EXECUTIVE SUMMARY

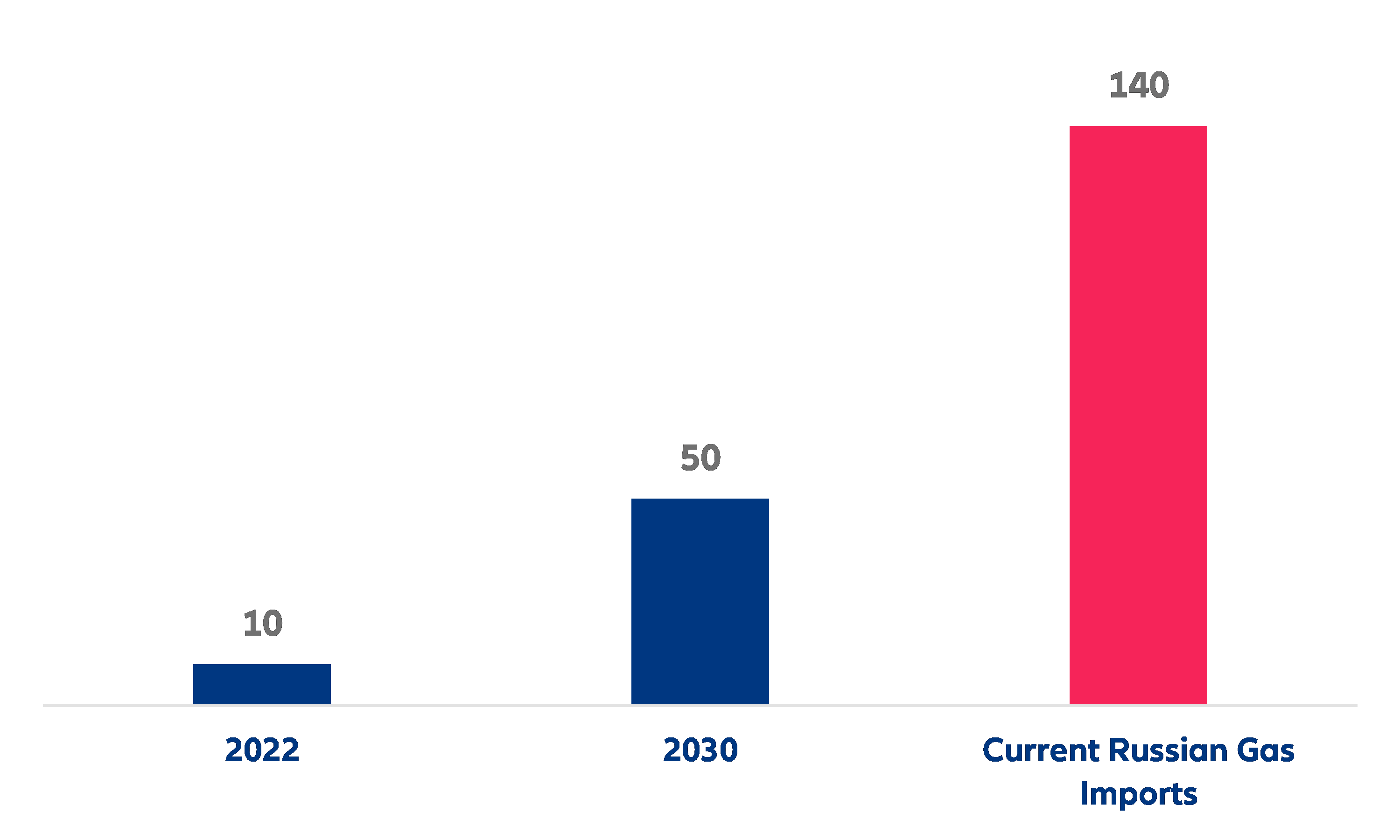

- Energy storage could help Europe tackle its energy crisis but is overlooked in policies, by 2030 total storage capacity will amount to about 35% of annual average Russian gas imports. Indeed, the recent REPowerEU plan does not directly refer to targets for energy storage and, more importantly, the region does not have strong incentive for energy-storage providers or investors to ramp up their efforts – growth will be organic, indirect and slow.

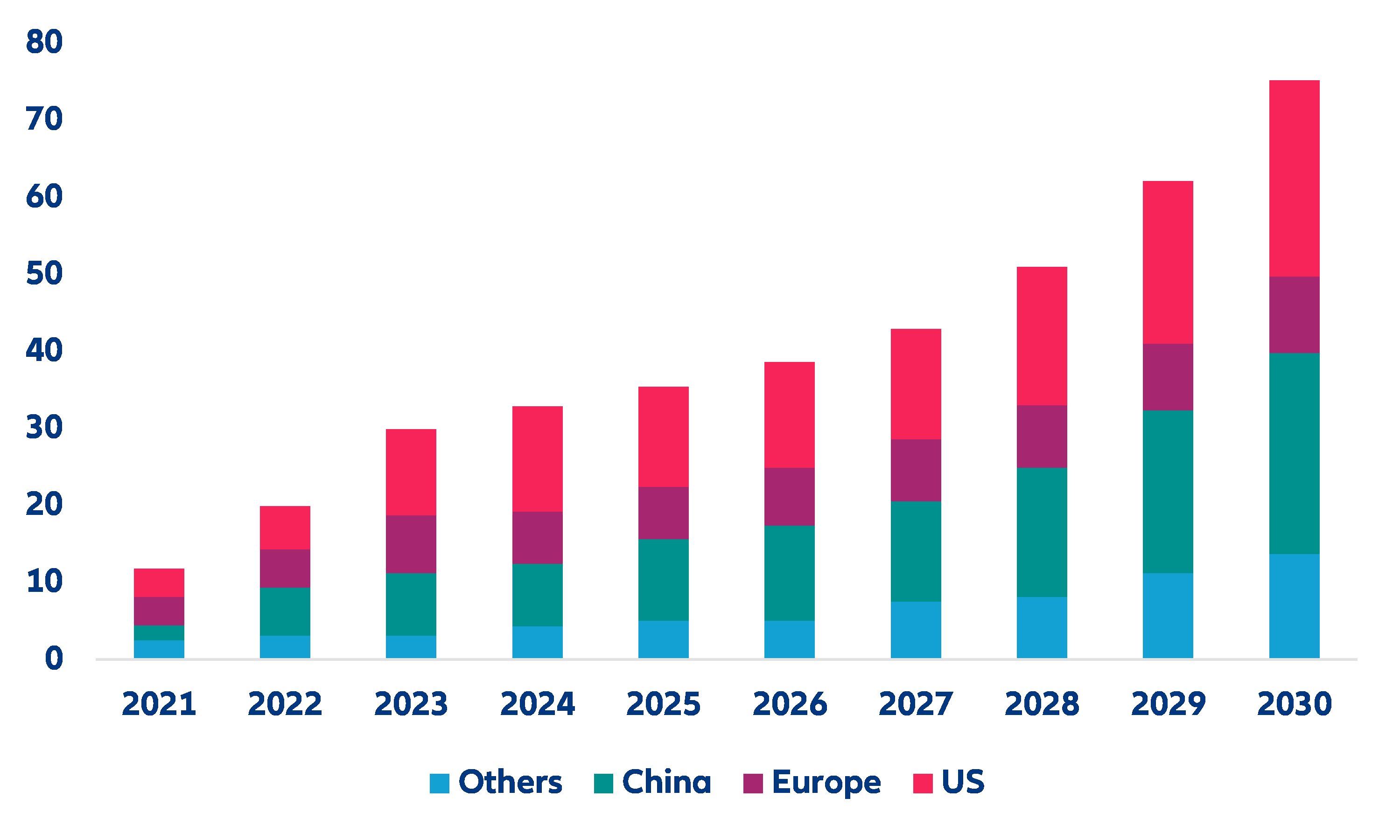

- In 2021, total energy storage capacity was close to 27 GW – which is five times the level of 2015. Overall, the global energy storage market is expected to grow 15-19-fold by 2030, with cumulative energy storage capacity totaling 400-500GW. Most of this growth will stem from the US and China. Both countries have laid-out ambitious plans on energy storage which should support large grid-scale projects.

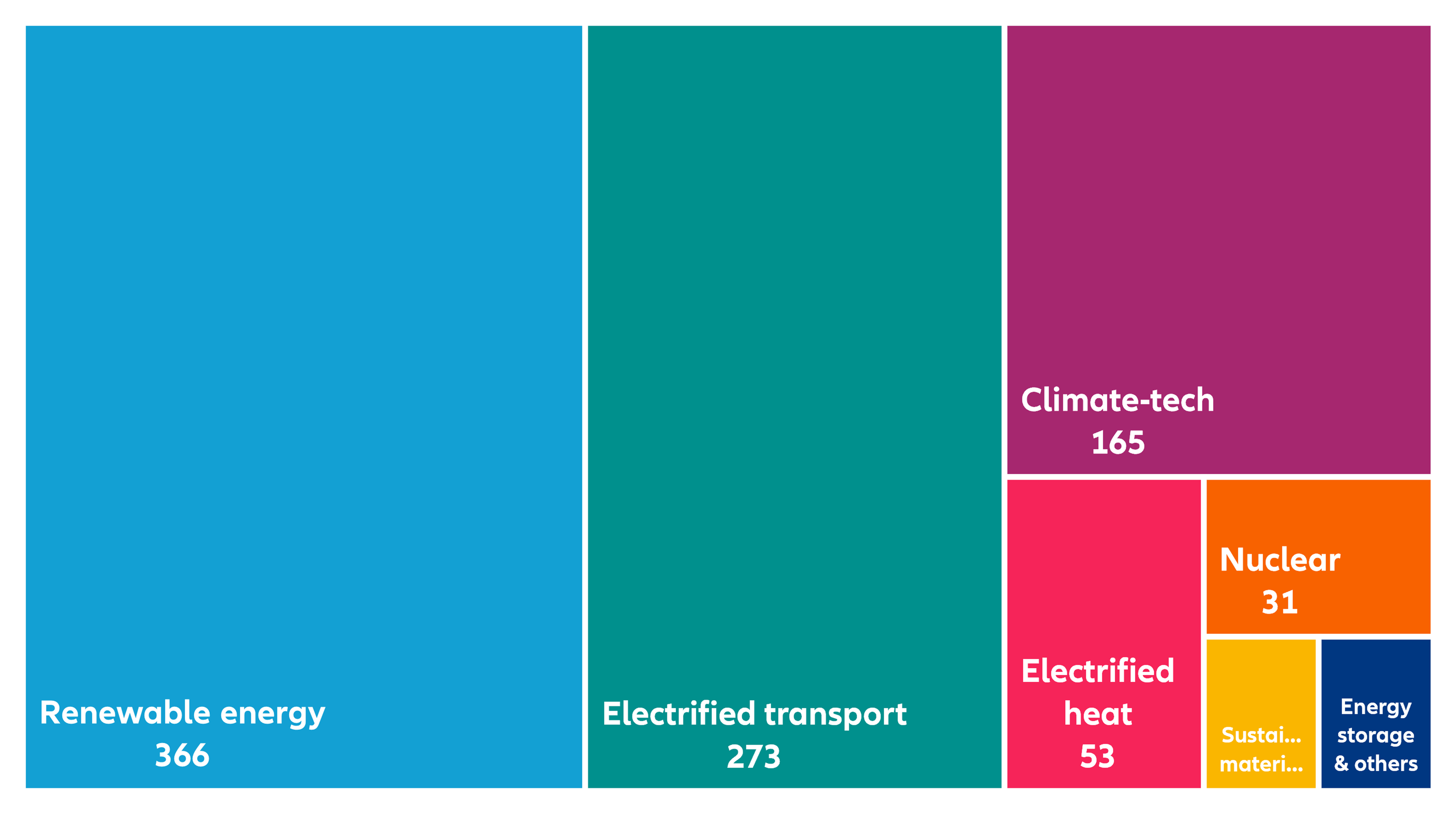

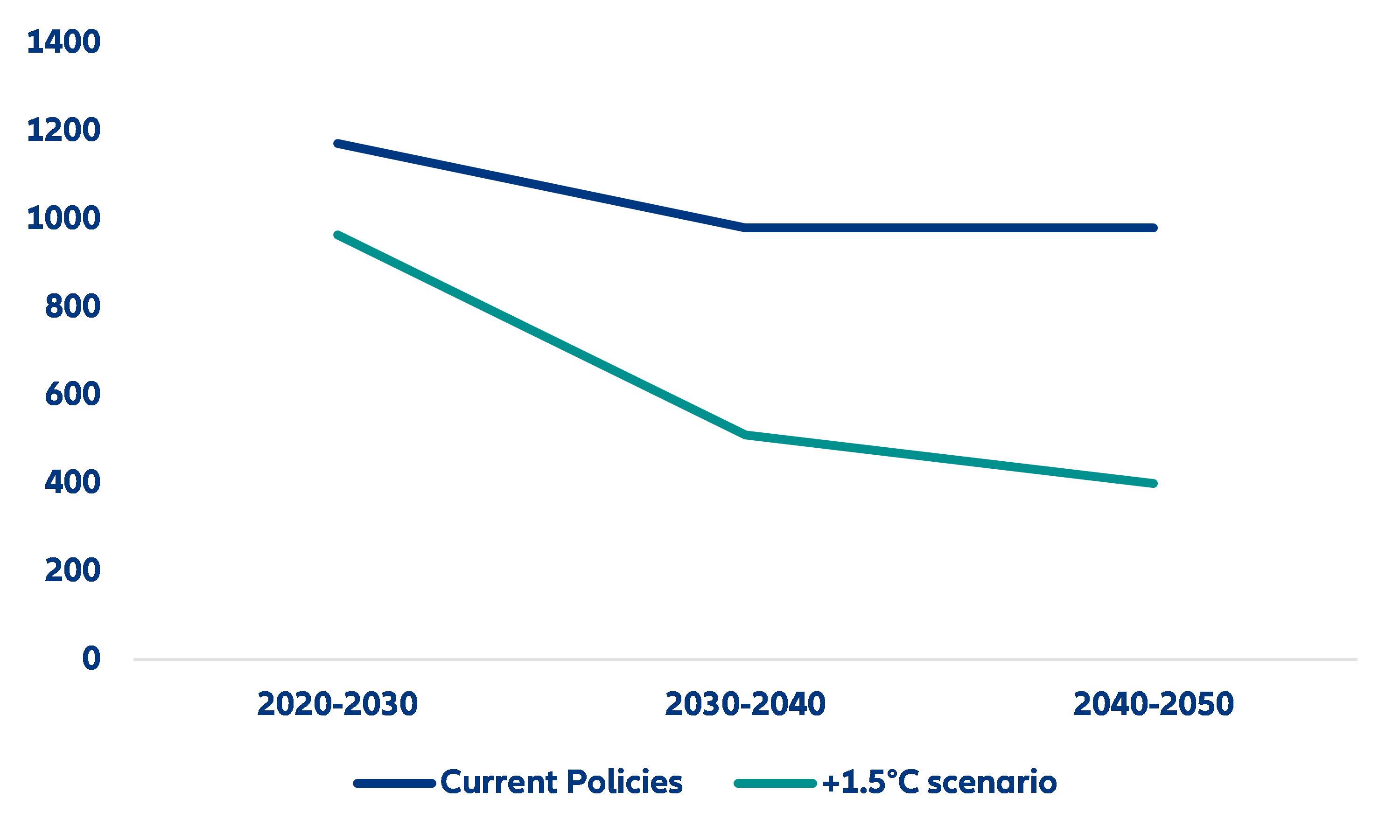

- In the short run, the energy storage market is likely to face some challenges but in the longer run, economies of scale and decreasing prices should support higher investments. Chip shortages, supply-chain issues and high lithium prices are likely to weigh on project progress and funding in the next few years. However, from a long-term perspective, decreasing costs set the stage for stronger annual capex in energy storage as costs per kWh could be slashed by -60%.

Energy storage is the missing piece in Europe’s energy strategy

Amid the ongoing energy crisis in Europe, the European Commission released an ambitious REPowerEU plan in May 2022. Under this plan, the target for renewables in the share of energy production by 2030 has been increased from 40% to 45%; energy saving targets were also increased from 9% to 13%, solar photovoltaic capacity should double by 2025 and administrative processes should be simplified for renewables throughout the EU. All these targets will have a positive indirect impact on energy-storage deployment. However, there are only a few explicit references to energy storage in the plan (i.e. recognition of the role of energy storage in system flexibility and improving permitting processes for energy storage). More importantly, in the current setting, there are neither incentives for energy-storage providers to boost their efforts, nor for investors to support energy-storage projects, and the European Commission is yet to provide an energy-storage strategy. For reference, under current policies, energy-storage capacity will amount to only about a third of current Russian gas imports, which – under the assumption that Russian gas will be replaced in the long-term by renewables – falls short of the needed capacity (see Figure 1).

Figure 1 – Cumulative energy storage forecast for Europe (GW)