Executive Summary

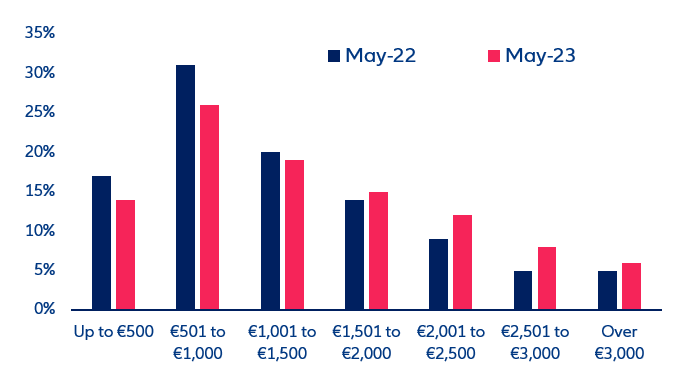

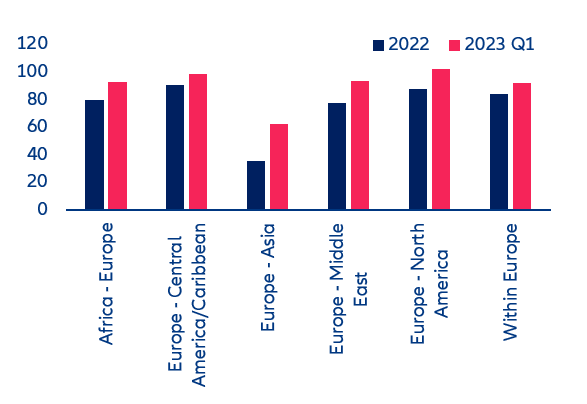

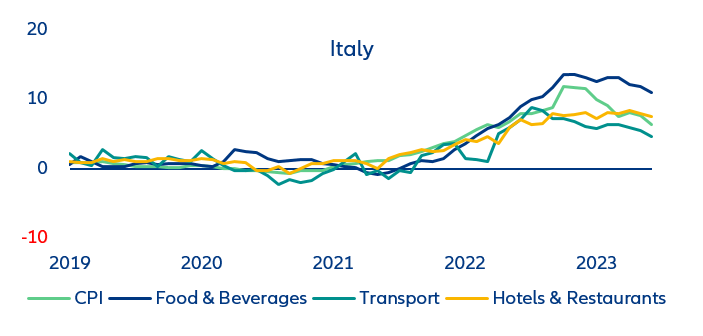

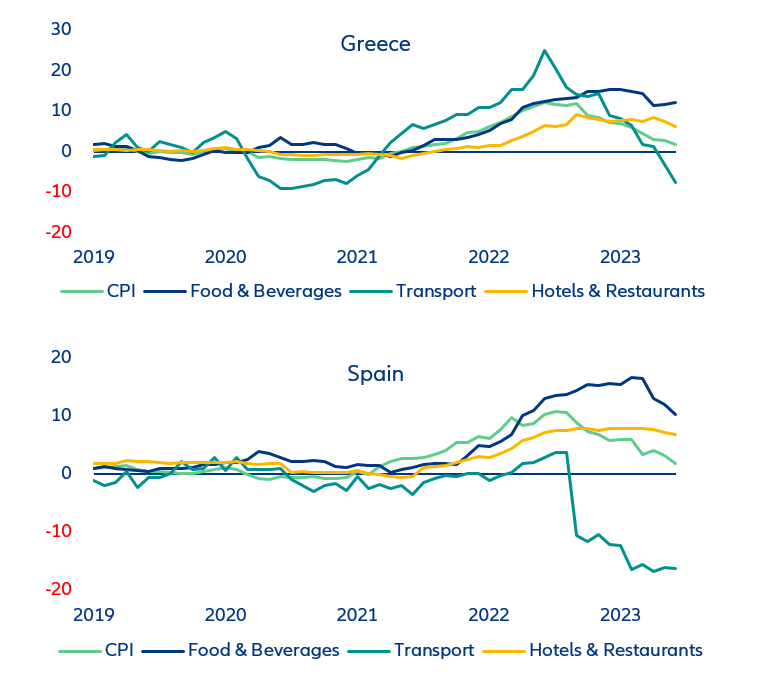

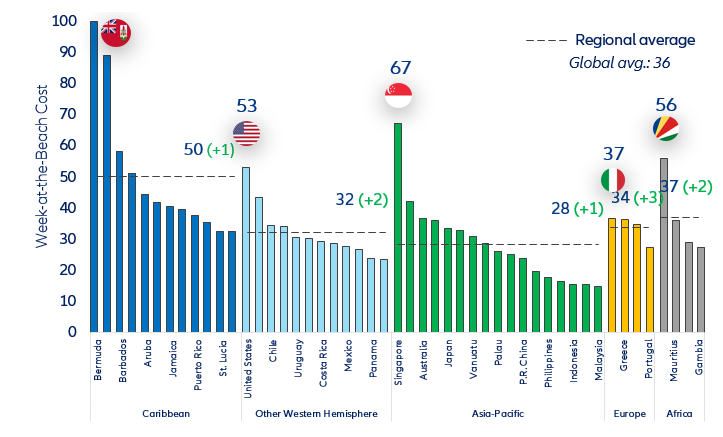

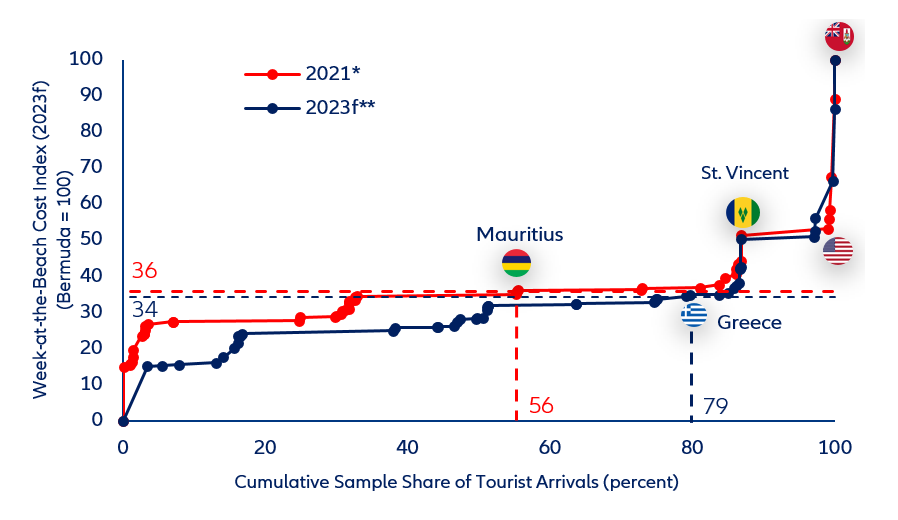

Will surging travel prices wash out Southern Europe’s all-important summer season? Beach holidays are the top choice for leisure trips (30.3%) but 41% of European travelers expect to spend more than EUR1,500 on their holidays this summer, up from 33% last year. Nevertheless, we find that an average one-week beach holiday in Southern Europe is still far cheaper than the Caribbean, Australia and the US, and on par with many premium destinations in Latin America, Africa and South-East Asia. And higher prices do not seem to be deterring holiday plans: Revenue per passenger kilometer (RPK) for trips within Europe already reached 92% of the 2019 level during the first quarter of 2023, while air-ticket sales volumes for the May-to-September have also reached 91% of the 2019 summer level.

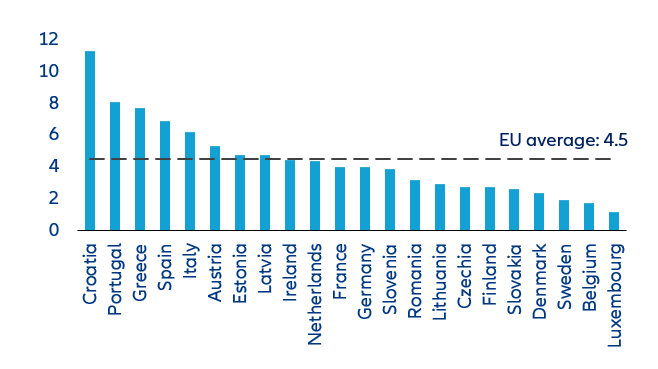

Yet, Southern Europe is caught between the devil and the deep blue sea. Tourism accounts for the largest share in total gross value added in Croatia (11.3%), closely followed by Portugal (8.1%), Greece (7.7%), Spain (6.9%) and Italy (6.2%). This results in a bad equilibrium of strong structural dependence on foreign tourists and an increasing vulnerability to exogenous shocks (such as the pandemic). It also risks perpetuating the region’s inherent structural problems of low-skilled jobs and low productivity.

Southern Europe needs to invest in sustainable tourism practices to ensure the preservation of natural environments and cultural heritage for future generations. Enhancing infrastructure, including transportation networks and accommodation, can also improve accessibility and cater to diverse traveler preferences. And promoting off-season tourism and diversifying offerings beyond traditional beach holidays can also help attract visitors throughout the year.