EXECUTIVE SUMMARY

- Crisis after crisis, emerging market economies (EMs) have questioned a global financial system dominated by advanced economies and anchored to the US financial cycle. From pandemic-strained supply chains, over exposed flaws in energy markets and sanctions coordination, to the most recent tremors in the banking sector—fragmentation seems to become inevitable. In the meantime, China and several larger EMs have become more deliberate and strategic in promoting initiatives to achieve greater monetary sovereignty and reducing their dependence on cross-border capital flows from advanced economies.

- A multipolar financial system could be more resilient and welfare-enhancing, especially for smaller economies dependent on foreign capital—but it also raises the stakes for greater policy coordination. Deeper local capital markets in EMs could help cushion the impact of external shocks, and more so when cycles are not completely synchronized. However, decoupling also means matching the policy framework and governance in EMs to the standards underpinning the current global financial system, which will take time. Geopolitical tensions require more (rather than less) interaction and coordination to help shape a global financial system that acknowledges the greater economic role of EMs.

- The consensus on the post-Bretton Woods framework of global finance seems to be fraying

Growing fragmentation and geopolitical tensions are challenging globalization just when international coordination is needed the most. The recent crises have strained global supply chains, tested the willingness of countries to coordinate their containment of a deadly virus and exposed critical flaws in energy markets in many parts of the world. At the same time, policy choices adopted to address these economic shocks have had unintended consequences and, if used deliberately for economic gains at the expense of others, could also slow or even reverse decades of global integration. In many countries, public support for economic openness has declined and cross-border flows of goods and capital have levelled off for more than a decade (in relation to GDP), even as data flows have increased massively. In addition, current tremors in the banking sector further the raise the stakes for greater policy coordination to mitigate the risk of adverse spillover effects from financial shocks.

Added to this are geopolitical tensions, which have made it even more difficult to achieve international agreement on critical challenges and raised the specter of international finance and trade fragmenting into rival economic blocs. More recently, the three prominent bank failures in the US and the recent shotgun wedding of UBS and Credit Suisse have inflicted financial-sector trauma again in advanced economies, hinting at further dislocations, which are likely to have outsized economic implications for many emerging market (EM) economies. According to a recent IMF study (2023), the longer-term cost of trade fragmentation alone could range from 0.2% of global output in a limited fragmentation scenario to almost 7% in a severe scenario. If technological decoupling is added to the mix, some countries could see losses of up to 12% of GDP.

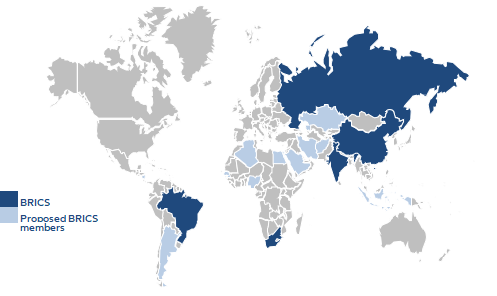

The energy crisis (and related Western sanctions) triggered by the war in Ukraine has also catalyzed efforts to dismantle the current global financial system. The freeze on Russia’s foreign exchange reserves held by other central banks raised concerns in several large EM countries about the dominance of the US financial system and the extent to which the global monetary regime is entangled with US foreign policy (and that of mostly Western allies). But even before the war in Ukraine, BRICS countries had already become more deliberate and strategic about gradually weaning themselves off the US-dominated financial-market infrastructure and intermediation of global capital flows.

Many EMs want to achieve greater monetary sovereignty and less reliance on foreign capital through greater regional integration of trade and finance

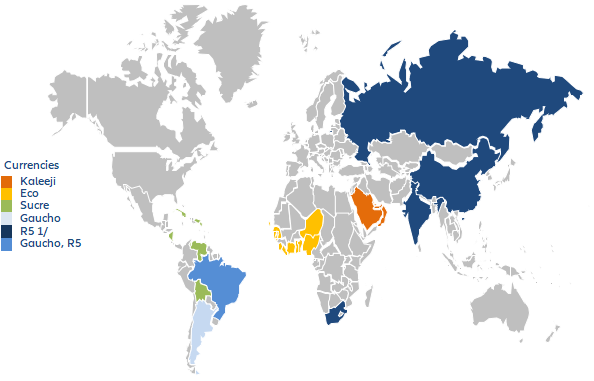

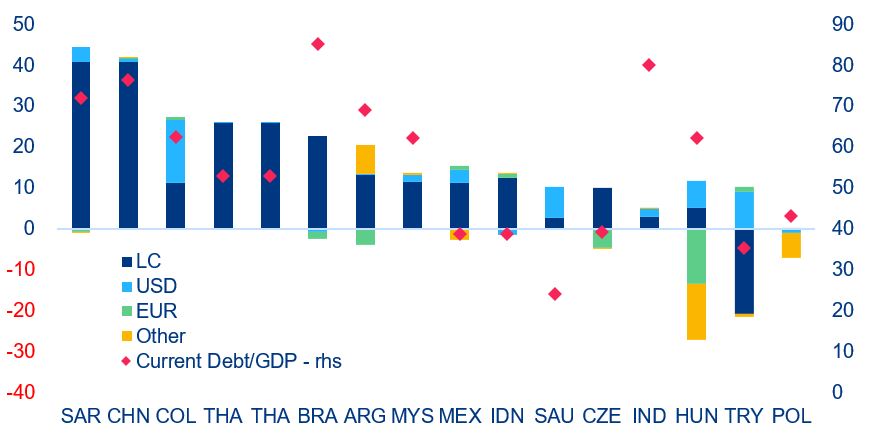

Given their limited local capital market development and high reliance on external borrowing, EM countries tend to be highly vulnerable to financing conditions in advanced economies. For instance, during tightening cycles, central banks in EMs have little room to maneuver lest they put exchange rate stability at risk (since a high share of USD-denominated trade invoicing limits the benefit from cheaper exports). One of the preconditions for monetary sovereignty in an open economy is sufficient size. While China has made some efforts in opening its capital account to internationalize its currency, the share of the Chinese Yuan in central bank reserves is still small (Box 1, Figure 1.1). Smaller EM countries have proposed common currency areas to achieve greater size by aggregation. However, insufficient economic and financial integration limits their potential for creating effective and sustainable currency unions (Figure 1). Alternatively, monetary sovereignty can be achieved via reserve accumulation, and we find a clear trend in many EMs towards greater reserve accumulation in non-USD assets, such as gold (Box 1, Figure 1.2). The temporary one-sided gold-fixing of the Russian ruble in combination with ruble-invoicing of energy exports reintroduced a de facto gold standard, which could provide the blueprint for commodity-exporting countries to depart from the post-Bretton Woods system of fiat currencies and achieve greater monetary sovereignty.

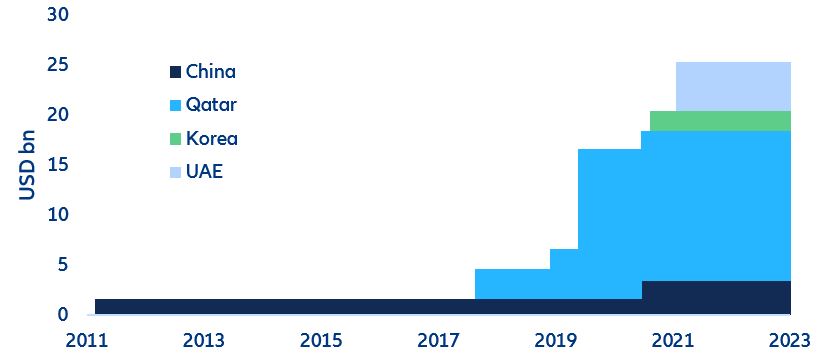

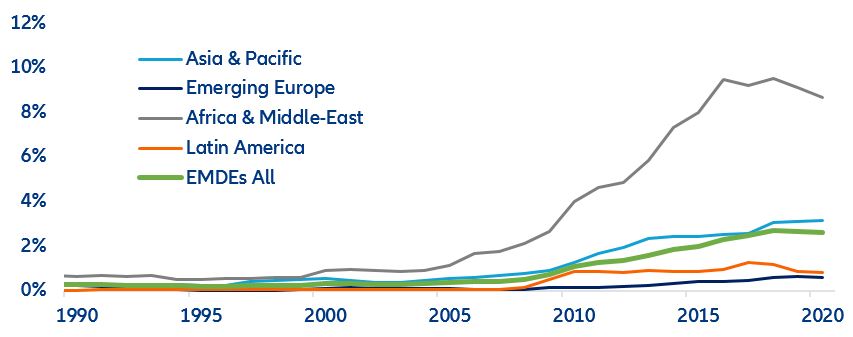

Seeking greater monetary sovereignty also means greater mutual crisis support without the involvement of advanced economies. Intra-EM monetary support has increased over the last 30 years in the wake of painful crises in the 1980s and 1990s. In the wake of the Asian crisis, the Chiang Mai Initiative (CMI) of major Asian economies introduced a regional multicurrency swap arrangement, which has fostered greater coordination of monetary policy in the Asia-Pacific region. The bilaterally-agreed currency swaps among EM countries are another more recent example, including the Central Bank of Turkey’s “lira-ization” experiment (Figure 2), which has arguably kept it going.

Figure 1: Common currency proposals in emerging market (EM) countries