Executive Summary

- Today's financial release from Tesla Inc, the U.S. manufacturer of electric vehicles (EVs), is a perfect reminder of two key challenges facing the automotive industry in the short-term: (i) boosting sales of alternatively powered vehicles (APVs), notably EVs, to compensate for the decline in traditional powertrains and (ii) limiting the decline in profitability to preserve the capacity to invest in the future of automotive. To this regard, 2020 already appears to be pivotal.

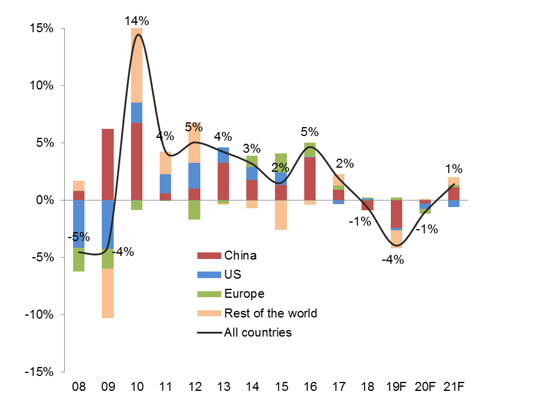

- The rise in APVs is not yet strong enough to support a rebound of the global automotive market in 2020. We expect the latter to experience another decline in volume terms in 2020 (-1%) after a noticeable contraction in 2019 (-4%).

- What does this mean for companies? Increased price competition and downside pressure on margins, which will push down the combined EBITDA of the top 25 automotive manufacturers (-11% in 2019 and -3% in 2020) in an environment of low revenue growth (+1%).

The first available figures for 2019 point to a double-digit increase in global EV sales to more than 2 mn. This represents a noticeble performance since the Chinese market, which is the largest one, posted a contraction in 2019 for the first time, with EV sales slumping -4% to 1.2 mn, far below the 1.6 mn target. In China, the drastic cut in subsidies — triggered in June to thin the overcrowded market and increase competitiveness — deeply impacted the sales of battery electric vehicles (BEVs droped -1% to 972,000) and plug-in hybrid electric vehicles (PHEVs dropped -15% to 232,000).

We expect 2020 EV sales to remain on a strong dynamic at a global level (+20%). This growth would come mainly from (i) a stabilised level in China, where there should be no further winding down in the incentive program but rather a likely adjustment in the time frame for the phase out, and (ii) a pick-up in Europe, where carmakers are multiplying efforts to boost EV production and sales in order to comply with the regulations aiming at lowering emissions (see our report on CO2 emission regulations). We expect notable growth in Germany, which already in 2019 became the leading country in Europe for new EV sales, overtaking Norway. In this context, there should be more than 10 mn EVs on the road worldwide in 2020, compared to less than 2 mn in 2016.

Indeed, EV sales should benefit from several simultaneous factors playing positively, such as the roll out of new models with higher ranges, the development of charging infrastructure and the various incentives in relation to climate change initiatives. We expect business fleets to lead the dynamic in Europe because they account for more than 50% of new car sales (when aggregating rental cars to dealers/wholesalers and public and corporate fleets) and because households are not expected to fully give up their wait-and-see attitude soon. De facto, the latter comes from (i) a moving perception of the relative advantages and disadvantages of each type of engines and, more importantly, (ii) a price affordability issue for a vast majority of clients (low and middle income-households).

Despite the positive EV dynamic, the global automotive market is likely to post another decline in volume terms in 2020 (-1%) to 90.4 mn. The rise in EV sales will still represent a limited number of vehicles in 2020, with 2.5 mn i.e. a 3% market share. At the same time, the prolonged wait-and-see attitude towards EVs will partly weigh on non-EV sales – and increase the average age of the fleet of vehicles on the roads. In this context, we expect the global automotive market to struggle to stabilize in 2020. We forecast a -1% decline in volume terms to 90.4 mn, after a noticeable -4% decline for 2019 (based on the aggregation of the first figures available for the top 25 markets). This would represent an extra loss of 0.9 mn vehicles over 2019 and 5.3 mn since the peak registered in 2017.

The top three markets (2/3 of the total) present a weak outlook for 2020. China (-1%) is not expected to see another round of it’s the high-speed development recorded over the the last 20 years especially if the ongoing coronavirus epidemic lasts. The epidemic would delay sales as well as production since the Hubei region is the fourth automotive hub of the country (with ~9% of the national production), after Guangdong, Jilin and Shanghai. The U.S. market, which reached a peak in 2016 with 17.9 mn, should see another ‘moderate’ decline in 2020 (-2.5%) on the back of a macroeconomic slowdown and the attractive pricing on relatively new second-hand cars, while new vehicles prices have approach USD40K in average. Europe (-2%) should see its first decline after six consecutive years of growth, which led to 15.3 mn in 2019. The jump in registrations at the end of 2019 was driven by one effect (sales promotion and self registrations of less CO2 compliant models to limit CO2 fines in 2020).

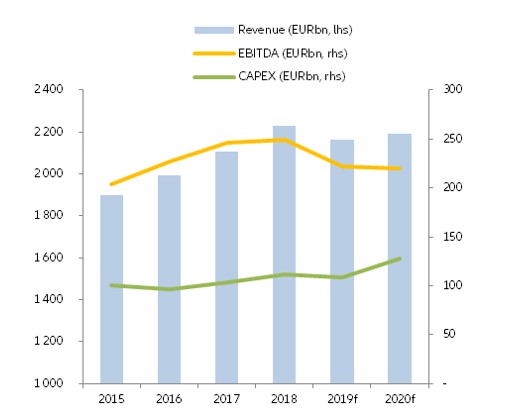

What does this mean for companies? Increased price competition and downside pressures on margins, pushing down the combined EBITDA of the Top 25 automotive manufacturers (-11% in 2019 and -3% in 2020) in an environment of low revenue growth (+1%).

Globally we expect increased price competition to limit revenue growth and intensify margin pressure, notably for the automotive manufacturers more concerned by CO2 compliance issues in Europe (since commercial offers may be needed to speed up the switch to EVs in order to limit CO2 fines). We expect the earnings season to confirm a decline in revenue and profitability (EBITDA) for 2019, -3% and -11%, respectively, for the top 25 listed automotive manufacturers. This implies a decrease of the EBITDA margin by 0.9pp to 10.3% (compared to 11.2% in 2018 and 11.7% in 2017).

For 2020, we expect a limited upside in revenue (+1%) and another decline in EBITDA both in value and relative terms (EBITDA margin to drop below 10%), despite increased pressure on suppliers and another round of cost-cutting (through closing/relocating factories, firing staff). The latter looks highly probable since the industry still needs to keep on investing massively in zero-emission vehicles, and faces other mobility issues (connected cars, autonomous vehicles). For our panel, CAPEX should remain largely above EUR100bn in 2020.