Q4 2019 Mexico’s GDP growth came in unchanged from Q3, which confirms our view that it has escaped technical recession, yet remaining flat for the second half of the year.

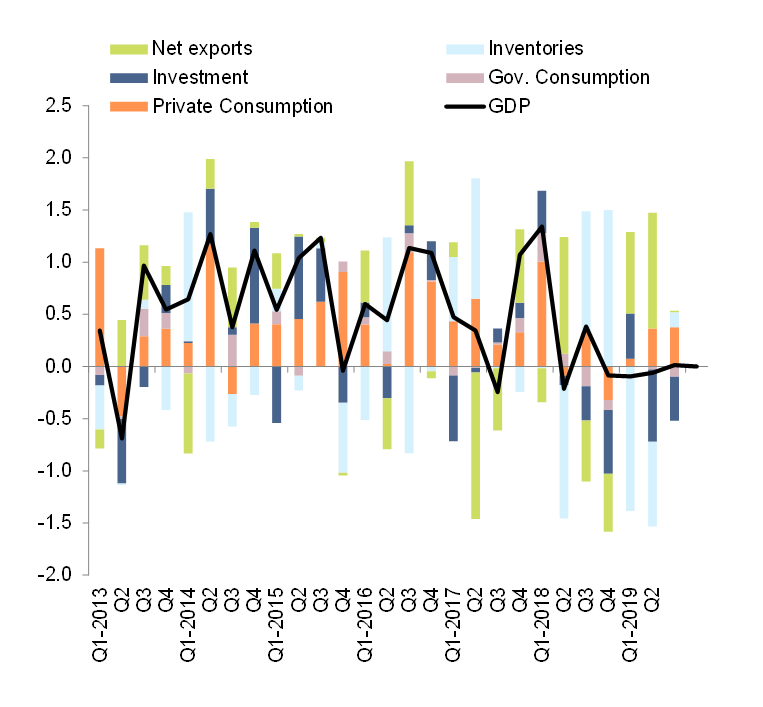

Preliminary data shows services saved the day (+0.3% q/q) while the primary and secondary sectors contracted respecively by -0.9% and -1% q/q. 2019 illustrates the divide between Mecixo’s supply and demand sides: amidst a manufacturing recession, investment was likely the biggest drag to GDP growth, notably due to political uncerainty, while the domestic consumer proved resilient, helped by social spending and a tight labor market (see Figure 1). Overall, this lackluster performance confirms that high domestic policy uncertainty took a toll on economic outcomes, adding to U.S. trade and foreign policy uncertainty. The Q4 release brings total annual growth for 2019 at -0.1%, lower than we expected, after +2.1% growth in 2018 and +2.4% in 2017.

We expect Mexico's GDP growth to moderately rebound this year but stay weak, which means there remains significant downside risk on our current +1% forecast.

Policy uncertainty and specifically the volatility in President AMLO’s policy announcements will continue to limit the monetary policy transmission to the real economy, and halt investment decisions. On a more positive note, the entry into force of the USMCA should restore some certainty on the trade front for companies in 2020. In addition, AMLO’s consumer-oriented policies and social spending could help consumers stay resilient.

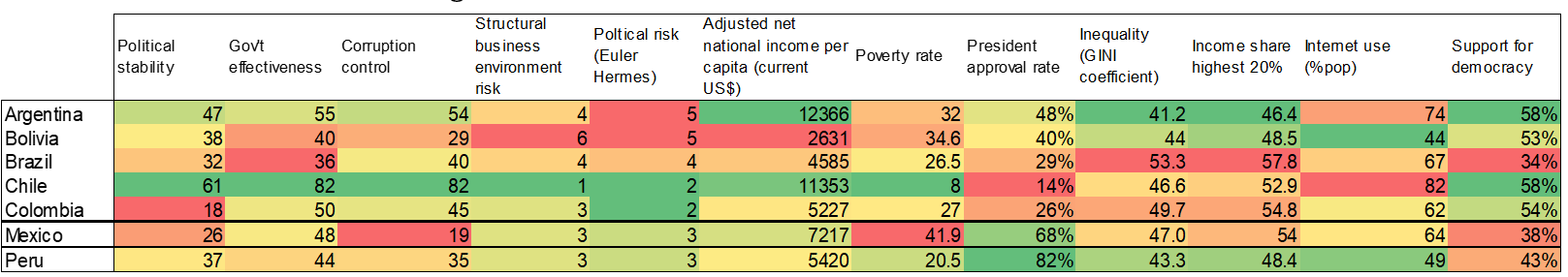

While in some aspects, social risk is high in Mexico (see Figure 3) it currently seems lower than in peer Latin American countries, as president AMLO’s approval ratings remain high (68%). 2020 will be pivotal as the President prepares the 2021 “recall referendum” and legislative elections.

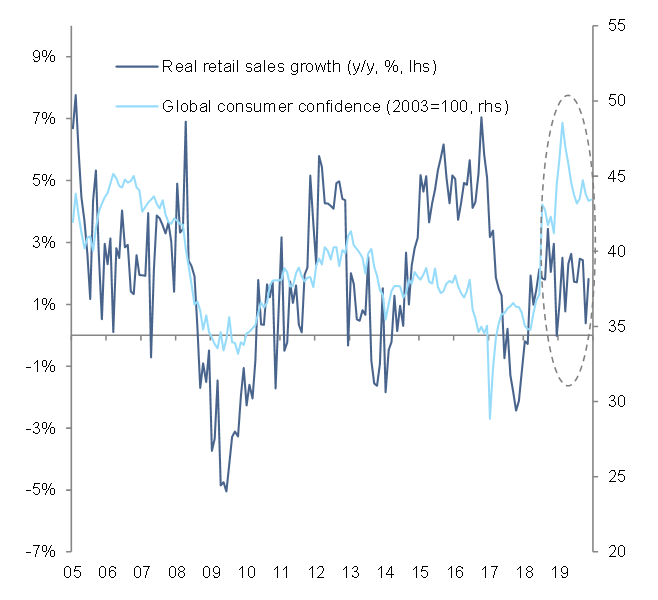

Consumer confidence still seems disconnected from actual consumer data (see Figure 2). Moreover, the slowdown in the U.S. could negatively impact the healthy flow of remittances. While this year the minimum wage was raised +20%, the largest increase in 44 years, the Mexican central bank warned it could hurt future employment. Lastly, despite policy rate cuts from 8.25% to 7.25% in 2019, credit to corporates has continued to decelerate while consumer credit struggles to re-gain momentum. We see room for further monetary easing in 2020, but the central bank will closely monitor the risk picture and the potential pass-through from the minimum wage hike to inflation.