Executive Summary

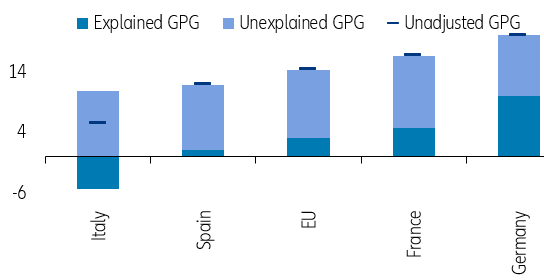

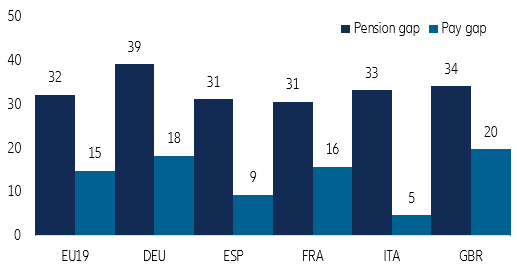

- The unadjusted gender pay gap is a snapshot that shows the average differences in pay between all men and all women in the workforce. It stands at 15% in the EU. Reflecting mostly lower participation rates and shorter working lives, the unadjusted gender pension gap is more than twice as high.

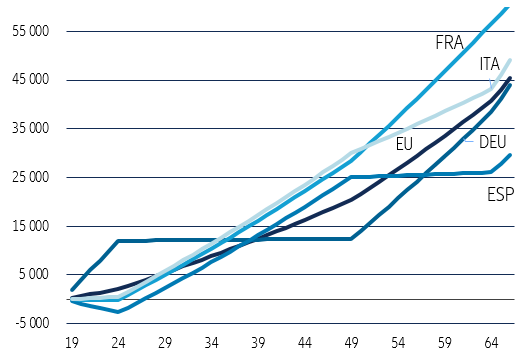

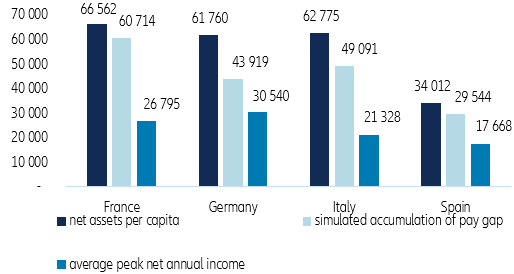

- If the shortfall in women’s income was invested in a 1% annual yielding safe asset over time, we estimate it could generate EUR45,410 on average at retirement age (EUR29,544 in Spain, EUR43,920 in Germany and EUR49,100 in Italy). In France, the sizable divergence in net income by age and gender mean that this sum could be as much as EUR60,714 for women at retirement age.

- In a context of a 3% yielding safe asset, these gender income gaps would amount to EUR71,500 on average in the EU; EUR73,000 in Germany; EUR51,300 in Spain and a hefty EUR94,300 in France, as well as EUR81,300 in Italy.

- Against this backdrop, policymakers need to level the playing field and equip women with initiatives such as raising the wage floor; promoting the return of women to the labor market after maternity leave with increased childcare facilities; longer shared parental leave and/or tax incentives and increasing the representation of women in political and economic decision-making positions.

The gender pay gap and pension gaps are a snapshot that show the average differences in pay between all men and all women in the workforce or in retirement, respectively. There are key factors addressed by the literature that have an influence on Europe’s gender pay gap: career preferences and overrepresentation of women in lower-paid jobs, the lower labor participation rate of women (EU-19: 66.2%) compared to men (77.2%) and shorter working lives (EUW:33 years, EUM: 38 years) due to maternity leave and/or work interruption. Additionally, there is a persistent and uneven concentration of women and men in different sectors in the EU: Three in every ten women work in education, health and social work (compared to 8% of men), which are traditionally low-paid sectors. On the other hand, almost a third of men are employed in the traditionally higher-paid sectors of science, technology, engineering and mathematics (STEM), compared to 7% of women.

Work and investments by the EU have been implemented to study and measure these so-called “explained Gender Pay Gaps” (see Figure 1). They do not, however, account for the entire pay gap; the so-called “unexplained” factors include statistically unobserved wage determinants of the gender gap such as personal ability, negotiating skills and institutional settings.

Figure 1 – Explained and unexplained parts of the unadjusted gender pay gap (%)