Executive Summary

- After eight months of political deadlock, two elections in 2019, and tedious negotiations with the left-wing regionalist party ERC (obtaining that they abstain rather than vote against the government), socialist PM Pedro Sánchez was finally able to secure a simple majority in Parliament (by a magin of only two votes) and will now form a government. The PSOE (socialist party, center-left) and UP (Unidas Podemos, left-wing) should govern together, pushing for more social spending and a reversal of previous crisis time reforms. However, policymaking will not be a walk in the park and the coalition will be fragile, which could slow the implementation of structural reforms. We expect moderate risk of early elections in the next year.

- What does it mean for markets? Markets have shrugged off the announcements, with no sizable movements on bond or equity markets. Ten-year bond yields slightly declined today from 0.40% to 0.38% - and IBEX 35 equities were down -0.3%. Indeed markets remain driven by the ECB monetary easing, rather than fully pricing endogenous risks. The ECB will step up its easing this year with an additional cut of the deposit rate to -0.6% and continued monthly asset purchases. In addition, despite the presence of Podemos in the government, the risk of major drift in public finances is limited.

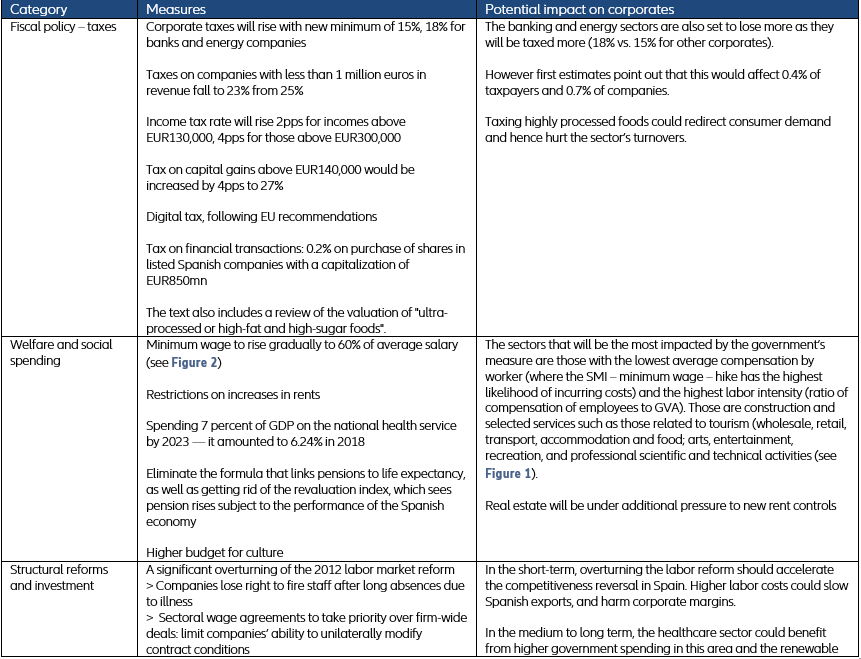

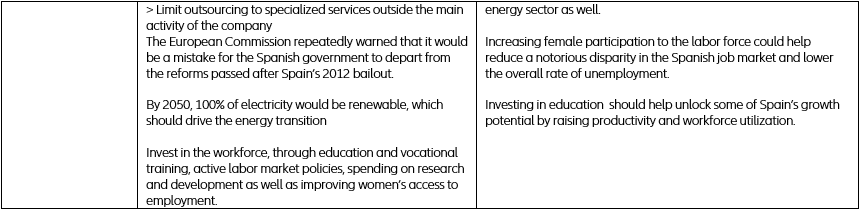

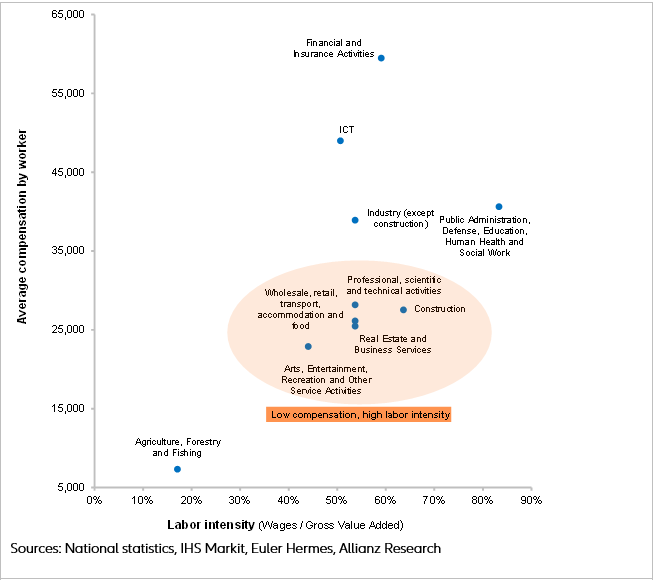

- What does it mean for companies? We expect an improved outlook for consumer-oriented sectors and small companies, along with potential longer-term benefits from productivity gains due to higher spending on education. However, competitiveness will be reduced in the short term, and higher labor costs could indent profit margins (to below 40% of value added, down from a peak of 44.3%) ; in addition, we expect the construction sectors, the services sectors to be most negatively impacted by a higher minimum wage, banking and energy by higher taxes, and the real estate sector by rent control.

- In consequence, we still expect a gradual deceleration of GDP growth in Spain from 2% growth in 2019 to +1.6% in 2020 and +1.4% in 2021. Higher purchasing power due to accelerating salaries and social spending will be a modest buffer for private consumption, amid the slowest job growth since 2014 and an increasing savings ratio. Decreasing competitiveness in an uncertain global trade environment should slow exports. But significant progress on structural reforms and climate-related investment could help growth accelerate again in the medium-term.

The PSOE-UP government will be the first coalition government of Spain’s recent history, against the backdrop of a highly fragmented political landscape. It is likely that the the government will have to make concessions to regionalist parties, and that policymaking will be frustrated by the remaining disagreements between the PSOE and UP. But political instability is not a new feature of Spanish politics. And most importantly, markets remain driven by the ECB monetary easing rather than fully pricing endogenous risks. Indeed the ECB will step up its easing this year with an additional cut of the deposit rate to -0.6% and continued monthly asset purchases. Ten-year bond yields slightly declined today from 0.40% to 0.38% - and IBEX 35 equities were barely down -0.3%. The markets had priced in a government on January 2 when ERC officialized it would abstain, and there was no sizable movement at that moment either. In addition, social spending will mean Spain does not comply with Brussel’s goals of deficit reduction, but will not exceed the 3% of GDP cap on the fiscal deficit. Indeed, the PSOE is pro-European and as the economy minister, former Director-General of the European Commission for Budget (2014-2018) is expected to remain in place. However, policymaking will not be a walk in the park and the coalition will be fragile, which could slow the implementation of reforms. We expect moderate risk of early elections in the next year.

The coalition’s policies will create winners and losers among corporates: The winning sectors will be the most consumer-oriented sectors in the short-term, healthcare and renewable energy in the medium term, given investment plans. Smaller companies as a whole could also benefit from a proposed reduction in their corporate tax rate. In the longer term, we expect productivity gains given the coalition’s plan to invest more on education, vocational training, active labor market policies and boosting female workers participation in the labor market. Lastly, the more conciling tone of the coalition and its apparent constructive approach on Catalonia’s political crisis could reduce political uncertainty.

However, competitiveness will be reduced in the short term, indenting profit margins, and some sectors should be more vulnerable to the higher minimum wage. During the coalition’s mandate, we expect corporate profit margins overall to continue declining, at a faster rate than in the Eurozone, and eventually drop below 40% of gross value added for the first time since 2008. We identify the losing sectors: construction, real estate, tourism, professional and entertainment services will be negatively impacted by the higher minimum wage – and rent controls for real estate; the banking and energy sector will be subject to higher taxes. Highly processed food could also be taxed more, which could redirect consumer demand.

Economic policy proposals and impact on corporates