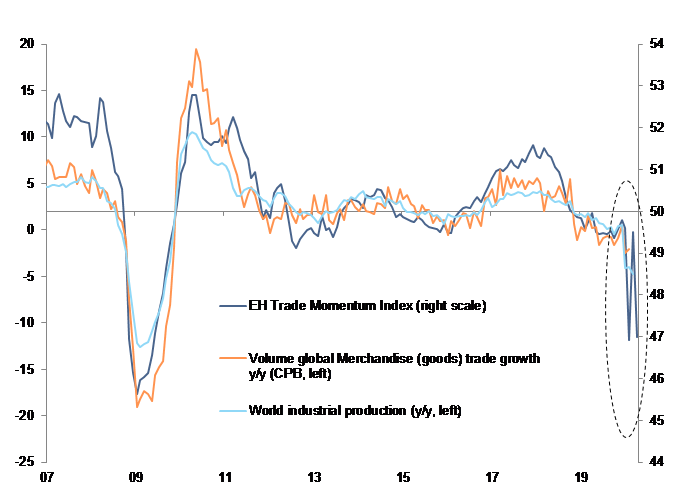

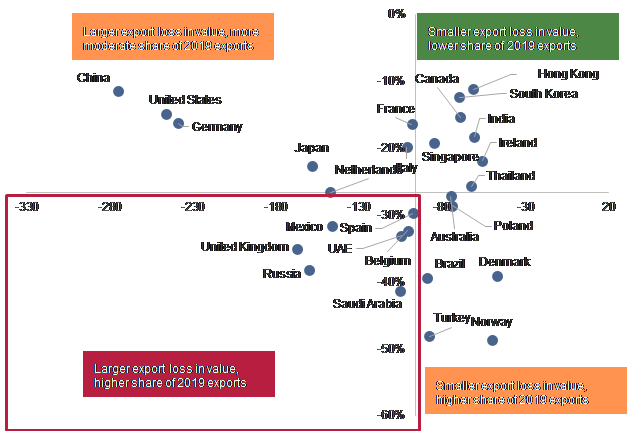

Lastly, short-term protectionist measures on medical goods, the resurgence of economic patriotism rhetoric and reshoring policy stances could disrupt supply chains in the recovery phase and slow the resumption of activity in H2. While China recently slapped Australian barley exports with an 80% tariff, rumors about tariffs on the U.S.’s imports from China are mounting as accusations against Beijing’s role in the Covid-19 crisis intensify. Short-term trade spats could derail confidence, spook markets and halt the investment cycle. Economic historians have demonstrated that the 1930s Great Depression was likely aggravated by the adoption of restrictive trade policies. As recently as in 2019, the U.S.-China trade feud and the manufacturing recession it created subtracted more than USD300bn from global trade.

Medium-term policy shifts also ought to be monitored. The U.S. trade representative hailed the end of offshoring, while the European parliament declared it “supports the reintegration of supply chains inside the EU”. Could a generalized move towards reshoring and decoupling from the Chinese economy make sense?

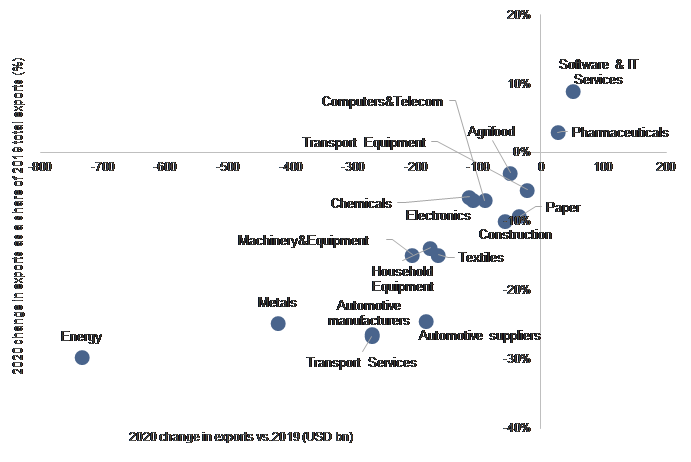

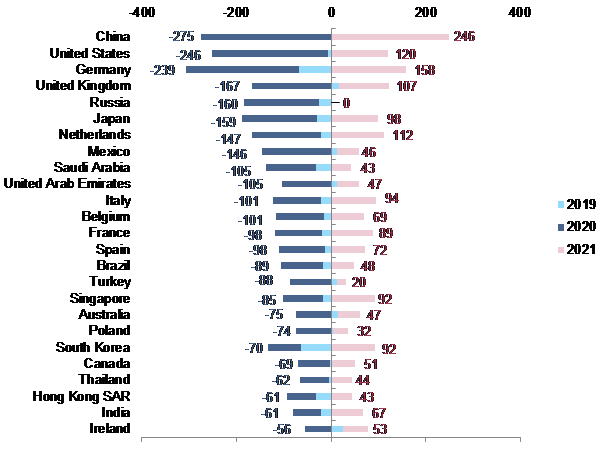

First, the total reliance on Chinese manufacturing has grown in the past 20 years, rendering reshoring all the more difficult: Not only did Chinese manufacturing as a share of world manufacturing more than double since 2004, but countries have increased their direct and indirect reliance on Chinese inputs (Baldwin and Evenett, 2020). Indeed, China is a supplier of inputs for the U.S.. But it is also a major supplier of auto parts to Germany, Japan, Mexico and Canada. These countries in turn use Chinese inputs when making auto parts and components they sell to U.S.-based automakers, which creates an indirect reliance on China, much larger than the observed reliance.

Second, reshoring does not necessarily mean de-risking: it can also mean putting all your eggs in the same basket, thus creating a risk of pro-cyclicality when the crisis hits. Imagine all sectors become exposed to domestic fluctuations in the economy. If an economy is in lockdown and its factories have to be locked, it cannot really produce everything it needs locally.

Third, growing social discontent could be incompatible with reshoring as it would entail high labor costs passed down to the consumer. While strategic independence is touted by policymakers, raising the price for key durables such as automobiles or everyday electronic items could be unpopular and politically delicate.

Lastly, beyond political arguments, incentives for businesses to reshore are still lacking, and they could cost a lot of public money, possibly passed down to taxpayers. Will companies take it on their margins? Will all governments manage to bypass Ricardo’s comparative advantage and allocation of labor where it’s cheaper? As of today there seems to be a discrepancy between ambitious policy stances and business incentives.

But it’s not only trade that could be disrupted, as more diligent foreign direct investment screening could slow cross-border capital flows. According to the OECD, in most recent years, around 55% to 65% of global Foreign Direct Investment inflows went into countries that apply cross-sectoral review FDI processes – twice the share of global FDI inflows that were potentially subject to security-motivated screening for most of the 1990s. The Covid-19 crisis is likely to accelerate this trend, with the EU and the UK notably potentially tougening their screening rules. UNCTAD predicts a drastic drop in global FDI flows – up to 40% – during 2020-2021, reaching the lowest level in two decades.