary retail sales