After the U.S.-China trade feud slashed global trade growth to its slowest pace since 2009 last year (+1.2% in volume terms), we expect the Covid-19 outbreak to act as a major trade barrier in 2020. According to our calculations, the ongoing containment measures to respond to the Covid-19 outbreak are already equivalent to +0.7pp of additional tariffs on goods — bringing the world tariff average to a notional 6.5% at end of Q1 2020. In other words, in one quarter, global trade already suffered from the equivalent of the full-year trade war between the U.S. and China in 2019.

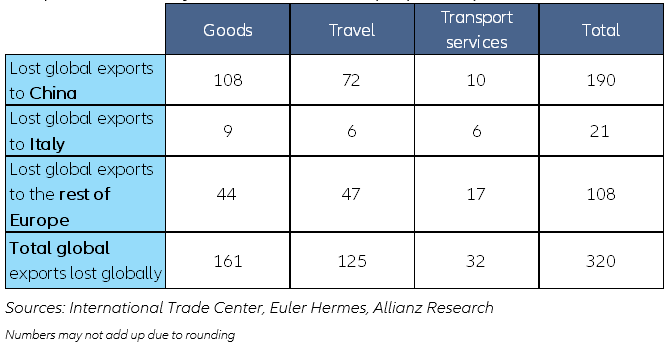

We estimate that losses of trade in goods and services could amount to USD320bn per quarter of business disruption (see Figure 1). Each quarter of Covid-19 related trade losses in 2020 is thus comparable to the annual impact of the U.S.-China trade dispute on world tariffs in 2019. On the goods side, our main assumptions take into account the lockdowns in China and Italy and limited containment measures in other countries. We expect the resumption of business activity to be gradual in March and April and reach full speed by the end of May. Export losses should amount to a total of USD161bn as demand from China and Europe will remain significantly impacted by the end of April. Our assumption for services is a significant reduction in tourists from and to China, Italy and, more generally, intra-Europe, to which we add a significant slowdown in transport services. The return to normal levels of activity is expected to be very gradual, pushing global export losses to USD125bn on the tourism side and USD33bn for transport services.

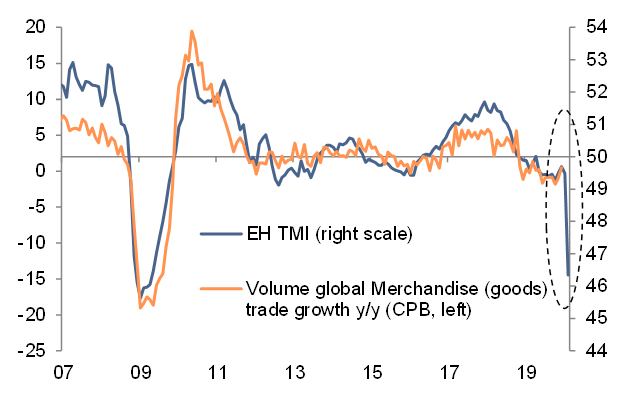

This trade shock is already visible in early trade indicators, which signal a trade recession in volume terms both in Q1 (-2.5% q/q annualized) and Q2 (-1%) 2020. After a slight rebound by 1.6% in Q4 2019, we expect global trade to contract by -2.5% in Q1 (q/q annualized), and certainly to stay in negative in Q2. Indeed, our proprietary Trade Momentum index shows trade in volume edged down again in January 2020 and plummeted in February, following dire activity reports in China but also deteriorating new export orders elsewhere, notably in Europe and Asia (see Figure 2). Shipping data point in the same direction. The International Chamber of Shipping estimates that the Covid-19 outbreak has removed more than 350,000 containers from global trade. There have been 49% fewer sailings by container ships from China in the last four weeks, according to the European Commission. The forecasted drop of 20-25% in global shipping industry throughput will have a corresponding impact on the port terminal industry. Today, a V-shaped recovery scenario points to a recuperation in H2 2020, and thus a global trade forecast of +0.4% for the full year 2020.

A strong dollar, lower commodity prices and depressed demand will keep nominal trade in recession for the full year 2020. A -10% drop in the S&P GSCI commodity price index since the beginning of the Covid-19 outbreak signals a continuation of 2019 deflationary pressures. This coupled with the appreciation of the dollar in a context of high uncertainty would push prices down. In value terms, trade should also contract in the first half of the year, keeping the full-year figure in negative territory after -1.5% in 2019.

Figure 1 – 2020 global export losses due to the Covid-19 outbreak in key hotspots: China, Italy and the rest of Europe (USDbn)