In focus – US inflation: How much should we thank the Fed for?

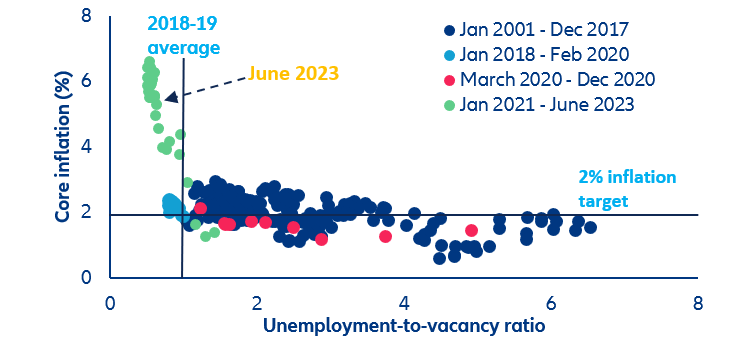

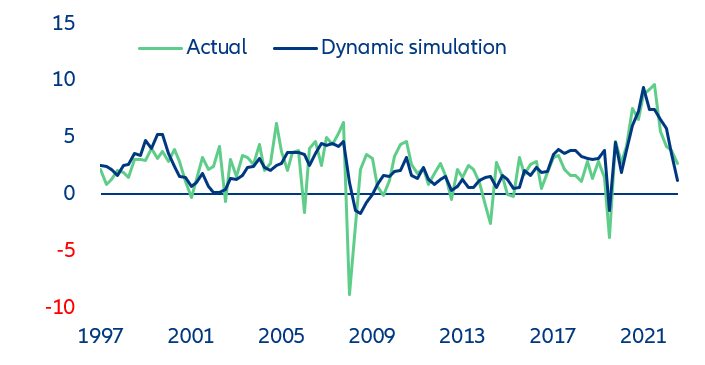

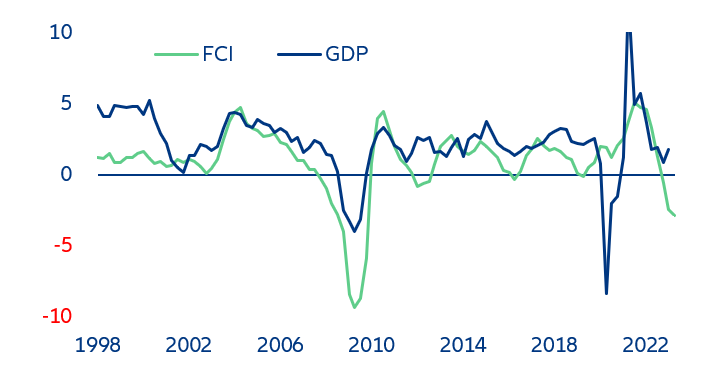

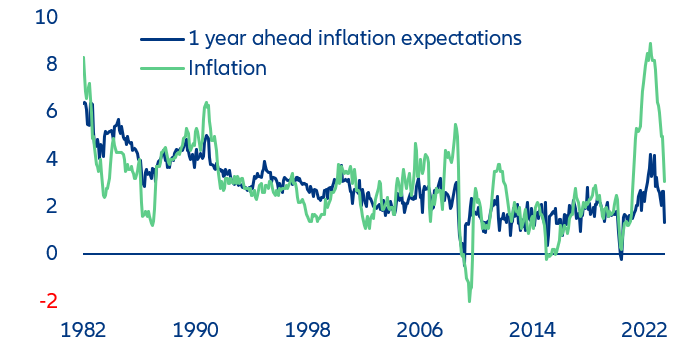

- Half of the decline in US inflation since last year is the making of the Fed. The fall of inflation to 3% in June has cheered markets by strengthening the argument that the US economy can achieve a soft landing, avoiding a recession and normalizing inflation. We find that the Fed has contributed to lowering inflation through two channels: (i) by cooling aggregate demand growth (-2pps) and (ii) by managing to keep inflation expectations anchored (-3pps). In total, the Fed has pulled inflation down by -5pps over the past 12 months.

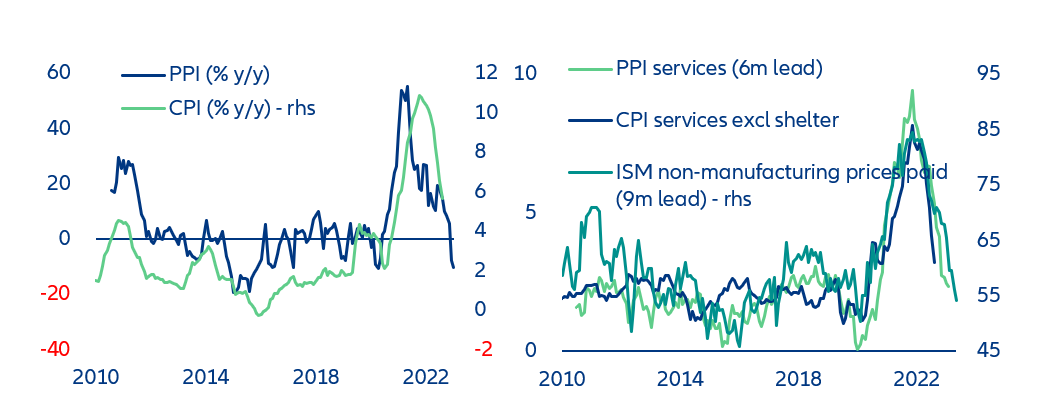

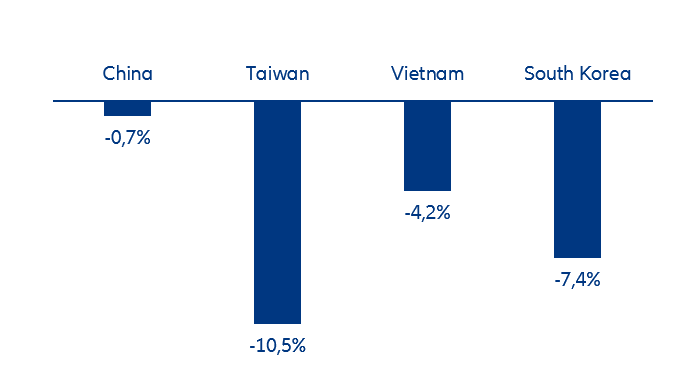

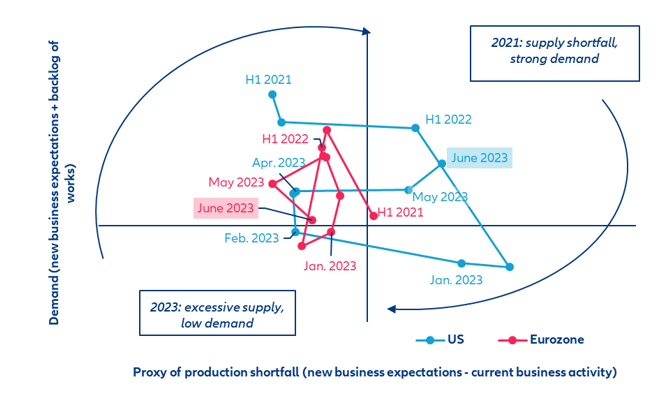

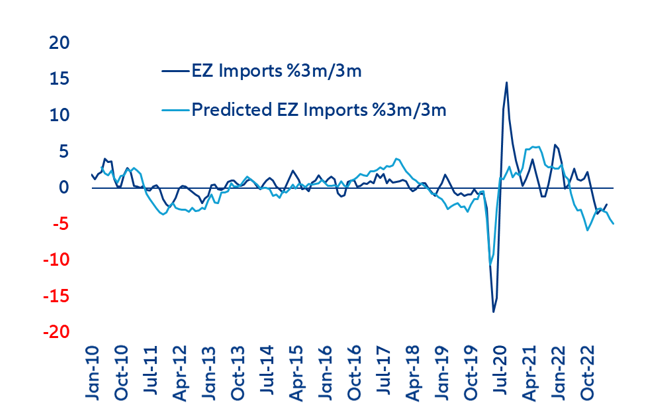

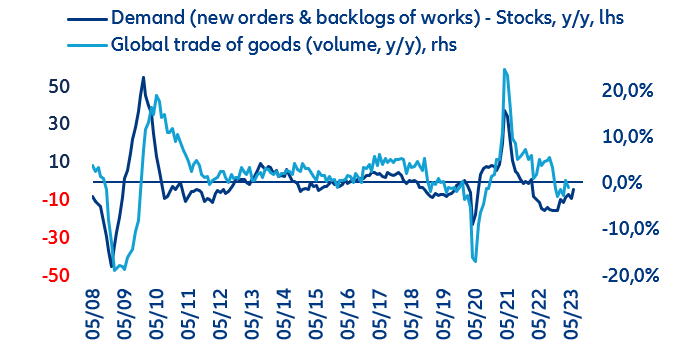

- The fading of supply-chain disruptions contributed equally to lower inflation. The mix of spiking demand for goods during the pandemic and pandemic-related disruptions to global supply chains (notably in Asia) had been the first trigger, pushing US inflation to historical highs. Now that global supply chains are operating as normal, goods inflation has dropped and this has contributed to reducing US inflation by -5pps.

- However, demand-push factors have pushed up inflation by close to +4pps. US GDP growth has been remarkably resilient to Fed tightening because of offsetting factors including labor market strength, solid household consumption growth funded by excess savings, and loosening fiscal policy (since early 2023).

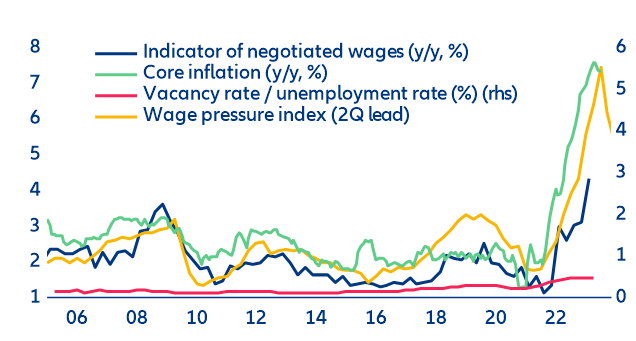

- Looking ahead, we forecast US inflation to hover around 2.5-3.0% through the end of 2023, and to reach around 2% by the summer of 2024. Rapid declines in inflation are behind us now that energy inflation is set to become less negative in the months ahead. However, core inflation and food inflation should continue to ease as lower input costs, squeezed corporate margins and slowing wage growth feed through. We forecast both headline and core inflation at around 2% by the summer of 2024. Our expectation of a soft landing of the labor market is compatible with inflation returning to 2%.

![Figure 15: Contributions of q/q annualized CPI inflation decline between Q2 2022 and Q2 2023 (-7pts)ate non-financial corporate debt via guarantees and central bank asset purchases [bottom] (% of GDP)](/en_global/news-insights/economic-insights/fed-us-inflation/_jcr_content/root/parsys/wrapper_copy_copy_co/wrapper/wrapper_copy_copy_co_1730082260/wrapper/image.img.82.3360.png/1689895262984/21072023-figure15.png)