Africa’s attractiveness is strong since the continent’s growth is driven by capital intensive needs, particularly infrastructure. Therefore financing (both levels and sources) is among the key questions that need to be answered in order to properly channel funds to the right projects. Let’s make it work through a mix of formal solutions (FDI, fiscal resources) and innovative ones (mobile banking).

Is Africa still following the same financing model?

Financing needs have increased and are financed differently

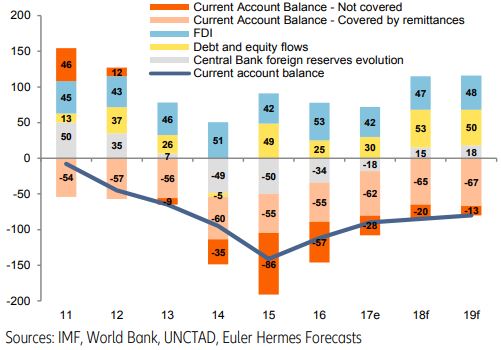

Back in 2015, Africa experienced a common financial stress, as a result of a commodity price slump and falling exports. It triggered a USD -141 billion (bn) current account deficit, with the -86bn not covered by workers remittances financed mainly through debt (bilateral and IMF loans).

The drop in exports led to lower private capital flows to the region. However, this symmetric liquidity shock is now over and the landscape has changed quite a bit. Growth is on again, but the overall current account deficit still prevails, mirroring remaining deficits in key oil exporters (Algeria, Angola mainly). These persistent deficits mean that the main African economies avoid growth collapses. The adjustment was less severe than in the eighties. Yet, since domestic demand kept growing, the current account deficit is still present following the market shock. Financing has changed as well, since debt and equity flows should top Foreign Direct Investment (FDI) in 2018 and reach an all-time high, as a result of growing bond issuance. Weakening FDI inflows mirror regional divergence with Central and Southern Africa still growing less than before the crisis and exhibiting attractiveness problems, whereas North, West and East Africa are not experiencing similar difficulties.

Figure 1 Aggregate current account financing excl. offshore centers, per source, (USD bn)