- Turkey’s currency crisis became full-fledged in August amid an ongoing withdrawal of global liquidity stemming from continued monetary tightening in the U.S. as well as lasting econom-ic policy mistakes. In particular, the Central Bank of the Republic of Turkey did not raise interest rates in late July despite surg-ing inflation; and a political feud with the U.S. culminated in the latter imposing sanctions on Turkey.

- In September, the CBRT hiked its key policy interest rate by 625bp to 24%. We have concluded that the hike and its magnitude were necessary to calm financial markets and also sufficient to keep future inflation expectations in check. Turkish assets have stabilized since the rate hike. Moreover, the expected appreciation of the US dollar vs. the Turkish lira (as a proxy for expected inflation) was close to 24% in the four weeks prior to the rate hike. Hence, the new benchmark lending rate more or less matches the rate of interest that an investor in TRY-denominated short-term deposits or long-term bonds should demand.

- Additional fiscal tightening is needed to stabilize the economy in the medium term. The Turkish government’s New Economy Program 2019-2021 aims in the right direction by focusing on a rebalancing of the economy. However, Turkey has a history of reform slippage and deviations from economic programs.

- A technical recession (two to three quarters of negative growth in H2 2018 and H1 2019) is expected, resulting in full-year growth of just +0.4% in 2019.

- Corporate sector debt is the key risk in Turkey. It was equiva-lent to 65% of GDP in Q1 2018, of which about 56% was de-nominated in foreign currencies. Hence, rolling over that FX-denominated debt will be challenging amidst the current glo-bal liquidity tightening, especially in a hard landing scenario.

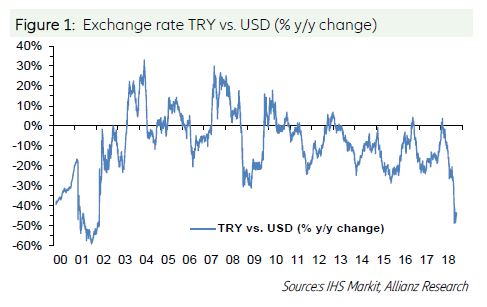

- The Turkish lira is forecast to depreciate by an average -40% against the US dollar in 2018 and by -37% in 2019.

Evolution of a textbook BoP crisis

Turkey, along with Argentina, has been increasingly in the focus since the beginning of 2018 as financial markets began to sanction the most vulnerable emerging markets (EM) amid an ongoing withdrawal of global liquidity, which has been mainly a result of continued monetary tightening in the U.S. The reasons for Turkey’s high vulnerability were manifold, including:

- Lasting economic policy mistakes, namely strong pro-cyclical fiscal policy since H2 2016 combined with overly loose monetary policy (negative real interest rates).

- A subsequent overheating of the economy, reflected in rapid GDP growth (+7.4% in 2017, +7.3% y/y in Q1 2018), along with rising macroeconomic imbalances.

- Credit growth surged to over +20% y/y.

- CPI inflation, core inflation, as well as wage growth moved well into double digits.

- Crucially, the persistently large current account deficit, Turkey’s long-standing Achilles’ heel, widened further while the financing of the shortfall (capital inflows) weakened.

- Short-term debt obligations rose rapidly and exceeded official foreign exchange (FX) reserves more than twice since end-2017.

In May 2018, Turkey faced a first strong storm as fading investor confidence resulted in a considerable sell-off of the Turkish lira (TRY, -10% vs. the USD during the month) triggered by a range of weak data and increased concerns about the independence of the Central Bank of the Republic of Turkey (CBRT) especially with regard to monetary policy. Only a 300bp hike of the late liquidity window lending rate (at the time the effective policy rate) in an emergency meeting of the CBRT could stabilize the currency temporarily, though daily volatility remained high.

In August 2018, the currency crisis became a full-blown balance-of-payments (BoP) crisis. Markets lost their confidence in Turkey entirely after (i) the CBRT did not raise interest rates in late July despite surging inflation; and (ii) a political feud between Turkey and the U.S. escalated, culminating in U.S. sanctions against Turkey at the start of August. The TRY plunged by -14% vs. the USD in one day on August 10th and lost -24% during the month as a whole. Pressures on the TRY remained high, despite some measures taken by the CBRT to provide sufficient liquidity to the banking sector.

625bp policy rate hike in Sep-tember – was it enough?

On September 13th, the CBRT finally hiked its benchmark lending rate, the one-week repo rate, by 625bp from 17.75% to 24%. The CBRT’s pre-vious hikes – from 8% to 16.5% on June 1st and from there to 17.75% one week later – were already three months old. In the meantime, the TRY had depreciated by about -30% against the USD, the yield on 10-year TRY-denominated Government bond had spiked by 435bp from 13.85% to 18.19%, while CPI inflation had accelerated from 12% to close to 18%. By mid-August, as shown in the table below, Turkish assets had experienced an even more acute level of stress.

Interestingly, only a few days before its latest decision, there were wide-spread expectations that the CBRT would not move at all, as President Erdogan had long made public his somewhat heterodox views on the link between interest rates and infla-tion. And, should the CBRT be never-theless bold enough to hike interest rates, market participants were ex-pecting an increase limited to 300-400bp. Against that background, how should the CBRT’s latest move be judged? Was it too little, too late? Or was it more or less properly cali-brated? In our view, it was high time for the CBRT to hike its benchmark lending rate and its decision was remarkably well calibrated.

The first reason to hold this view is to be found in the markets’ response. Turkish assets had started to stabilize before September 13th; they have continued to do so since then, which is encouraging. However, fundamentals matter, too.

As CPI inflation has further accelerated to 24.5% y/y in September and is likely to remain above 20% for some time owing to the TRY’s past depreciation, the ques-tion is if, at 24%, the CBRT’s benchmark lending rate is now sufficient to provide a cushion and keep inflation expectations in check. In this respect, two things are worth keeping in mind. First, at the pro-ducers’ level, inflation is already running at 46% y/y. Second, in Turkey like in many other developing economies, measuring inflation is easier said than done, as a result of which variations in the external value of the domestic currency against “hard” currencies are often perceived to be the best proxy for “real” inflation, the expected appreciation of foreign “hard” currencies being therefore the best proxy for expected inflation.

In other words, an investor in a TRY-denominated short-term deposits or long-term bonds should demand a rate of interest that more or less matches the expected appreciation of the USD against the TRY. How can we measure this expectation?

We have modelled expectations by us-ing an algorithm known as the Allais transformation or Allais filter. It conveyed that the expected appreciation of the USD was on average 23.88% between mid-August and mid-September, a num-ber surprisingly close to 24%, the level at which the CBRT set its benchmark lend-ing rate on September 14th (see the Box at the end for details on the Allais trans-formation). Knowingly or not, the CBRT has set its policy rate remarkably close to this expectation. By doing so, the CBRT has signalled to domestic and foreign lenders that it cares about them, without overdoing it. This properly calibrated decision was necessary; it will contribute to rebalancing savings and investment in the private sector; subject to comple-mentary measures to be described be-low, it should pave the way to a sustaina-ble stabilization of the Turkish economy.

More is needed to restore lasting investor confidence

The lesson from previous BOP crises in EM is that both monetary and fiscal poli-cies need to be tightened decisively, preferably backed by an IMF funding pro-gram. While the monetary policy measures taken in September have stabilized financial markets in the short term, they will most likely not be enough to turn the economy entirely. Additional decisive fiscal tightening will be needed, at least. Moreover, current investor concerns would be mitigated by a political reconciliation of Turkey with its tradition-al allies in the West and an unambiguous re-establishment of central bank independence.

As regards fiscal policy, the government’s New Economy Program 2019-2021 (NEP; successor of the previously called Medium Term Programs), released on September 20th, 2018, aims in the right direction by focusing on a rebalancing of the economy instead of mainly boosting growth as the previous programs did. It envisages “strong fiscal discipline” and targets annual fiscal deficits of just below -2% of GDP in the next three years. The

announced policies and measures include:

- Increasing savings and revenues;

- Suspension of investment projects for which the tender process has not been finalized yet;

- Aiming for efficient, financially sound PPPs;

- Revision of the social insurance scheme;

- Removal of “non-effective” tax exemptions and rebates.

If successfully implemented, these measures could indeed facilitate some of the necessary fiscal tightening and further support the way to a lasting stabilization of the economy.

However, before getting too euphoric, it should be recalled that Turkey has a history of fiscal reform slippage under IMF programs – and this time there will most likely not even be IMF support. Moreover, the NEP 2019-2021 is based on real GDP growth forecasts of +2.3% in 2019 and +3.5% in 2020. Euler Hermes expects much lower growth in 2019, which would result in larger fiscal deficit to GDP ratios than targeted in the NEP. In all, the fiscal targets set for the next two years may be missed, either because of reform slip-page or due to lower than expected revenues, or both. This could result in a renewed loss of investor confidence, which in turn would require further policy tightening.