Executive Summary

- Preliminary GDP in Q4 came out significantly below expectations at -0.3% qoq. If this figure is confirmed, real growth in Italy will have stagnated in 2019. Slipping back again into technical recession can no longer be ruled out.

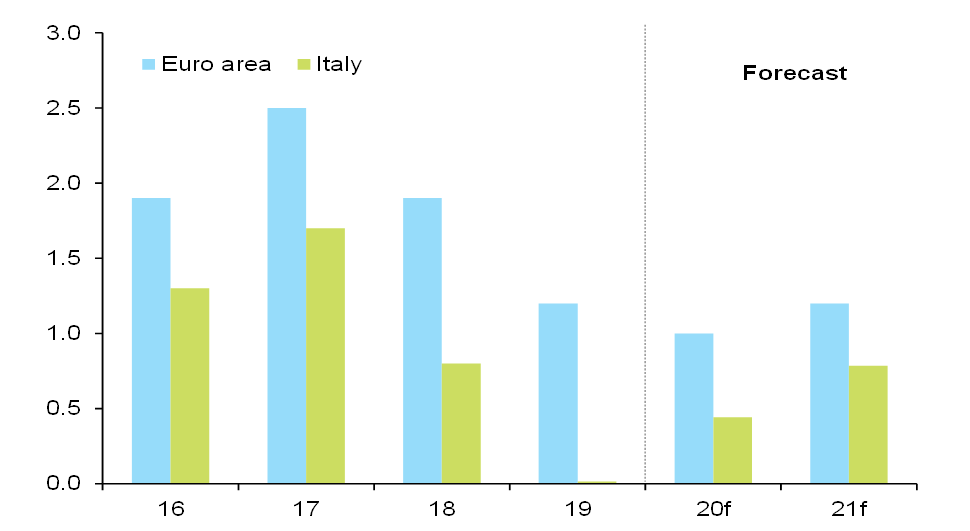

- We keep our growth forecast of 0.4% for this year but see clear downside risks. As for 2021 we stay with 0.8%.

- Although political uncertainty will persist, its effect of on economic activity should ease. As in the rest of the euro area, private consumption should be the main pillar of growth.

- On the capital markets, political uncertainty has so far been reflected only in higher sovereign spreads.

According to today’s flash estimate, the Italian economy retracted by -0.3% in Q4 2019 bringing the annual real growth down to 0.0%.

Overall, this is a very disappointing figure as consensus was expecting a slight increase of GDP by 0.1% qoq. Even if the figure might see some later upwards revision, the dynamic remains worrisome. The country still seems to struggle with the combination of declining in foreign demand (particularly evident in the reduction of inventories) and subdued domestic demand as especially with private consumption still affected by political uncertainty.

Given the continuing weak leading indicators especially in the manufacturing sector, a negative quarter in Q1 2020 seems now possible. This would mean a relapse into a technical recession. However, in 2020, we are confident that the negative impact of political uncertainty on growth will ease. The risk of snap elections has been reduced after the recent regional elections, giving a victory for the ruling Social Democrats in the important region of Emilia Romagna. There are also no signs that the government seeks to deviate from its conciliatory course with Brussels on the budget. In this environment we expect a moderate acceleration of Italian growth to 0.4% in real terms in 2020. For 2021, we expect real growth to reach 0.8% Italy should thus remain below the euro area (1.0% in 2020 and 1.2% in 2021), but the growth gap should narrow.

Private consumption will remain the main pillar of growth

As in the rest of the euro area, domestic demand should become the main pillar of growth. In Italy it will mainly be driven by private consumption thanks to stable employment and moderate real wage increases. Gross fixed capital formation, on the other hand, which in 2019 proved surprisingly robust, is likely to lose momentum as capacity utilization declines and sentiment in the manufacturing sector remains depressed. Foreign trade is also unlikely to provide any strong stimulus. In relative terms, Italy’s foreign trade was less affcetd last year thanks to its geographical focus (less China and UK) and the higher share of final goods in markets where private consumption was rather robust (US and euro area).This resilience may be challenged as external headwinds should persist and spread to consumer goods.

Dealing with stable instability in politics

Despite its success in the regional elections, the governing coalition of Social Democrats and M5S remains fragile. The weak economic perormance could cause additional trouble. However, snap elections seem unlikely given the poor results of the coalition parties in the polls. For this year, we therefore expect the coalition to persist in an environment of stable instability.

Political uncertainty costly for the sovereign

On capital markets, the effect of political uncertainty is currently limited to elevated sovereign yields. For the 10-year maturity, the premium over Germany amounts to around 130 bp. Our analyses show, however, that this spread currently only reflects the uncertainty about Italy's fiscal sustainability while the risk of euro exit (implicit currency risk) is entirely priced out. In contrast, Italian households and companies are not subject to significantly higher financing costs than their German counterparts. Currently no clear risk spillover can thus be observed despite the traditionally strong link between the sovereign and the banking sector (Italian banks still hold around 20% of domestic government bonds). This supports our view that the Italian private sector shows a certain degree of resilience to political developments, at least in this periods of usual instability.

Mind the doom loop

This resilience could be challenged, however, if a massive increase in the Italian sovereign spread were to put pressure on the banking sector and/or a large banking institution were to become distressed and require government assistance. In that case there would be a risk of a self-reinforcing doom loop. However, we currently assess this risk as relatively low. Despite remaining vulnerabilities (shown by the recent stress tests), the situation of the major financial institutions has generally improved and a massive increase in the sovereign spread would imply a significant re-pricing of the exit risk. However, this topic has now almost disappeared from the political agenda.

Figure 1 – GDP growth (% y/y) Italy versus Euro area